Members of the House Financial Services Committee from both parties, including GOP whip Rep. Tom Emmer (R-MN) have written to the SEC urging the agency to stop blocking the approval of various cryptocurrency ETFs.

An ETF, or an exchange-traded fund, is a type of product or investment fund traded on stock exchanges. ETFs own a set of assets, which traders can invest in via the exchange.

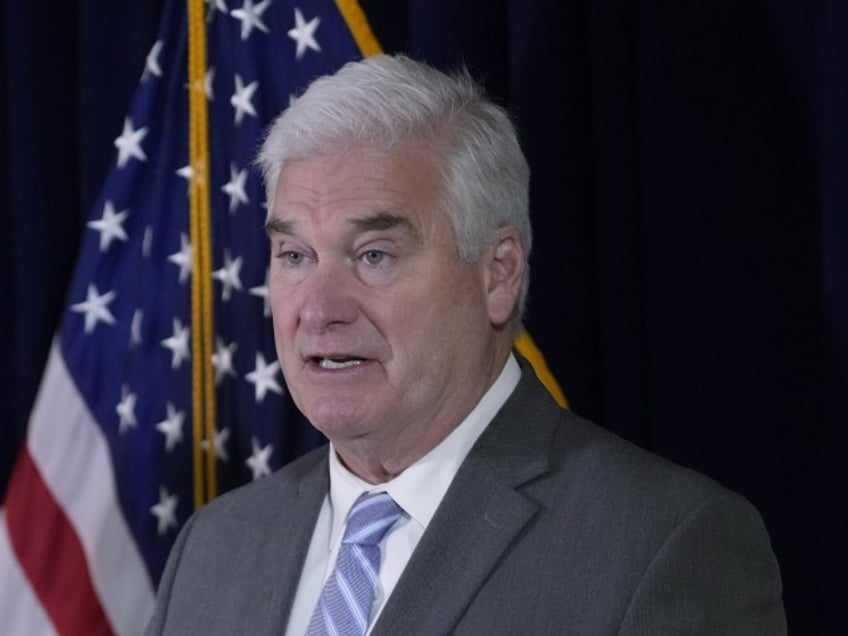

House Majority Whip Tom Emmer, R-Minn. (Patrick Semansky/AP)

A number of major investment companies have requested SEC approval for their bitcoin ETFs, including BlackRock, Bitwise, VanEck, WisdomTree (WT.N), Fidelity and Invesco (IVZ.N). This flurry of applications followed the SEC’s decision to sue Coinbase, a leading cryptocurrency exchange.

In their letter, the members of congress urged the SEC to move faster towards the normalization of bitcoin and cryptocurrency trading. The letter’s four signatories were Reps. Mike Flood (R-NE), GOP whip Tom Emmer (R-MN), Wiley Nickel (D-NC) and Ritchie Torres (D-NY).

Reps. Flood and Torres are both members of the Congressional Blockchain Caucus.

“The SEC’s current posture is untenable moving forward,” wrote the representatives, who cited an appeals court decision last month that ruled the SEC should reconsider its assessment of a bid by Grayscale Investments, a digital asset management company, to convert the Grayscale Bitcoin Trust (GBTC) into an ETF.

“There is no reason to continue to deny such applications under inconsistent and discriminatory standards,” continued the representatives, members of the influential House Financial Services Committee.

While the price of some digital assets, such as NFTs, have crashed spectacularly, the price of Bitcoin (BTC) has maintained a price floor above $26,000 since March of this year, although this is still a vast reduction from its all-time high of $64,400 in November of 2021.

Allum Bokhari is the senior technology correspondent at Breitbart News. He is the author of #DELETED: Big Tech’s Battle to Erase the Trump Movement and Steal The Election. Follow him on Twitter @AllumBokhari.