CANARY IN THE MORTGAGE MARKET

Before we get to UK property owners failing to comply with new energy rules could face prison (it has to start somewhere). Let's talk about the canary in the mortgage market because it all ties together.

Our opinion on real estate in leveraged (that is, Western) markets has for at least five years now been one of selling or standing on the sidelines.

Nothing we are looking at now changes this baseline view. It isn’t so much about real estate as much as it is about interest rate cycles and credit cycles, to which real estate is closely tied.

This is an unpopular view, mostly as far as we can tell because the majority of folks tend to have a sizable chunk of their wealth in property — in many instances, the majority of their net worth.

This has always struck me as a poor strategy, if only because it involves emotion and it rarely pays any income (unless you’re renting out rooms in your house).

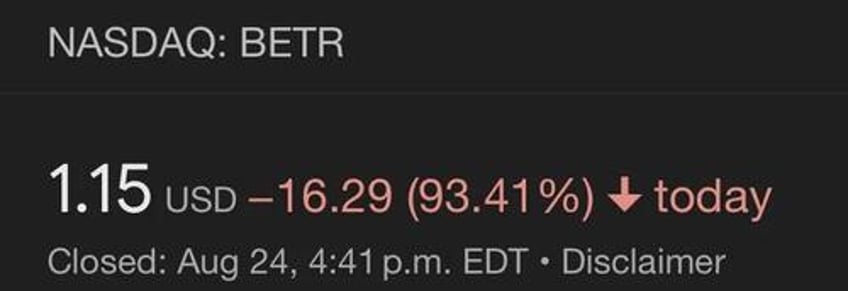

In any event, the tanking of one of the market darling IPOs — a mortgage company — is a harbinger of things to come.

This is a major mortgage company that went public a couple weeks ago via SPAC — nose diving a massive 93% in ONE DAY. They began the day valued at $4 billion and are now sitting at $400 million. Not bad for a day’s work.

Here is live footage taken on IPO day.

In all seriousness (this is a serious matter, of course), take a look here at mortgage demand. Ruh-roh!

An over-indebted economy facing rising stagflation (meaning less disposable income, more regulation/costs, and rising interest rates) is precisely what we promised you was coming for over four years now.

Our solution and advice was as follows: if you have a property you like and need to live in, then locking in long-term (30-year) mortgage rates (if you’re in the US) was essentially a way to short the bond market and still enjoy your home. The question to us wasn’t so much about real estate as much as it was about the bond market and the relationship between the two.

Fast forward to today, and certainly anyone who locked in rates 3-4 years ago is smiling today, but really this party is only just beginning. Over the course of the next few years, we anticipate things getting much, much worse on the interest rate side of things. Well worse if you were hoping for rates to come back down, that is.

Not to be callous about folks unwittingly now caught in a sticky situation, but the bigger issue as I see it isn’t in the average Joe Sixpack paying his mortgage. It is that the large pension funds and insurers all own a boatload of commercial paper tied to real estate.

As this unwinds, many of these funds are going to blow up. It is inevitable. And when that happens, it’ll be the perfect excuse for the central planners to come in and “fix” the problem. They will do so by eliminating pensions (they’re done, anyway as anyone with child level maths skills can see) and promising a universal basic income (UBI).

Countries that aren’t obligated to their citizenry in this fashion will have no such obligation or need. It is worth keeping an eye on since capital always moves to where it is treated best. And it sure isn’t going to be treated particularly well in a techno Marxist economy.

Sticking with real estate, the poor sods in that soggy little island that used to rule the globe…

Property owners failing to comply with new energy rules could face prison

Property owners who fail to comply with new energy efficiency rules could face prison under government plans that have sparked a backlash from Tory MPs.

Ministers want to grant themselves powers to create new criminal offences and increase civil penalties as part of efforts to hit net zero targets. Under the proposals, people who fall foul of regulations to reduce their energy consumption could face up to a year in prison and fines of up to £15,000.

But they’re not finished:

It provides for “the creation of criminal offences” where there is “non-compliance with a requirement imposed by or under energy performance regulations”. People could also be prosecuted for “provision of false information” about energy efficiency or the “obstruction of… an enforcement authority”.

It’s almost like they’re setting folks up to steal their property. But I’m sure they’d never do that.

The great reset barrels forward…

Now, it doesn’t take a genius to consider that the government can make up any sorts of daft plans like mandatory solar panels (the Sun doesn’t shine in the UK), installing wood chip insulation sourced only from saplings in the innermost Amazonian rainforests — and only when harvested by the indigenous tribes and only if they wear skirts.

Or even just follow the Germans…

So as you can see, this rapidly becomes much more than just a mortgage market issue. It is all tied into the energy crisis and impending food crisis — all wrapped up in bow and ribbon.

Smart investors are already preparing for what’s coming…

If you are a self-directed stock investor looking for an edge, we can show you. Click on the links (below my name) to find the best solution for you.

- Chris MacIntosh

Capitalist Exploits | Glenorchy Capital Macro fund | Subscribe to Insider | Rebel Capitalist Pro