Apple's Worldwide Developers Conference kicked off on Monday and was widely disappointing. What wasn't disappointing was Elon Musk's threat to ban Apple devices from his companies following Apple's announcement of a partnership with ChatGPT-maker OpenAI.

In other Apple news, iPhones and iPads will soon be integrated with Affirm's buy now, pay later feature. This product will soon be available for Apple Pay users.

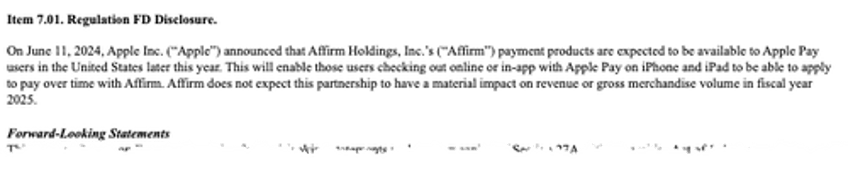

First appearing in Affirm's 8-k filing on Tuesday morning, new "payment products are expected to be available to Apple Pay users in the United States later this year."

"This will enable those users checking out online or in-app with Apple Pay on iPhone and iPad to be able to apply to pay over time with Affirm," the fintech company wrote in the filing.

It noted, "Affirm does not expect this partnership to have a material impact on revenue or gross merchandise volume in fiscal year 2025."

Mizuho Securities analyst Dan Dolev wrote in a note to clients, "The news is a big positive for AFRM, especially since the stock traded down several times in the past when Apple announced its entry into BNPL."

Shares of Affirm are up nearly 6% in the first hour of the US cash session.

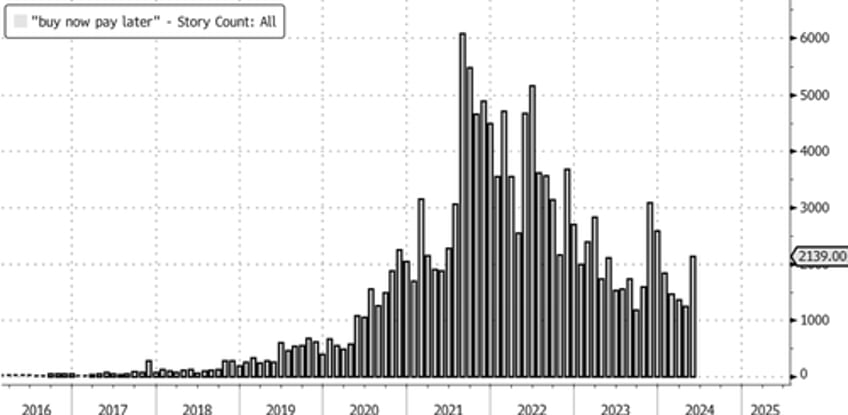

In recent years, we've outlined the explosion in BNPL use among consumers.

Bloomberg data featuring "BNPL" headlines in corporate media has rocketed higher since the onset of Covid, signifying the payment method first became popular in early 2020.

Meanwhile, the Bank for International Settlements has warned that BNPL adoption is high among young adults, particularly those with low education. The report said this is a troubling trend, given that overuse and poor understanding of the service can be disastrous for consumers and lead to overindebtedness.

Why Apple is only now deciding to embed BNPL into Apple Pay may reflect a recent theme Goldman has pushed out about a struggling consumer.