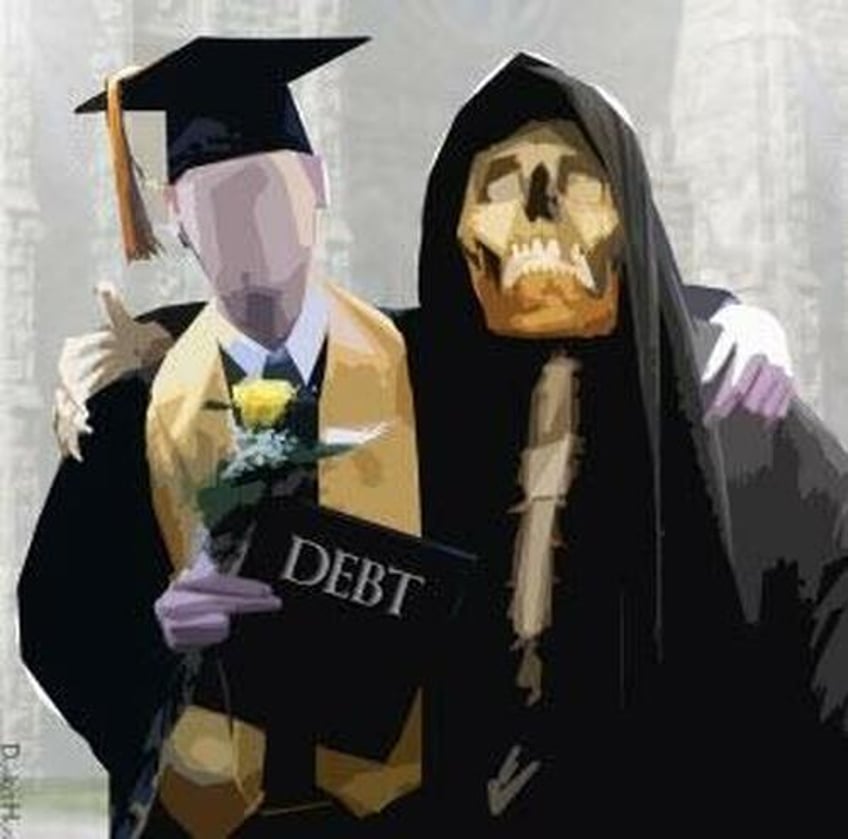

After a more than 3-year pause, government student loan repayments started again this month and it’s already putting the squeeze on borrower’s wallets. This is bad news for an economy already strained by massive levels of debt and rising interest rates.

Interest accrual on student loans resumed on September 1 with the first payments coming due in October.

According to a recent survey reported by Yahoo Finance, about 40% of people with student loans expect to cut spending in order to make payments. Consumers planning to tighten their belts to cover student loan payments said they would likely cut back spending on restaurants, apparel, and electronics.

A separate Morgan Stanley survey found that only 24% of student borrowers can make monthly student loan payments in full without reducing spending. That was down from 29% just three months ago, indicating growing financial stress on consumers.

The Trump administration paused student loan repayment for the first time in March 2020 as governments began locking people down due to COVID-19. The Biden administration extended the pause eight times. Nearly three and a half years later, borrowers must start paying again and that’s a big shock to many budgets.

Even with loan payments paused, many student loan borrowers said they are struggling to keep up with expenses. In a survey earlier this year, 53% of borrowers said they were struggling to pay other bills (e.g. auto loan, mortgage, credit card), even though they have not been making their student loan payments.

Around 43 million Americans have outstanding student loans totaling $1.8 trillion, according to the most recent data from the Federal Reserve. Student loan debt has tripled since 2008.

When the US government stopped defaults and allowed borrowers to pause payments due to the COVID-19 pandemic, 11.1% of student loans were 90 days or more delinquent or were in default. This didn’t include the people who were in various deferment programs and were not counted as delinquent.

Wedbush analyst Tom Nikic crunched Fed numbers and concluded that the typical student loan payment ranges between $200 and $299 per month. That means some 43 million Americans just had their discretionary spending budget cut by at least that amount. This comes to about $120 billion annually.

Nikic estimates that if consumers incrementally spend $120 billion annually on student loan payments, it could wipe out 2.5% of the total $5 trillion in annual discretionary spending.

He called that “brutal news” for retailers.

With consumers now needing to divert some of their monthly income towards student loan payments, there is risk that this could ‘crowd out’ other spending items. Furthermore, this comes at a time when US consumers are increasingly feeling pressures from a variety of sources, including waning pandemic savings, rising gas prices, record-high credit card debt, and a continued normalization of spending on services vs. goods. Thus, these factors could combine to weigh on a variety of companies, including retailers of discretionary goods.”

There is some indication retailers are already feeling the effects. Macy’s reported a 36% reduction in credit card sales year-on-year in the second quarter. Nordstrom reported a similar trend.

Meanwhile, it appears that some student loan borrowers started making payments early to avoid accruing interest. While credit card debt spiked by over 13% in August, non-revolving credit, which includes student loans, fell by 9.8%. This is a sign of a strained consumer trying to make ends meet by charging everyday purchases on credit cards.

“The unexpected contraction in consumer credit in August appears to have been driven by the one-off jump in voluntary repayments of student loans early ahead of the October resumption deadline,” Oxford Economics lead US economist Michael Pearce told MarketWatch.

The resumption of student loan payments will reverberate through the economy. Consumer spending primarily drives economic growth in the US. As spending shifts from buying goods and services to paying student loans, it will add to recessionary pressures.

This is yet another reason to question the “soft landing” narrative. Despite all the rosy economic narratives out there, Americans are under a tremendous amount of financial stress.

On Aug. 22, the Biden administration announced the “Saving on a Valuable Education” (SAVE), a new repayment program that will reportedly lower or eliminate monthly payments for more than 20 million borrowers.

The plan might take the weight off some student loan borrowers, but in effect, it just shifts that burden to the taxpayer.

Nothing the government does is free. Ultimately, student loan debt relief will add to the already massive budget deficits. That means Uncle Sam will have to borrow more money that taxpayers will have to repay, either in higher taxes or the inflation tax.

This is yet another example of government trying to fix a problem it created in the first place.

The widespread availability of student loans drove up college tuition in the first place. Studies have shown the influx of government-backed student loan money into the university system is directly linked to the surging cost of a college education.