The Emerging China/LATAM Silver Cartel (Update)

On July 28th we published China and LATAM Silver Part 1 (posted here on ZH as China Wants All The LATAM Silver (Part 1)with the intention of publishing Part 2 relatively soon thereafter.

That post summarized in three sentences is:

1) According to Mainland China sources: China is buying unrefined Silver concentrate from LATAM miner/refiners, something infrequently done except briefly during times of acute supply/demand imbalances.2) From LATAM mining sources: China is paying refined prices for unrefined Silver Concentrate, spending as much as $200 more a ton for each load of material. 3) China is effectively laying claim to LATAM silver before it is refined and crowding out Western buyers by paying higher prices for ore without directly affecting spot price.

Part Two will be posted this weekend and contain an interview with a Silver mining exec. The post will largely focus on the following questions:

- QUESTION: What is Silver Concentrate, Dore bars, and where do they fit in the chain?

- QUESTION: The supply deficit is about 4 years old now and running, how is this shortfall being covered?

- QUESTION: We have been seeing since 2022 a marked drop in financial hedging for LATAM silver miners using Comex and also as reflected in the SiFO rates for leasing metal. Is that consistent with what you are seeing on the ground there?

- QUESTION: We’ve been told that China silver production has been declining for quite some time and they’d been outsourcing increasingly. Any comment on that?

- QUESTION: Are you seeing more direct purchases of Silver now? If so, by who?

- QUESTION: Where do Bullion Banks Fit in?

Is this also indicative of why SHFE/SGE Silver prices now chronically trade at a premium to Comex/ LBMA? That is an important question.

The China Silver Premium Puzzle-Piece

One issue relevant to the China/LATAM connection is a noticeable price difference in globally deliverable Silver. We refer to the price differential between China's published Silver prices and global prices ex-China.

If the China premium is a reflection of regional demand overwhelming regional supply, then our China/LATAM thesis is empirically bolstered. If, however, that premium is a result of a Chinese Value Added Tax (VAT) as many believe, then there is no harm or foul. Either way, the source of the China Silver premium must be uncovered. But we must know the source of the price Premium either way

Why must we know the source of the China Silver premium?

If the premium is not from a VAT, then the lack of arbitrage says very much about global trade and more about a Silver collateral shortage. That all harkens back to a Zoltan Pozsar post entitled: A Crisis of Commodities is Unfolding. If the China premium is *not* VAT related, then the local China Silver shortage is going global.

The CPM pending conclusion (yay or nay) will be helpful in determining to what extent that belief has merit.

Therefore we will post Part 2 of the China/LATAM connection this weekend without it. Here, however, are some broad strokes on the topic related to their early findings

China Silver VAT Controversy

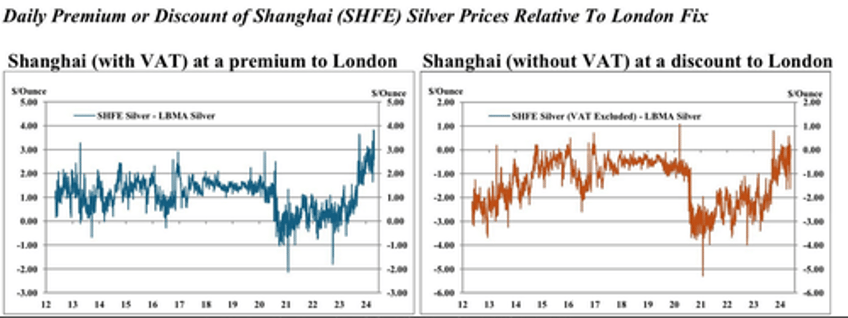

On June 10th CPM Group — a well known and respected Silver analytics firm headed by Jeffrey Christian— published 'Part 1' of an analysis explaining the SGE (physical) and/or SHFE (futures) Silver price premium as they are publicly displayed versus Silver prices ex-China.

The CPM report’s early tentative conclusion was that the price differential may largely be due to China’s VAT. (pic 1, pic 2)

CPM's Initial Findings on the China Silver Premium...

Pic 2: Backing VAT out puts SHFE (a futures contract) at a discount to LBMA (a physical contract)

Since then major bank reports (eg Pic 3 below) touching on the topic have been published that do not corroborate this, while not addressing a VAT’s presence or absence at all.

Pic 3: BOA shows changes in the China Premium over time...

From : BOA Loves the Silver

GoldFix and interested parties would like to know if further analysis is near completion towards the expected 2nd part of CPM’s cursory observations on this matter. While it is possible our reading of the report is incorrect, —as elsewhere in the report it seems the analysis does imply captive silver demand in China’s region is at least partly driving the price differential— further explanation would be helpful.

It should be noted we have calls into the banks asking for clarification of their own work and others claiming knowledge of the market structure there.

Bottom Line on this Update:

We believe a large portion of the price premium in China Silver is *not* due to a China VAT fee and is merely indicative of supply/demand dynamics already confirmed by China’s feverish activities to acquire more Silver. We are posting the Part 2 mining executve interview without the VAT update this weekend

Continues here

Free Posts To Your Mailbox