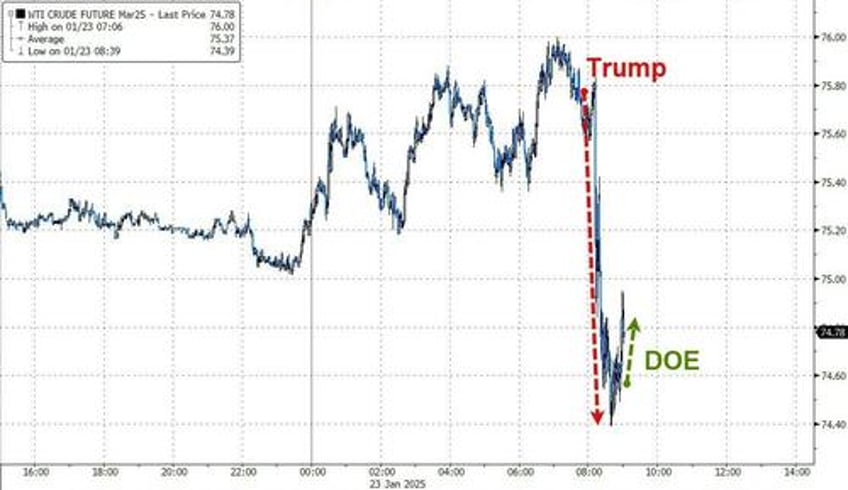

Oil prices are lower this morning (extending a multi-day slump) following comments from President Trump to Davos that he will push Saudi Arabia and OPEC to lower oil prices. Prices had recovered some overnight weakness (due to across the board inventory builds reported by API) before Trump's comments.

“I’m also going to ask Saudi Arabia and OPEC to bring down the cost of oil,” Trump said in remarks delivered virtually to world leaders gathered in Davos Thursday. “You’ve got to bring it down.”

The remarks stifled a rebound earlier in the session that had been driven by signs that fresh US sanctions on Russian crude, introduced before Trump took office, were tightening the global market.

API

Crude +1mm

Cushing +500k

Gasoline +3.2mm

Distillates +1.9mm

DOE

Crude -1.02mm

Cushing -148k

Gasoline +2.33mm

Distillates -3.07mm

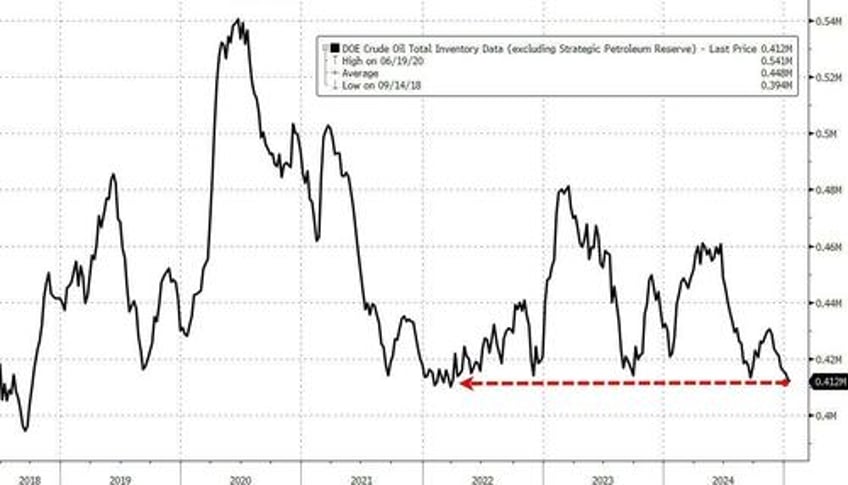

While API reported across the board builds, the official data was almost the opposite with only gasoline stocks rising (though only modestly... even if it was the 10th weekly build in a row). Crude inventories are down for the 9th straight week

Source: Bloomberg

Total US crude stocks dropped to their lowest since March 2022 and the seasonally lowest since 2015...

Source: Bloomberg

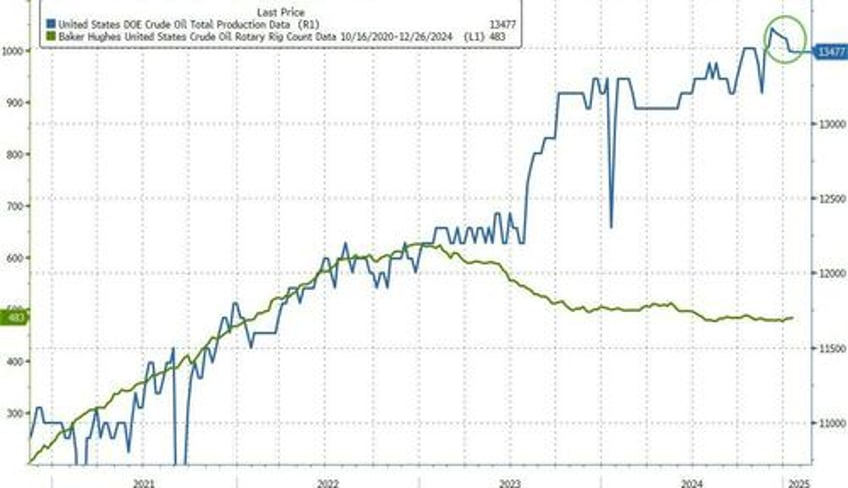

US crude production remains near record highs...

Source: Bloomberg

WTI was trading around $74.50 ahead of the inventory data and tricked up very slightly on the crude draw...

“Oil markets are now facing the introduction of a new variable this year, that is the ‘Trump call option’ on energy prices,” said Frank Monkam, head of macro trading at Buffalo Bayou Commodities.