Submitted by QTR's Fringe Finance

At no other point in history has discussion and free speech in the world of economics and finance been as necessary as it is now.

For those of you cut from the same financial-outlook cloth as I am, I'm sure you've made peace with being called a fear monger by now.

Because apparently, pointing out the basic laws of economics that seem to stand at stark odds with our current, unprecedented Keynesian experiment makes you some type of conspiracy theorist.

As those pushing modern monetary theory are quick to remind us, it is our brains that are broken, not the monetary system or their academic take on the economy. Take it from the woman who authored a book advocating for MMT that was published right before the country found itself mired in 7% inflation:

“The debt isn’t the reason we can’t have nice things. Our broken thinking is. To fix our broken thinking, we need to overcome more than just an aversion to big numbers with the word debt attached. We need to beat back every destructive myth that hobbles our thinking.

—Stephanie Kelton, The Deficit Myth

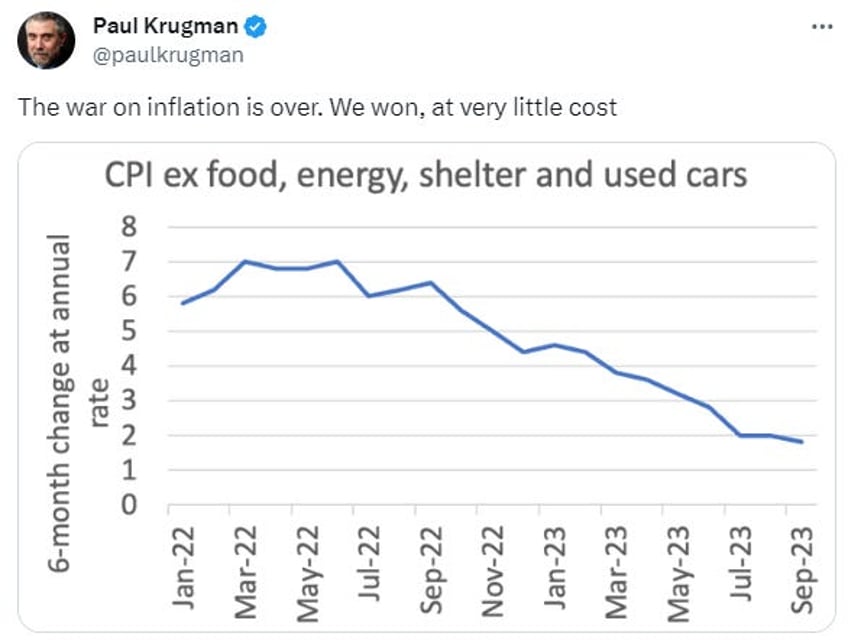

Remember, we’re the idiots. It’s our brains that are broken. Higher rates no longer means there will be a slowdown in spending, contracting GDP no longer means recession, dollars can be printed without any consequence to anyone at any point and the war against inflation has already been won…that is, as long as you subtract food, energy, shelter and used cars from equation.

This inane idiocy will continue, Nobel Prizes and all, until our “conspiracy” (read: math) is eventually proven true.

Free speech is our First Amendment right for a reason: it is of grave importance. Even more important is a reminder we need more and more as the days go by: it is the speech you disagree with the most that is the most important to protect.

In the financial world, this means those of us from the Austrian school (i.e. we can actually balance a budget, believe cash flow is vitally important to a business and understand that productivity and efficiency in an economy doesn’t come from printing dollars) are widely seen as “broken clocks” that are right “only twice a day”. In some respects, I’m fine with this.

After all, it’s tough to argue the point that we are on a treacherous, long-term path that will result in catastrophe at an unknown point in the future because everything that every academic, analyst and media personality is saying and doing is wrong, without looking like a broken clock. Those that read me consistently know that I constantly struggle with whether or not my analysis will wind up being on the right side of history.

But at the very least, you can’t have “rock solid” financial rules, like the ones academics swear by (and the ones that have driven us $33 trillion in debt) without having...(READ THIS FULL ARTICLE, FREE, HERE).