After puking 7.1% MoM last month, pending home sales were expected to continue their decline (down 2.0% MoM) in September, following existing home sales weakness (and ignoring new home sales surprising surge).

However, pending home sales rose 1.1% MoM (best since Jan 2023), pushing sales up to -13.1% YoY (the smallest decline since May 2022)...

Source: Bloomberg

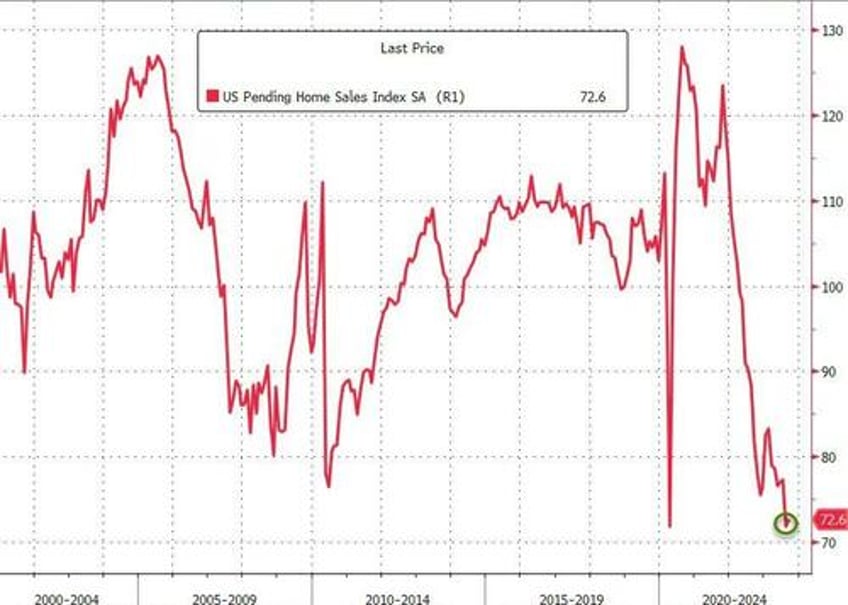

The Pending Home Sales Index bounced off record low...

Source: Bloomberg

The South, Midwest and Northeast posted increases in September pending home sales. Contract signings in the West, meantime, fell to a fresh record low.

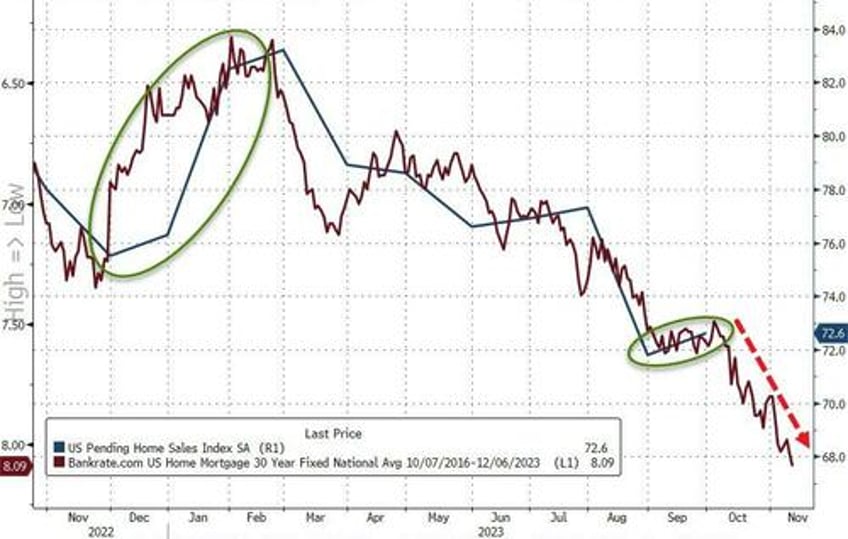

“Despite the slight gain, pending contracts remain at historically low levels due to the highest mortgage rates in 20 years,” Lawrence Yun, NAR’s chief economist, said in a statement.

“Furthermore, inventory remains tight, which hinders sales but keeps home prices elevated.”

The unexpected jump could be related to mortgage rates stabilizing in September... but don't expect this to continue in October...

Source: Bloomberg

The pending-home sales report is a leading indicator of existing-home sales given houses typically go under contract a month or two before they’re sold.

How long with Powell and his pals be able to keep this 'higher for longer' stress up as Americans' largest source of wealth evaporates?