By Graham Summers, MBA | Chief Market Strategist

The Fed just confirmed my thesis.

Over the last week, I’ve noted that Uncle Sam is the economy now.

What I mean by this, is that the U.S. government is spending so much money, and hiring so many people, that the economy is refusing to fall into recession despite weakness in the private sector.

By quick way of review…

- Since, mid-2021, public sector job growth has outpaced private sector job growth.

- Government transfers (social spending) accounted for 40% of the growth in income in 1Q24 and was the single largest contributor to personal income growth in 20 states.

Put simply, the “fix” is in as far as the economy is concerned. And it’s Uncle Sam, NOT the Fed, sitting in the economic driver’s seat.

The most powerful financial insider in the world, Fed Chair Jerome Powell, confirmed this in a speech at the ECB Forum on Central Banking yesterday.

Some highlights from Fed Chair Powell’s comments.

- The budget deficit is very large, and the deficit path is unsustainable.

- Debt sustainability should be a real focus going forward, should be tackled sooner or later.

- Fiscal policy is a job for elected officials.

- The Fed has been told to stay out of politics and they do.

(h/t Bill King)

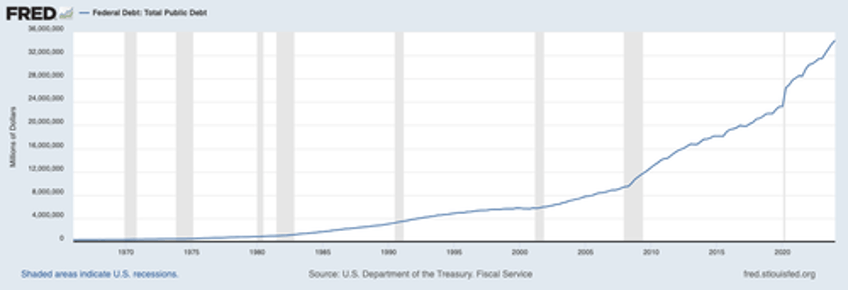

This is a MAJOR tell from the most powerful financial insider in the world: the Federal Government is the one running the “economic” show right now. And it is issuing a truly jaw dropping amount of debt to accomplish this: the Biden administration is on pace to add $9 trillion in debt in just four years.

See for yourself… the U.S.’s debt load is going parabolic.

At some point, this is going to be a REAL problem. But for those of us focusing on making money from the markets, the important thing to note right now is that the economic “fix” is in. And the Fed’s not going to get in the way.

Small wonder then that stocks keep ripping higher. By the look of things, the S&P 500 will hit a new all-time highs later today.

After all, as investors, our job is to make money, not look for any excuse to dump stocks and panic about something bad happening. And as I’ve outlined in recent articles, this means riding bull markets for as long as possible, and then side-stepping bear markets when they eventually hit.

In the very simplest of terms, you need to be invested in stocks, until an objective, verifiable tool (not your feelings or limiting beliefs) tells you it’s time to “get out.”

I’ve developed a tool that takes ALL of the guessing work out of this problem. With just one look at this tool, you can tell whether it’s a good time to buy stocks or not. I detail it, along with what it’s currently saying about the market today in a Special Investment Report How to Predict a Crash.

To pick up a free copy, swing by

Best Regards

Graham Summers, MBA

Chief Market Strategist

Phoenix Capital Research