The most unexpected highlight from Counterpoint Research's Market Pulse Early Look is Apple's rise to the number one position in global smartphone shipments in Q1 2025, capturing about 19% of market share and outperforming Chinese rivals. This rebound in fortunes for CEO Tim Cook is particularly notable given the underwhelming iPhone 16 launch last fall and the company's weak Q4 performance.

Counterpoint found that the launch of Apple's entry-level model, the iPhone 16e, propelled sales and allowed the company to seize the number one spot for shipments in the first quarter, with a 19% share.

"OEM dynamics continue to remain interesting. Helped by the iPhone 16e launch in a non-traditional quarter and continued growth and expansion in its non-core markets, Apple took the #1 spot in Q1 2025, despite the challenges faced in its biggest markets," the report stated, adding, "While sales in the US, Europe and China were either flat or declining, Apple recorded double-digit growth in Japan, India, Middle East and Africa, and Southeast Asia."

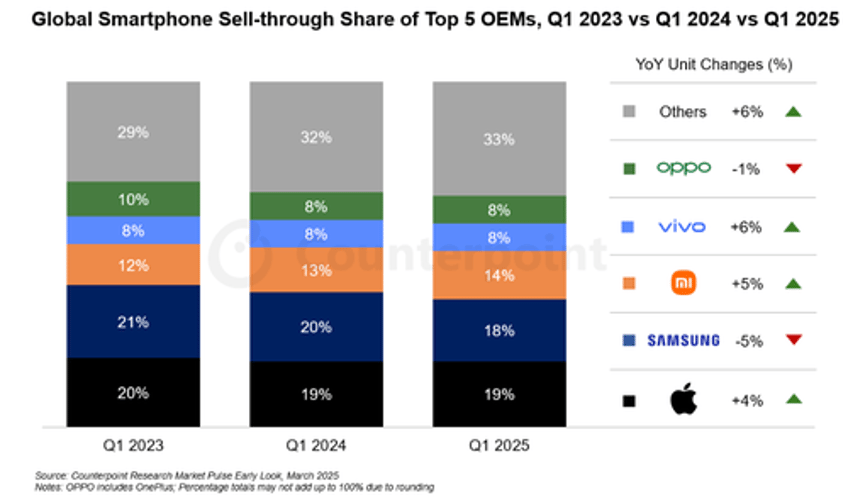

Samsung followed Apple with an 18% market share, Xiaomi held 14%, while Vivo and Oppo were tied at 8%. All other brands collectively accounted for 33%.

Last quarter, the global smartphone market expanded by 3% YoY. Declines in developed markets were partially offset by "growth in China owing to government subsidies and continuing recovery in key emerging markets across Latin America, Asia-Pacific and Middle East & Africa," according to the report.

"The market got off to a mixed start in 2025, where Q1 saw continued improvement in economic conditions, particularly in emerging markets. But mature markets like North America, Europe and China showed signs of fatigue after a recovery in 2024," Counterpoint Senior Research Analyst Ankit Malhotra said.

Malhotra said, "Sales in January were particularly strong, with a subsidy-led demand boost in China. The momentum continued with major launches like Samsung's S25 and iPhone 16e, but it turned quickly as economic uncertainties and trade war risks started mounting, especially towards the end of the quarter. We continue to analyze changes in policies and are currently projecting the market to decline YoY in 2025, despite growth in Q1."

Counterpoint warned that the global smartphone market will likely slow this year amid mounting macroeconomic headwinds and tariffs that will pressure consumer demand across most markets.