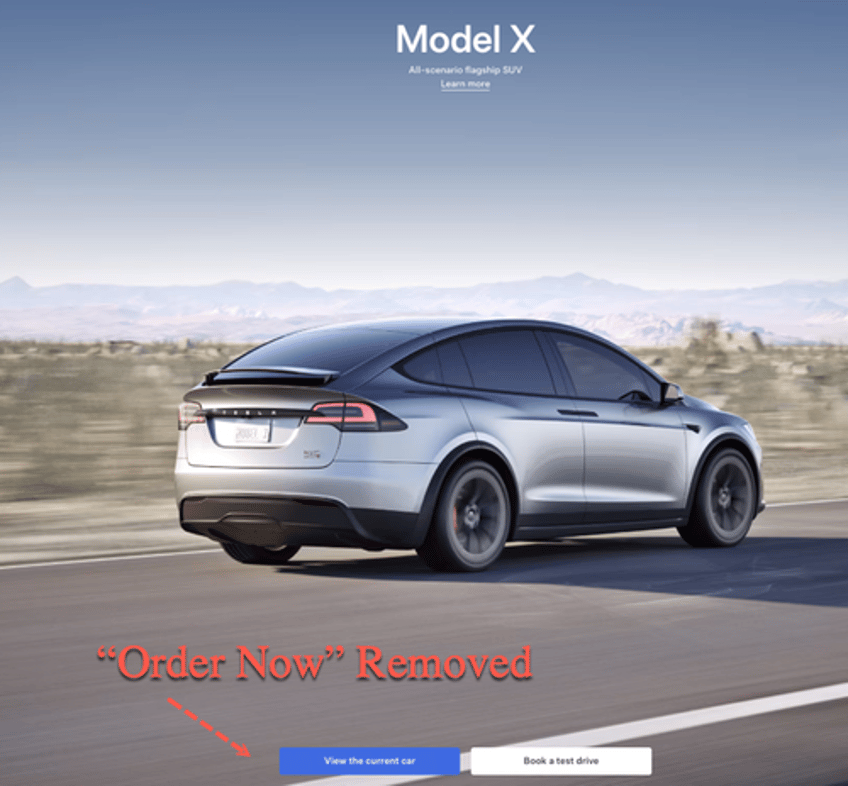

Tesla has quietly removed the "Order Now" button for its Model S and Model X vehicles on its Chinese website, signaling potential disruption amid a deepening US-China trade war. The move comes as Beijing announced a new round of retaliatory tariffs early Friday, raising the effective duty on U.S. imports from 84% to 125%.

Both the Model S and Model X are manufactured in California, making them directly exposed to China's tariff escalation—in other words, those vehicles would not be economically feasible to sell in a high-rate tariff regime overseas.

"The electric-car maker was offering the option to order the two models as of the end of March, according to a screenshot of its China website archived by Wayback Machine," Bloomberg noted.

The sudden suspension of ordering Model S/X should not come as a surprise, considering both are made in Fremont, California and then loaded up on RORO carriers to Beijing.

The good news for Tesla: Model S/X were a tiny fraction of Tesla sales in China last year, coming in just under 2,000 units, compared with 661,820 for both the Model 3 and Model Y (both made at Shanghai Gigafactory).

Here's EV blog Electrek's take on the situation:

One of the first victims of the trade war in the EV space. It kills a relatively small market of about 2,000 vehicles for Tesla in China, but those are profitable vehicles, which is not the case for most vehicles Tesla sells in the country these days.

90% of the vehicles Tesla delivers in China are Model 3 and Model Y RWD, which are low-margin vehicles that Tesla has to subsidize 0% financing on to move. It results in the automaker making little to no profit on those vehicles.

In the case of Model S/X in China, we are only talking about roughly $170 million in potential lost revenue for Tesla, but at least the company was making some profits on those.

As we previously reported, Tesla's biggest concerns amid this trade war are the tariffs on Chinese battery cells entering the U.S., which support its Megapack and Powerwall energy business, and Chinese buyers turning away from American brands.

If the trade war with China escalates even more, Tesla could even start worrying about the status of its factory in Shanghai, which is a rare auto factory wholly owned by a foreign automaker in China.

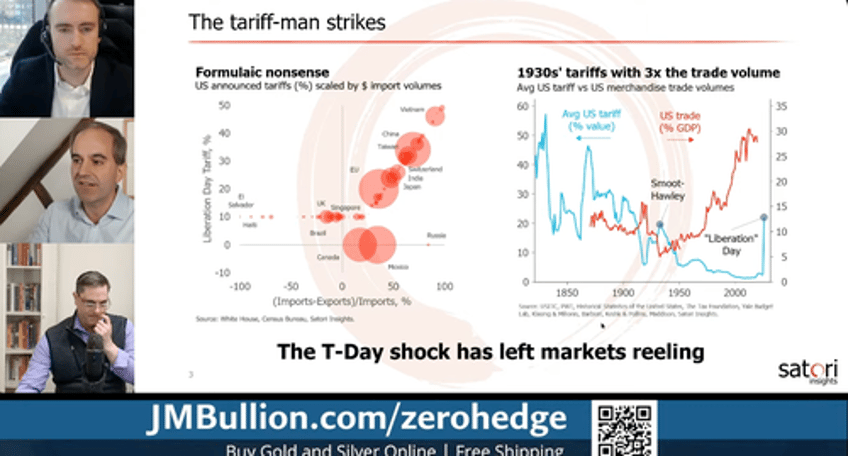

On Thursday evening, HSBC Head EM strategist Alastair Pinder and the legendary Matt King (formerly Citi's top strategist who correctly called the Lehman collapse) debated on ZeroHedge to discuss the incoming fallout from tariffs on global trade. King was gloomy about global trade (watch here).

We have reported some of the first immediate economic fallout of this week's tariff war:

Amazon Cancels Orders, Walmart Pulls Forecast As Tariffs Take Hold

Chinese Sellers On Amazon Panic After Trump's Tariff Bazooka

Tariff wars are beginning to disrupt global trade flows—from Amazon's supply chain to Tesla's China sales—and the affected companies are only expected to grow.