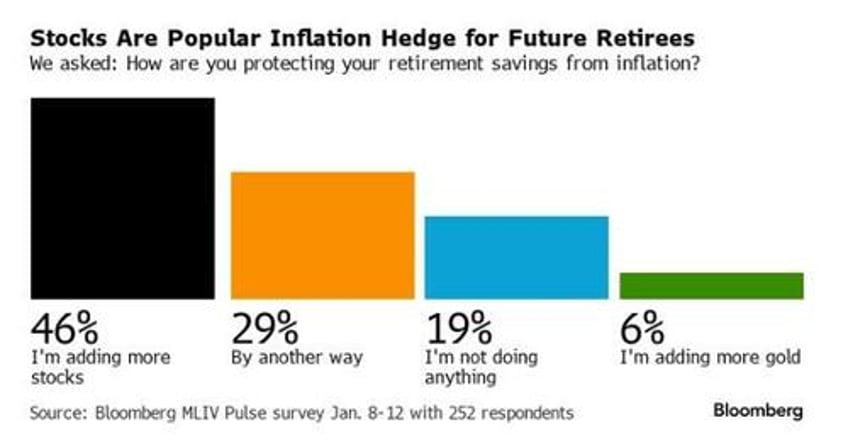

Retirement savers want more stocks in their portfolios as a hedge against inflation, potentially offering a long-term tailwind for equities as societies age, according to the latest Bloomberg Markets Live Pulse survey.

Almost half of the 252 respondents said they were putting more funds into stocks as a response to rising prices – far eclipsing the 6% who said they’d be adding the traditional inflation hedge, gold.

After the biggest jump in consumer prices for a generation, the survey highlights the range of strategies that pension investors have turned to as a counter. Real estate and commodities – also assets that historically have weathered inflation fairly well – were among the other choices. But shares of companies, whose earnings are expected to rise with prices, were clearly the preferred option.

That doesn’t make them the right one, of course – in the inflationary 1970s, stocks were the worst-performing asset in real terms.

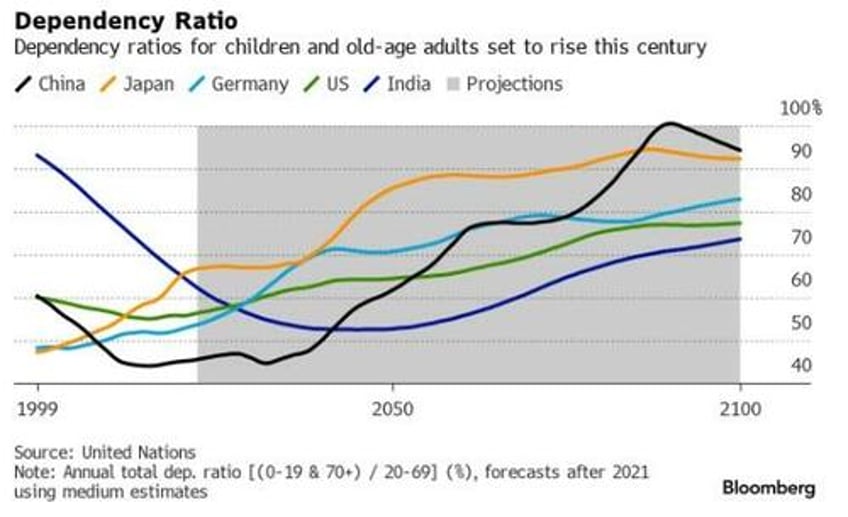

There’s a fierce academic argument over the likely effects of demographic trends on economies and markets – and over one issue in particular: Will aging populations tend to push bond yields up, or down?

In the MLIV survey, that’s the question that provoked the most individual responses. Reflecting the wider debate, the findings were exactly split down the middle.

For those who expect yields to rise as societies age, the focus is on the mounting fiscal expense – and the knock-on inflationary effect – of supporting populations with a longer life expectancy when there are fewer workers.

As one respondent put it: Medical and health costs grow faster than what the government can finance through tax, hence more debt must be issued.

Among those making the opposite case – that yields will trend down – the most common argument was that there’ll be higher demand for fixed income from those close to or in retirement.

Several respondents mentioned Japan, the country that is furthest along the aging track. It already has about 66 dependents for every 100 people of working age, while yields on Japan’s government debt have been below 2% for almost all of this century.

One thing that could determine how yields behave as populations age is simply whether politicians are willing to push them down via what’s known as “financial repression” – essentially, government action that directs private capital flows into public debt markets. There are many ways to achieve this. One example is rules that require pension funds to own government debt to match their liabilities.

One MLIV survey participant suggested that financial repression is exactly what will happen as states aren’t able to sell enough debt.

All of this means that anyone shifting funds from bonds to stocks as a hedge against inflation may find that they’re jumping from the frying pan into the fire.

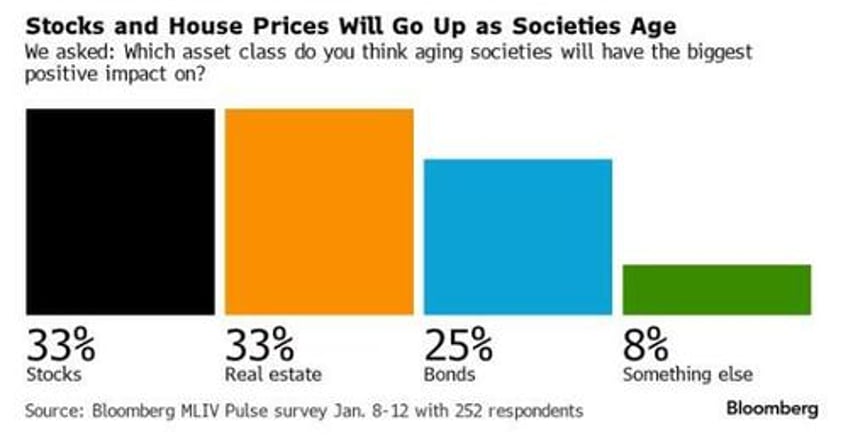

Nonetheless, that’s the direction suggested by responses to the MLIV question on which asset class will see the biggest positive impact from aging societies.

Stocks and real estate were the two most popular answers. The latter is a more proven inflation hedge. Land is in finite supply while typically demand for housing rises as populations age and the average household size falls.

Around a quarter of respondents chose bonds, while some of the other answers given included healthcare stocks, gold, and Bitcoin.

Another finding to emerge from the survey was a strong belief that the retirees of today and tomorrow will take a different approach to their pension portfolio compared to the baby boomers. Almost 60% of respondents took this view.

Gen Z and millennials are set to have lower incomes and less wealth than their parents.

That doesn’t mean they will mimic traditional approaches to pension investing by increasing bond allocations the closer they get to retirement age – which in any case may not be the most prudent strategy if elevated inflation turns out to be a feature rather than a bug.

That not only has implications for current generations when they retire, but for the whole structure of the market that’s been in place for most of the past three decades.

It’s too early to say exactly what that means for investing – but one thing is clear: aging populations mean the rules have changed.