The newest phase of the technology war between the US and China involves Beijing's plan to eliminate American-made semiconductor chips from Chinese telecommunications systems by 2027. This strategy is expected to impact US chip manufacturers such as Intel and Advanced Micro Devices, according to The Wall Street Journal, citing people familiar with the matter.

China's Ministry of Industry and Information Technology, the regulator responsible for overseeing wireless, broadcasting and communication industries, is leading the current effort to replace American-made core chips in China's telecom infrastructure. The regulator ordered state-owned mobile operators to inspect networks and provide a timeline for when the foreign chips would be replaced.

Beijing's move to eliminate American chips from its telecommunications systems comes amid a worsening tech war with Washington. In the US, lawmakers on Capitol Hill have banned Chinese chips from telecom equipment over national security risks and have restricted AMD and Nvidia from selling advanced chips to China.

In late March, China introduced new guidelines for phasing out Intel and AMD chips from government computers and servers.

This escalation in the chip war between the two superpowers, in the form of stricter government procurement guidance, also aims to eliminate Microsoft's Windows operating system and foreign-made database software in favor of domestic options. It runs alongside a parallel localization drive underway in state-owned enterprises.

Beijing's move to rid critical systems and infrastructure of foreign technology is part of a national strategy for technological independence in the government, state sectors, and military that has become known as xinchuang or "IT application innovation". Regulators have told state-owned enterprises to transition technology to domestic providers by 2027.

The creeping ban on US-made chips and software is terrible news for US companies, such as Intel and AMD, that are heavily exposed to Chinese markets. China was Intel's largest market last year, providing 27% of its $54bn in sales and 15% of AMD's $23bn in sales. Microsoft does not reveal Chinese sales, but president Brad Smith last year told the US Congress that the country provided 1.5% of revenues

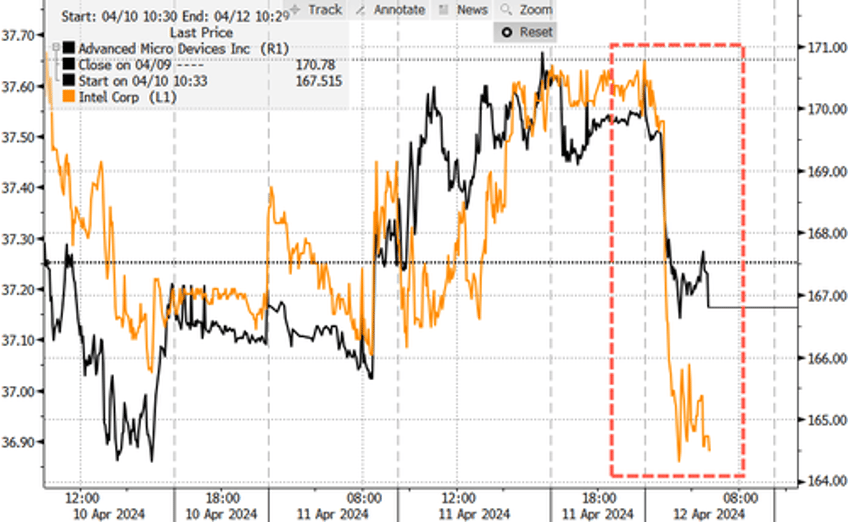

The continued localization push sent AMD and Intel shares down around 2% in premarket trading in New York.

Meanwhile, Peter Tchir of Academy Securities recently wrote that he is "worried that as we restrict things for China, it will make them better at it. I think that we've asked before how China is making so many phones with 7 nanometer chips, when there have been restrictions in place on chips thinner than 10 nanometers."

And it's not just Beijing phasing out US tech. There is also a nationalist push among consumers in the largest handset market in the world to abandon Apple iPhone products for Huawei Technologies Co.'s Mate 60 series smartphone.

While Beijing's desire to wean off American chips ramps up, the US is rebuilding its semiconductor manufacturing base to wean off Chinese chips and chips made in Asian countries that could experience disrupted supply chains in conflict. The world is continuing to fracture into a dangerous multi-polar state. The tech war between the world's largest superpowers is evidence of this.