Yeah, yeah, I know. Tulip bulbs. The South Sea bubble. Japan in the late 1980s. We've heard these tired old tropes countless times, yet given the age we live in, these allegories are the equivalent of holding up a $20 bill and expecting to keep the rapt attention of your audience while there is a billion bucks of gold stacked up behind you. We need the drama to match our new reality.

What we are experiencing at this very moment utterly dwarfs all past examples, and on this very weekend, we have entered an entirely new level of crazy.

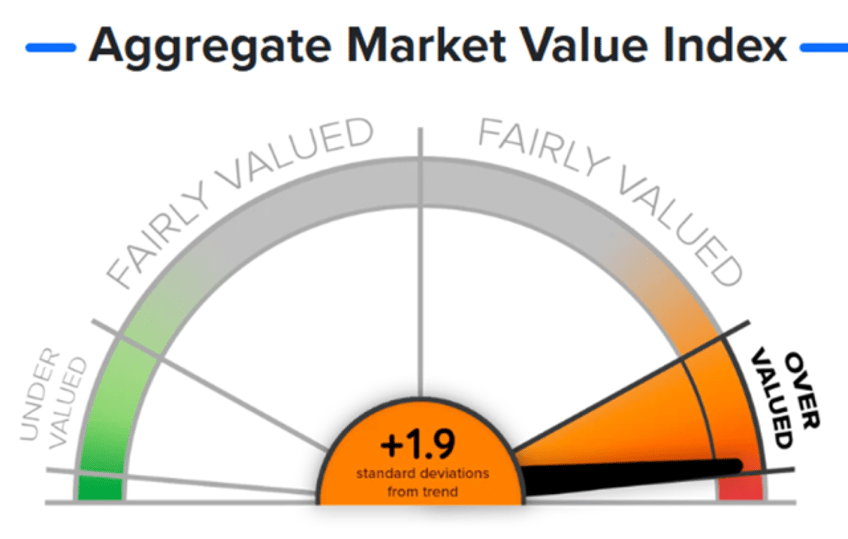

I'm not even speaking of equity markets, which is my specialty and which the above meter represents. We collectively owe the people of early 2000 an apology for pointing at laughing at the likes of pets.com, which is, in fact a completely defensible and sustainable business model, as chewy.com ultimately proved. The denizens of 2000, instead, would be completely gob smacked to learn that a quarter century of progress later, their future selves would offer up such financial instruments as fartcoin.

Over a decade ago, I tried to put together a collection of what I regarded as the most interesting lunacies in financial history in my Panic Prosperity and Progress book. I'm afraid even the most dazzling of these tales would come across as thin gruel in the present environment. Maybe I'll have to do a second edition one day, although it would be twice as long.

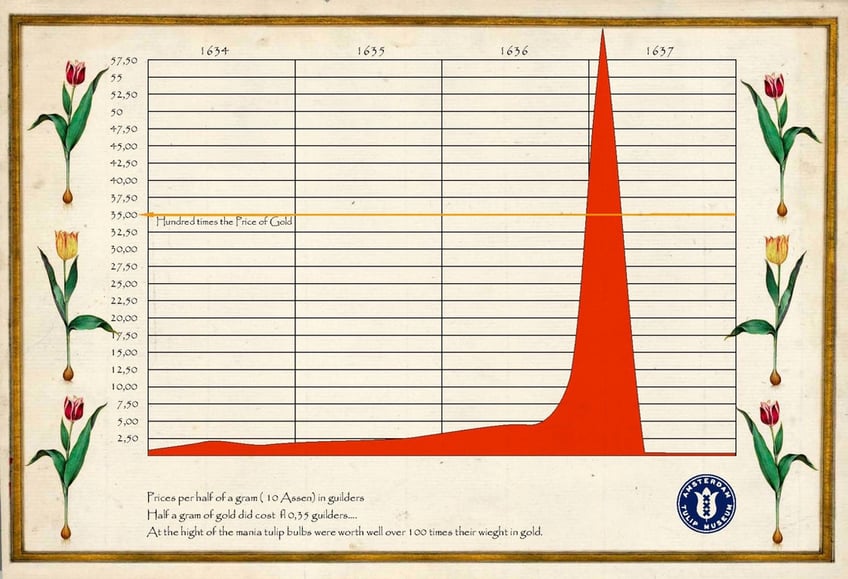

Take the most famous example of all, which is early on in my book: tulipmania. This took place about 400 years ago, and yet it is still widely known (I can only hope the humans of the year 2425 aren't discussing fartcoin).

The chart below illustrates this world-famous "madness of crowds", in which the most coveted of these bulbs grew in value about thirty-fold in the span of a few months.

Thirty-fold. In a few months.

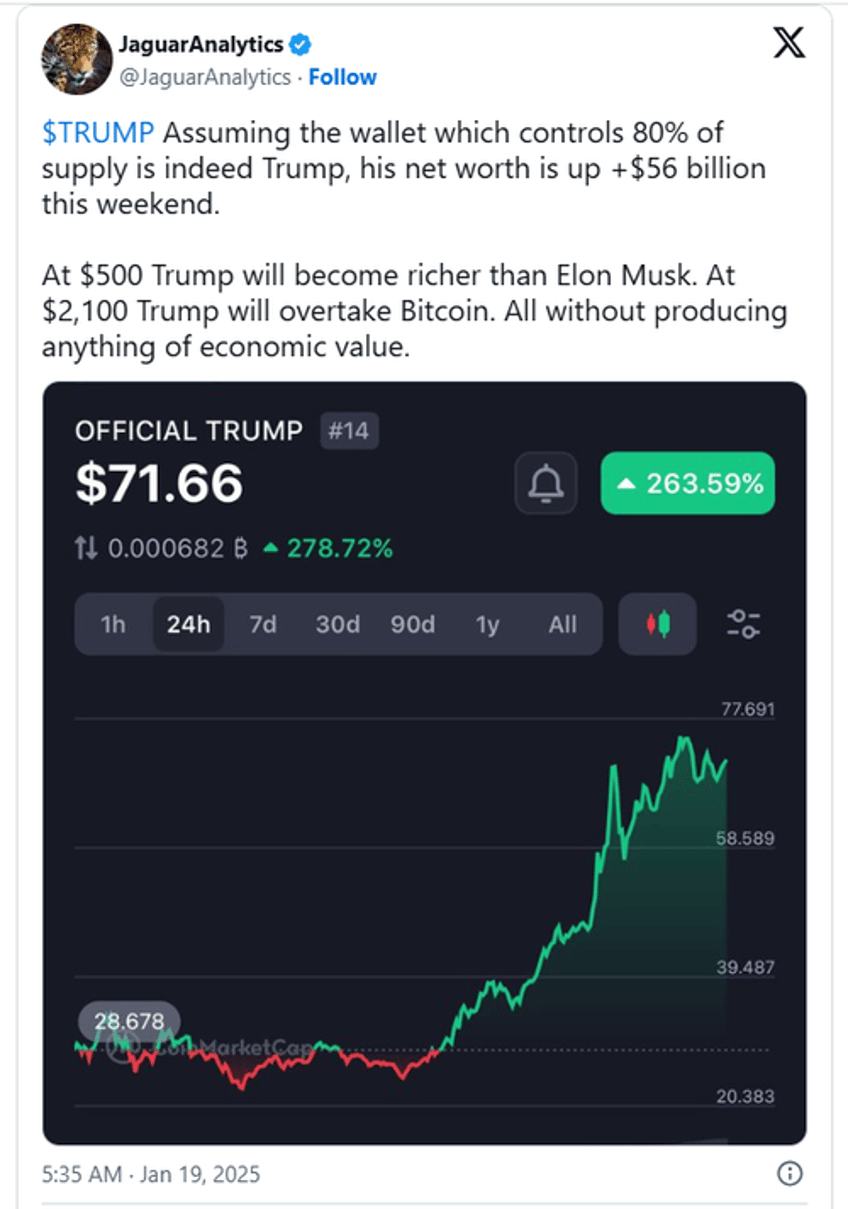

Well, folks, may I direct your attention to something which didn't even EXIST thirty hours ago, and yet is all everyone is talking about this weekend: the Trump coin. I've looked at a lot of different price charts, but they all have different starting values, because no one was paying attention when this thing burst on the scene Friday night. It seems clear that the price gains are much greater than thirty-fold, and it didn't take months, it took hours.

As a person who is happy to short anything with a ticker symbol, even I wasn't stupid enough to go anywhere near this beast, as I prefer watching with amazement from a safe distance.

On Saturday, when the coin got to the lower 30s and then sank to the mid-20s, I witnessed plenty of "told-ya-so's" being bandied about, as well as people entering sizeable short positions. By the next morning, the coin had more than doubled again. These punters are absolutely playing with fire.

Not surprisingly, the web is enjoying the arithmetic on this sensation (to say nothing of the questionable ethical optics), noting that this little fantasy piece is already worth more than the entirety of MicroStrategy, and that this one asset of Trump's is worth far more than all of his other assets put together.

It's a little tough picturing a former President like Warren G. Harding rocking the world quite like this.

Life is replete with ironies, however. While this coin's instant mega-success is being heralded as the validation of the entire crypto "industry" and a harbinger of the good times to come, some serious voices - - and quite pro-crypto, I would add - - are stating that the Trump coin is making a mockery of the entire sector by showing how it is driven only by emotional as opposed to any practical economic reality.

As we've seen with milder forms of assets, such as the equity DJT, passions about a particular person can fade as rapidly as they rise. I would hasten to add that the price movement, and the languorous ascent and descent of the stock make DJT seem as exciting as a passbook savings account compared to the aforementioned Trump coin.

What's really going on here? Is this just about politics?

I don't think so. My view is that it has become so easy (or "frictionless" as the modern parlance goes) to create a financial instrument, that human beings have, at long last, been able to securitize not just the economic fundamentals of a business but, instead, their own emotions. Whims and fancies can effortlessly be transformed into ticker symbols.

Emotions have always played at least a small part in business. It tends to be wrapped up in an abstract concept called "brand." To varying degrees, people have a certain emotional investment in being an iPhone user, or a Nike shoe buyer, or a Marvel Comics Universe fan, or a devoted customer of Chik-Fil-A.

Why is the Trump coin, which as of this composition is worth more than $70 billion, so highly valued?

Is it because it incorporates all of his real estate? Or has a claim on all future earnings of his family?

Well, no. It's because of..............feelings. More specifically, a combination of:

- The enthusiasm from a substantial enough portion of the population to create lots of underlying bids (which only get more enthusiastic as the price ascends), and

- A restricted supply, since the lion's share (I believe 80%) of the coins are not in circulation.

Thus, over the past 48 hours, at least, there is a virtuous cycle. I would be remiss if I didn't state here and now that, should it come to pass that a bunch of everyday investors suffer big losses on their, umm, investment, they have absolutely zero financial recourse. We're talking zilch.

I don't think there's anything in the year 2025 which is unique to these circumstances. Let's do a bit of a thought experiment in that light.

Let's just suppose that the whole Internet, crypto, and mobile thing happened twenty years earlier, and that in August 2001, I introduced a coin called World Trade Center is Awesome. (I was originally trying to think of some Islam-themed coin, but I decided I have enough going on in my life without some kind of terrorist group hunting down the author of this post, and I thought the better of it).

Maybe some folks in the summer of 2001 would have traded my coin because they thought the image looked kind of cool, or they wanted to give some of this crypto to their friend who was going to visit New York as a gift, but let's face it, my WTC Coin wouldn't be getting much traction, all the way through September 10, 2001.

Immediately thereafter, however, my coin might go up in value 5-fold, 20-fold, or who-knows-how-much-fold.

Why?

Is it because the underlying value changed? Well, no, because it was zero before and it's zero now.

What changed is the collective feelings about it.

Perhaps my coin would suddenly be getting all kinds of attention in the press and social media, and in a desire to show their patriotism or somehow obliquely support the firefighters, the victims, or, ultimately, the troops, millions of people would buy up the WTC coin.

I'd be an awfully rich man, and quite by accident! All thanks to a sudden outpouring of emotion that no one could have predicted. Lucky me!

We live in a world which still has the crusty old economics of business to justify the valuations of companies like Caterpillar, Costco, and Kodak. We also live in a world in which the collective good and bad feelings of the public at large - - the collective upvote/downvote - - is playing an increasingly large part of establishing "value" when, in fact, there is none.

I didn't expect to spend my holiday weekend reading a hundred-year-old economic piece, but I stumbled upon Thomas Mann's 1925 "Disorder and Early Sorrow." It provides fascinating insights into the kinds of absolutely corrosive effects hyperinflation (which I believe would come about with the insane stuff we're witnessing these days) has on the public at large.

I took the time to type up some snippets from an analysis of this piece, and I've emphasized portions of it below:

The absurdity of modern life has been traced to many sources, but here Mann looks to the absurdity of modern economic policies. As he shows, inflation eats away at more than people's pocketbooks; it fundamentally changes the way they view the world, ultimately weakening even their sense of reality.

Everything threatens to become unreal once money ceases to be real. Money is one of the primary measures of value in any society, perhaps the primary one, the principal repository of value. As such, money is a central source of stability, continuity, and coherence in any community. By making money worthless, inflation threatens to undermine and dissolve all sense of value in a society. Thus, Mann suggests a connection between inflation and nihilism. Perhaps in no society has nihilism ever been as prevalent an attitude as it was in Weimar Germany; it was reflected in all the arts, and ultimately in politics

Under these insane conditions, people become obsessed with the economic facts of life and must devote all their energy just to trying to stay above water.

There is a tall, pale, spindling youth, the son of a dentist, who lives by speculation. Those who know how to exploit an inflationary situation can gain as much as others lose. As a result, inflation creates a topsy-turvy world. There is no use planning for the future, since inflation, especially hyperinflation, makes future conditions uncertain and unpredictable. As Mises demonstrated, the most insidious effect of inflation is that it makes economic calculation nearly impossible. It thereby destroys the Protestant ethic, which ever since Max Weber has been viewed as linked to capitalism.

The young are more adaptable to changing conditions, while the old are set in their ways. Hence the young cope better with inflation....…[Inflation] alters the dynamic between the generations in society, giving the young a huge advantage over the old. Not having experienced economic stability, the youth of Germany are more able to go with the inflationary flow

It is not simply a matter of the old losing their economic advantage over the young. In an inflationary environment, all the normal virtues of the old suddenly start to work against them, while all the normal vices of the young suddenly seem to look like wisdom. Conservatism and a sense of tradition make it impossible to respond to rapidly changing economic conditions, while the profligacy of youth becomes paradoxically a kind of prudence in an inflationary environment.

"Disorder and Early Sorrow" also suggests that we may also hold them responsible for the empty self-referentiality of much modern art. The nearly $7 million purchase of a banana recently lines up beautifully with this assertion:

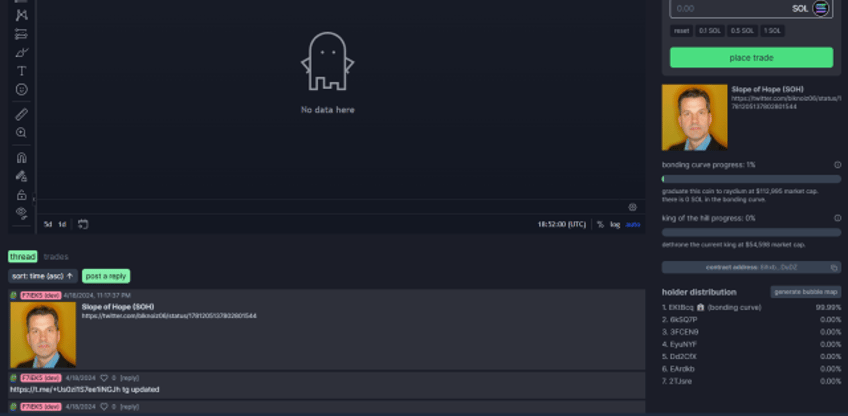

Having wallowed around in this stuff for a while, I began to wobble and think to myself, screw it, why not come out with a Slope of Hope coin and see what happens?

Imagine my surprise when I wandered out onto the web and discovered my dour face looking right back at me. Someone already beat me to it!

Finally, as I was wrapping up this way-too-long post, I was curious how much higher the Trump coin had gone, since it had already been pushing into the 70s. Who knows what it'll be by the time you read this, but for this particular snippet in time, it lost half its value within minutes.

All of which, I suppose, puts a nice bow on top of this package of words I'm giving to you.

My belief is that 2025 is going to be the strangest and most mentally unhinged years of our financial lives, if not our lives in general.

Look to the past to get a sense of the future.

Trust me, almost no one else is doing so.