Oil prices extended gains from yesterday afternoon's rebound, helped by a big draw at the Cushing Hub reported by API. Escalating risks in the Middle East are competing with IEA's forecast that the market will be well-supplied this year (the US is at record production and global economic activity slows), which is at odds with OPEC's forecast of a large shortfall.

The inventory/demand/supply data may give us an early glimpse at who will be right?

API

Crude +483k (-900k exp)

Cushing -1.98mm

Gasoline +4.86mm (+2.5mm exp)

Distillates +5.21mm (+600k exp)

DOE

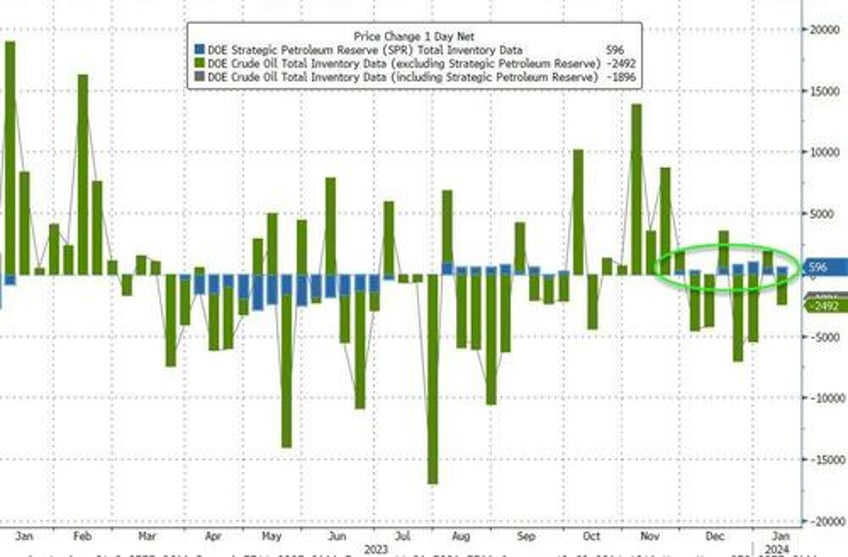

Crude -2.94mm (-900k exp)

Cushing -2.1mm - largest draw since Sept '23

Gasoline +3.08mm (+2.5mm exp)

Distillates +2.37mm (+600k exp)

The official data confirmed API's large draw at Cushing but saw a bigger than expected crude draw also as product builds were bigger than expected (but smaller than API reported)...

Source: Bloomberg

The Biden administration added 596k barrels to the SPR last week - the 7th weekly addition in the last 8...

Source: Bloomberg

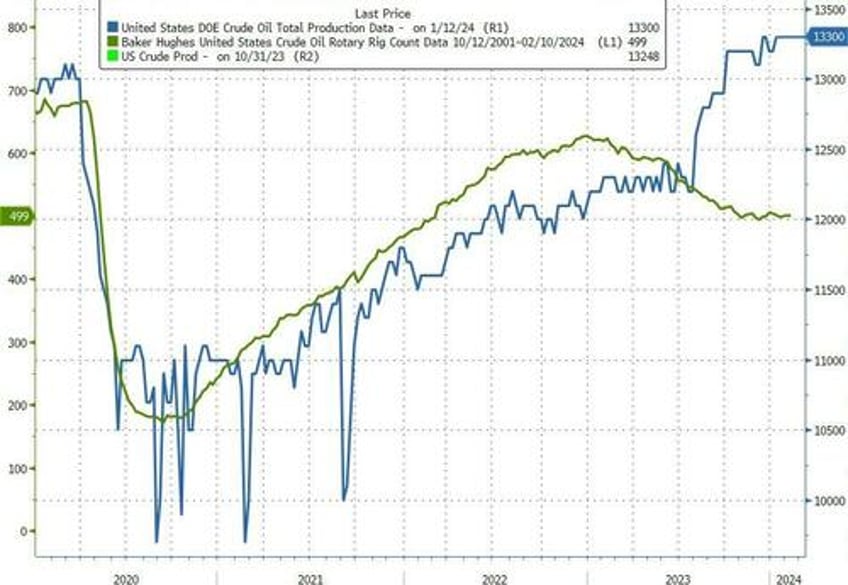

US Crude production remained at a record high 13.3mm b/d, despite the ongoing trend lower in rig count...

Source: Bloomberg

How much longer can they sustain this?

Spot where shale drillers put existing wells into 120% efficiency overdrive to attract takeover bids, Also, good luck sustaining this level of output pic.twitter.com/RDDaV5f73N

— zerohedge (@zerohedge) January 18, 2024

WTI was trading back at the upper end of its YTD range ahead of the official data...

And extended gains on the crude and Cushing draws...

“Peak oil demand is not showing up in any reliable and robust short- and medium-term forecasts,” OPEC Secretary-General Haitham Al Ghais said in a separate statement, pushing back against expectations that climate change will cap the use of fossil fuels.

On the entirely opposite side of the spectrum, The International Energy Agency, which advises major oil consumers, projects that demand will decelerate sharply this year, and ultimately peak this decade thanks to the adoption of renewable energy and electric vehicles.

Who'll be right?