NASDAQ RALLY ON THIN ICE

The rally in the Nasdaq is not broad based. It is essentially being powered higher by a relative few stocks. This isn’t a bullish environment, rather it has all the hallmarks of a relief rally in an ongoing bear market. Let’s take a closer look…

You may have noticed the press of popular opinion talking about the Nasdaq being up some 45% since the start of the year. Yes, that indeed is the case in the Nasdaq 100. That was one hell of a short bear market (strangely, from January 1st, 2022 to January 1st, 2023).

But is the bear market really over? We define a bull market as a “general rise in the average listed stock.” Of course, that begs the question as to how one defines a “general rise,” but let’s not get bogged down with that for the time being. What is critical is that one should be able to make good money by randomly choosing a basket of 30 stocks across an exchange rather than just investing in the major market index.

Everyone thinks that a major market index, like the Nasdaq 100 or Nasdaq Composite, is “the market.” These are just constructs based on market cap weighting and often are not good proxies for the performance of the “average listed stock.” We are better served by looking at the behaviour of small cap indices to give an approximation of the performance of the average stock.

Notice how the Nasdaq small cap index has hardly budged since the start of the year — a very different picture from the performance of the Nasdaq index itself.

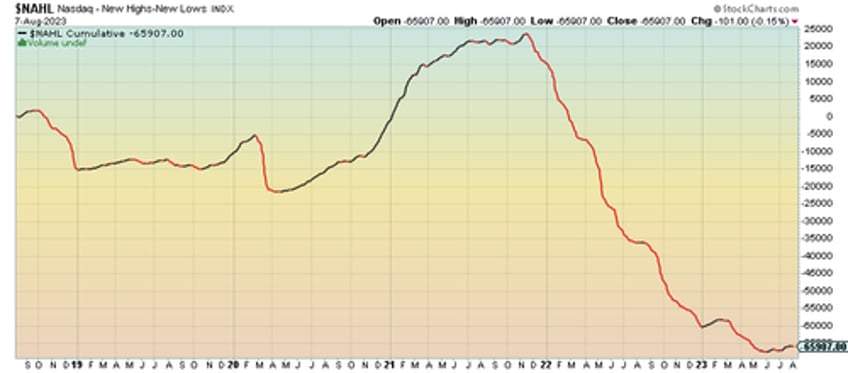

And here is what has really been happening beneath the scenes — the New Highs-New Lows Index (the cumulative index of the number of stocks making 52 week highs less 52 week lows) has been trending down since late 2021 and is lower YTD. This indicator suggests that the bear market is alive and well and that the 45% rally in the Nasdaq YTD is a sucker rally.

If the Nasdaq (essentially tech/growth stocks) entered a bear market because of bond yields rising… well, they aren’t down YTD. Rather they look close to making multi-year highs:

Bond yields too high? Well, if history is anything to go by, they are getting back the “lower range of normal.” In other words, they are far from being too high. Of course, bond yields are essentially a function of inflation expectations. If you think that oil is going above $100, then inflation is far from being “transitory.”

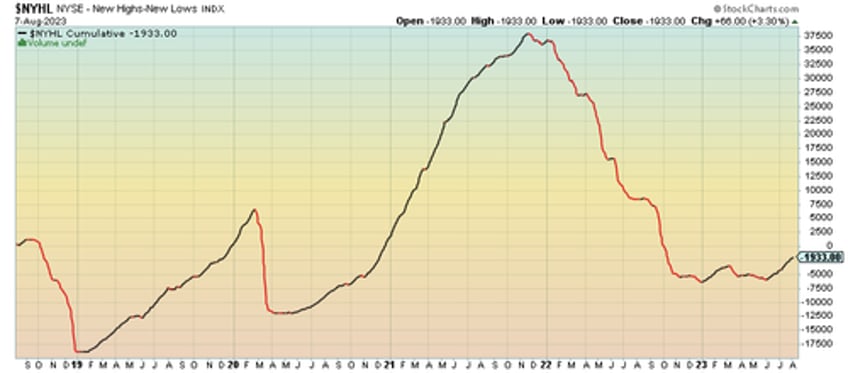

How does the NYSE look? In short, not much better than the Nasdaq. The strength since October last year isn’t broad based, at least not typically what you would see at the start of a bull market.

All very interesting, but what are the implications for investing? A few points come to mind:

- We are probably still in a bear market where the next big move for the major market indices is down… or at best we are in for a long period of the market going nowhere but with a lot of +/-20% moves, so index tracking probably isn’t going to be a very rewarding strategy.

- Investments need to be REALLY focused on markets/sectors/stocks that are offering great value and where the earnings outlook is positive for the next five years.

We continue to believe that we have entered a bear market somewhat similar to the TMT bear market of 2000-2003. Yes, the Nasdaq did fall some 75% during this time, but if you had invested in out-of-favour small cap value stocks (much like what we are investing in today albeit with a energy bias), then you would have come out with a slight profit — up 18% in the face of the Nasdaq being down 75% over three years is a huge outperformance.

It’s not without volatility. Note the “9/11” drop and then being up 55% as of May 2002 to being up 18% some 6 months later. From experience this was a hard slog even for value investors.

By way of interest, here is how the Russell 2000 and Nasdaq performed in the three years leading up to the start of 2000. Suffice to say that investing in small value was light years from being a popular investment strategy. Rather, it was horrid.

While we aren’t world renown for timing the market, quietly we wouldn’t be surprised to see more downside in major market indices over the next few years. However, we aren’t worried or concerned because history tells us if we constantly invest in stuff that has been out of favour for an extended period of time (where investors over the last seven years have only ever lost money), it is difficult to not come out ahead on a multi-year view.

If you are a self-directed stock investor looking for an edge, we can show you. Click on the links (below my name) to find a solution that works best for you.

- Chris MacIntosh

Capitalist Exploits | Glenorchy Capital Macro fund | Subscribe to Insider | Rebel Capitalist Pro