Even though there are warning signs everywhere, the markets keep on going. The good news is that the FTSE finally decided to turn up. This week the UK benchmark outperformed its peers with a rally of 2.63%.

This excitement came on the back of continually good inflation figures and a Bank of England meeting that suggests rate cuts are on the way.

The BoE kept its key interest rate unchanged at 5.25% for a fifth consecutive time, although the 8–1 vote in favour appeared to send a more dovish signal. Two previously hawkish policymakers dropped their calls for a hike; another backed an immediate cut. Governor Andrew Bailey said: “We are not yet at the point where we can cut interest rates, but things are moving in the right direction.” Later, in newspaper interviews, Bailey signalled greater optimism about the economy and told the Financial Times that rate cuts could be “in play” at future meetings.

The BoE’s monetary policy announcement came a day after data showed that annual consumer price growth decelerated to 3.4% in February from 4.0% in January. This latest reading was the lowest inflation rate in more than two years. Underlying price pressures also moderated but remained strong, with services inflation easing to 6.1%. Meanwhile, the early version of S&P Global’s purchasing managers’ survey for March appeared to provide more evidence that the economy may be emerging from recession. For a fifth consecutive month, the composite purchasing managers’ index (PMI), which covers the services and manufacturing parts of the economy, remained at levels indicating an expansion in output.

In Europe

The pan-European STOXX Europe 600 Index ended near a record high, climbing 1.03%. Dovish signals from central banks boosted risk-on sentiment. Germany’s DAX gained 1.58%, while Italy’s FTSE MIB advanced 1.30%. France’s CAC 40 Index, however, fell 0.17%.

European government bond yields declined on a weak purchasing managers’ survey for Germany and a reduction in Swiss interest rates.

PMI surveys showed that the output of goods and services in the eurozone came close to stabilising in March, with a first estimate recording only a marginal decline, S&P Global said. The eurozone composite PMI rose to a nine-month high of 49.9 from 49.2 in February. (PMI readings above 50 indicate an expansion in activity.)

In the US

Stocks in the US moved higher for the week, pushing the S&P 500 Index and the Nasdaq Composite to new records, as investors welcomed news that Federal Reserve policymakers were still anticipating three interest rate cuts later in the year.

The so-called dot plot showed that the median expectation for three rate cuts in 2024 remain unchanged, while the median expectations for interest rates in 2025 and 2026 went up by less than 25 basis points (0.25 percentage points), or by less than one cut.

Communication services led the gains along with technology shares. A late rise helped artificial intelligence chipmaker NVIDIA reach a record high on Friday and lift the company’s market capitalisation near USD 2.4 trillion. Reports that Apple might partner with Google parent Alphabet in offering generative artificial intelligence tools also boosted sentiment. Healthcare and real estate shares lagged. Trading next week is scheduled to end on Thursday in observance of the Good Friday holiday.

In Asia

Japanese equities gained over the week primarily on yen weakness resulting from the Bank of Japan’s unexpectedly hawkish tilt (it raised interest rates earlier than had been priced in by most market participants and for the first time since 2007). The Nikkei 225 Index rose 5.6%, and the broader TOPIX Index was up 5.3%, with both indexes rallying to record-high levels.

On the Japanese economic data front, consumer price inflation, as measured by the Consumer Price Index (CPI), rose to a higher-than-anticipated 2.8% annualised over the month of February. This was a sharp pickup from January's 2.0% and well ahead of the BoJ's inflation target.

Chinese equities retreated as concerns about the property sector slump offset optimism about better-than-expected economic data. The Shanghai Composite Index declined 0.22%, while the blue-chip CSI 300 gave up 0.70%. In Hong Kong, the benchmark Hang Seng Index lost 1.32%, according to FactSet.

Property investment in China fell by 9% in the January–February period from a year earlier, slowing from a 24% drop in December, according to official data. Property sales by floor area sank 20.5% in the first two months of the year, after slumping 23% in December. The slower pace of declines in property investment and sales came after Beijing rolled out numerous pro-growth measures to arrest the country’s years-long real estate slump. However, most investors remain cautious about China’s property sector as developers continue to grapple with high debt levels and weak homebuyer demand.

The week ahead

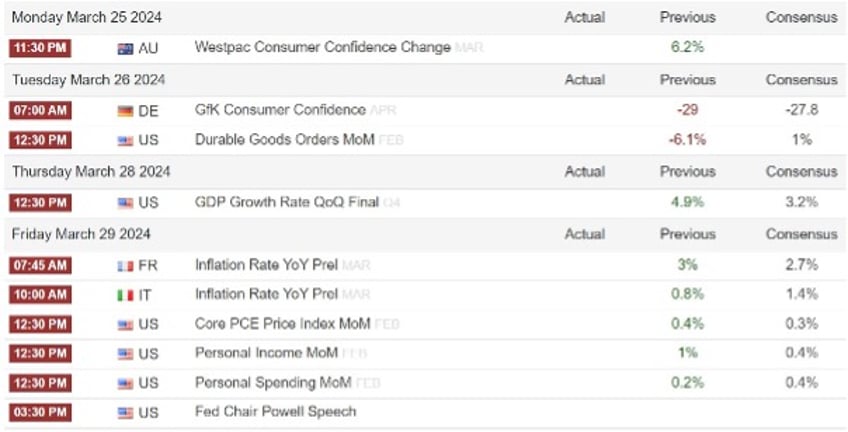

Next week’s calendar seems to lack top-tier economic events, and as it is the Easter weekend we may find volatility to be on the lower side. Still, a few things are worth mentioning in case they lead to new developments.

On Tuesday we have German consumer confidence and US durable goods orders. Confidence in Germany has been low in recent months edging up to -29.0 heading into March 2024 from February's 11-month low of 29.6, matching market forecasts. This month we’re expecting another slight improvement but still very negative and close to -28.

Thursday is the latest US GDP release. This is expected to come around 3.2%, slightly lower than the previous quarter but still very strong.

Most markets will be closed for the long Easter weekend but Friday still has a couple of data points of note. Both France and Italy announce their latest inflation figures. Neither are far away from the 2% target as inflation in Europe doesn’t seem to be an issue any more.

Then finally, we’ll get US PCE Price Index data. This is another inflation figure worth keeping an eye on as the FED most certainly will be. We saw an increase of 0.3% month-over-month in January 2024, in line with market expectations of 0.3%, and following a downwardly revised 0.1% rise in December.

Prices for services went up 0.6% while goods decreased 0.2%. The annual rate slowed to 2.4%, the lowest since February 2021, from 2.6% in the previous month, and compared to forecasts of 2.4%.

Meanwhile, monthly core PCE inflation which excludes food and energy and is the preferred Fed inflation measure, edged up to 0.4%, the biggest increase since February last year, and higher than a downwardly revised 0.1% rate seen in December, also matching expectations. Separately, food prices increased 0.5% and energy prices fell 1.4%. Finally, the annual core inflation rate slowed for a 12th straight month to 2.8% from 2.9%, a fresh low since March 2021, and in line with forecasts of 2.8%

The market is expecting a rise of 0.3% but a number higher than this and we could be looking at an exciting opening after the Bank Holiday Easter Monday.

Have a great week in the markets.

For more insight visit www.tppglobal.io