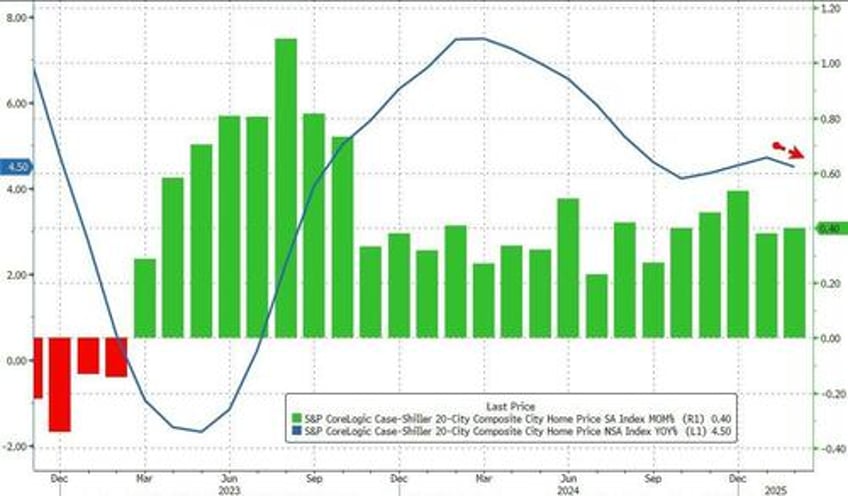

US home prices hit a new record high in February, according to the latest data from S&P CoreLogic Case-Shiller, rising 0.4% MoM (as expected). However, the pace of price rises did slow modestly (after accelerating for the past three months) to +4.50% YoY...

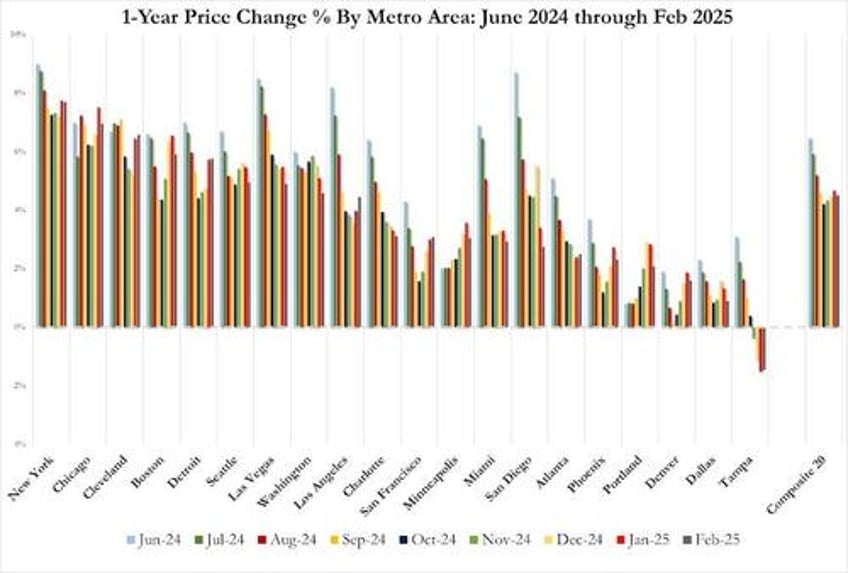

But as the average national home price rose to yet another record high, prices in Tampa continued to fall...

But Las Vegas and San Diego are also seeing prices start to decelerate rapidly...

Arguably, (lagged) mortgage rates dipped during that period (positive short-term for the highly smoothed and lagged Case Shiller series), but as is clear, the next couple of months do not bode well...

However, home price appreciation does seem to track very closely with bank reserves at The Fed (6mo lag), which implies prices are going continue to lag for the next couple of months before re-accelerating once again...

So 100bps of rate-cuts prompted a re-acceleration in home prices...Well played Fed!!