Our Alternative Way To Play Bitcoin

In a post last Monday ("A Better Way To Play Bitcoin?"), we mentioned an alternative to MicroStrategy (MSTR), Semler Scientific (SMLR).

$MSTR $SMLR https://t.co/HfDautuD7Z

— Portfolio Armor (@PortfolioArmor) January 13, 2025

As we wrote there, Semler Scientific adopted MicroStrategy's Bitcoin Balance Sheet Strategy, but--unlike MicroStrategy, it has a profitable underlying business:

Semler would seem to have a couple of major advantages over MicroStrategy, from an investor's perspective. To start with, Semler's core business is profitable, unlike MicroStrategy's. You can see this in the comparisons below (the quantitative ratings are via Chartmill).

MicroStrategy:

- Bitcoin value as a percentage of market cap: 51.8%

- Overall fundamental rating: 2

- Profitability rating: 3

- Health rating: 2

- Valuation rating: 2

- Last quarter's earnings: missed on top and bottom lines; lost money.

Semler Scientific:

- Bitcoin value as a percentage of market cap: 47.3%.

- Overall fundamental rating: 6

- Profitability rating: 9

- Health rating: 8

- Valuation rating: 5

- Last quarter's earnings: beat on top and bottom lines; made money.

So much for theory. Let's look at what our SMLR trades were and how they've done so far.

Our Semler Scientific Trades

We placed three trades on Semler Scientific, two on Friday, January 10th, when we shared this idea with our Substack subscribers:

- We bought shares of SMLR at $51.37.

- We opened a vertical spread on SMLR expiring on April 17th, 2025, buying the $55 strike calls and selling the $60 strike calls, for a net debit of $1.50.

And one last Monday, when we posted about this on ZeroHedge:

- We bought the the $55 strike calls on SMLR expiring on January 17th, for $0.75.

How That's Going So Far

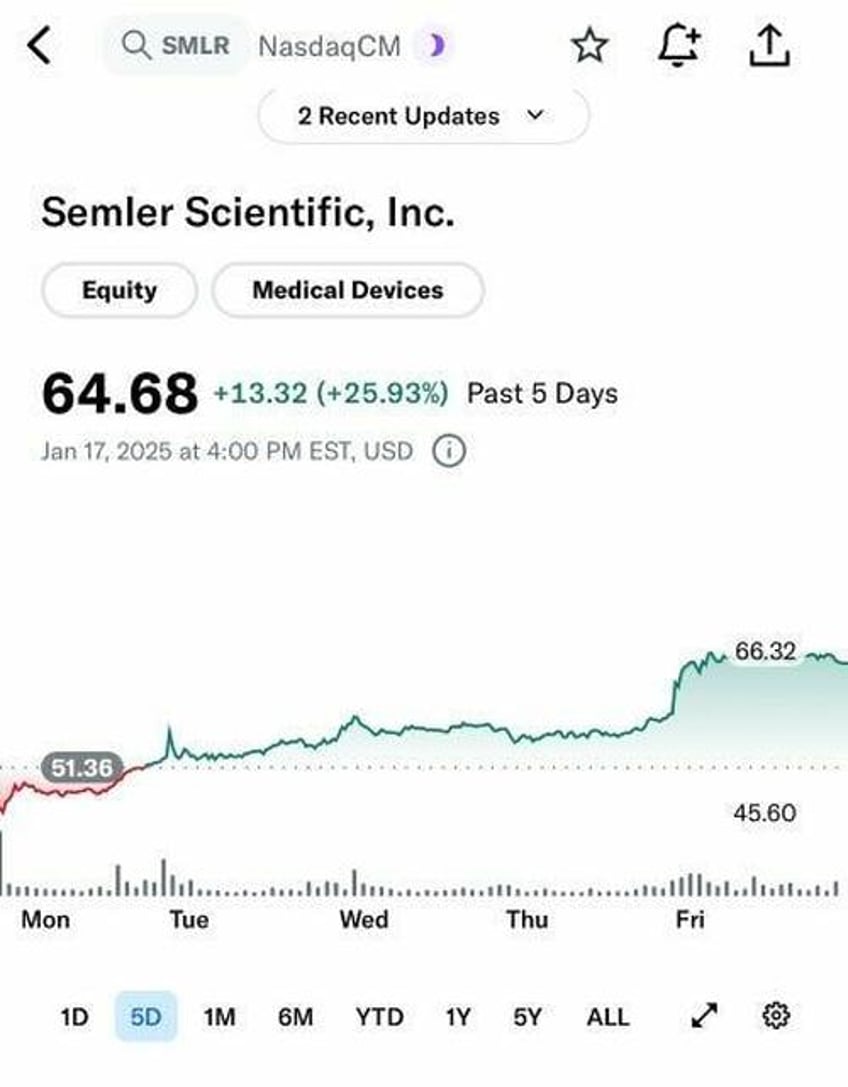

Semler Scientific closed at $64.68 on Friday, up nearly 26% on the week.

So our shares are up about 26%, and our vertical spread is in the money (if SMLR is still above $60 on April 17th, the spread we paid $1.50 for will be worth $5).

Good News And Bad News On Last Monday's Trade

The good news is we sold our $55 strike calls on SMLR on Monday for $2.91, earning a 288% gain.

The bad news is that had we waited until Friday instead, we could have sold them for about $10, which would have given us a gain of about 1,300%.

An Approach We'll Use Going Forward

The reason SMLR was on our radar was because it was one of our system's top ten names that week. On Friday, we opened up a longer term trade on another one of our top names last week, a chip stock.

If we get a pullback in that chip stock on Tuesday or Wednesday next week, we may take a flyer on another weekly call option.

If you'd like a heads up when we place our next trade, you can sign up for our trading Substack/occasional email list below.

And if you want to limit your downside risk, in light of Cem Karsan's market warning last week,

You can download the Portfolio Armor optimal hedging app by aiming your iPhone camera at the QR code below (or by tapping here, if you're reading this on your phone).

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).