Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, has voiced his apprehension about the rapid advancement of artificial intelligence technology, comparing its potential impact to that of nuclear weapons. Buffett warned that AI-powered scams, with their ability to trick everyday people into believing practically anything, could be “the growth industry of all time” for criminals.

Quartz reports that during the annual Berkshire Hathaway shareholders conference held on Saturday, Warren Buffett addressed questions from attendees and shared his thoughts on various topics, including the rise of AI. Despite admitting that he has very little knowledge about artificial intelligence, Buffett expressed his unease about the technology’s potential consequences.

Buffett drew parallels between AI and his views on nuclear weapons, recalling his remarks from the previous year’s conference where he described the atomic bomb as a genie let out of the bottle that has been causing terrible things and scares him. He stated, “AI is somewhat similar, it’s part way out of the bottle, and it’s enormously important and it’s gonna be done by somebody. We may wish we’d never seen that genie, or it may do wonderful things.”

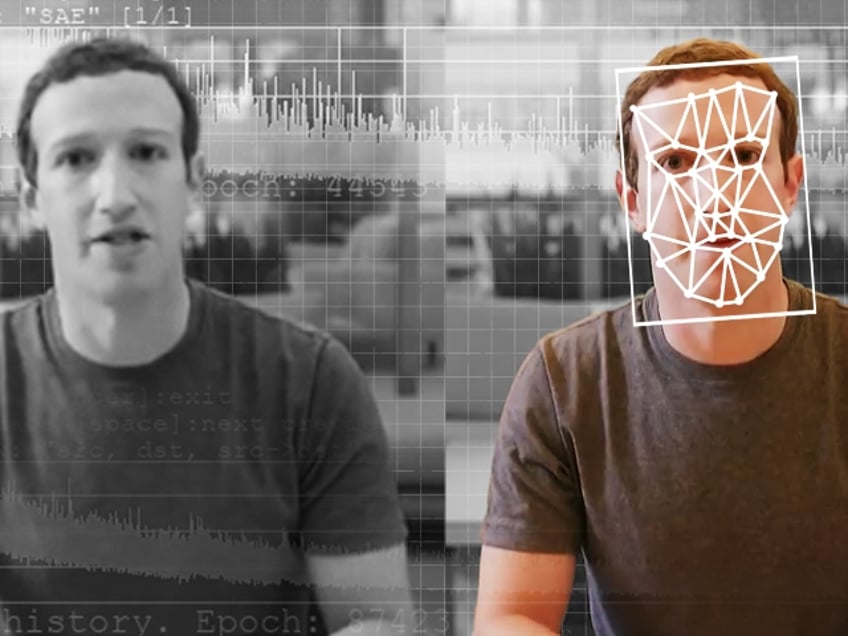

deepfake Mark Zuckerberg (The Washington Post / Getty)

The billionaire investor’s concerns stem from a personal experience where he discovered a video using his likeness generated by AI, delivering a message that he had not authored or approved of. Buffett worries that such instances could open the floodgates for potential scams, labeling it as “the growth industry of all time.”

Despite his apprehension, Buffett acknowledged that AI has enormous potential for both good and harm. He emphasized his limited understanding of the technology but recognized its significance in shaping the future. “I do think, as someone who doesn’t understand a damn thing about about it, that it has enormous potential for good, and enormous potential for harm,” he said. “And I just don’t know how that plays out.”

The annual Berkshire Hathaway shareholders conference, often referred to as “Woodstock for Capitalists,” attracts thousands of investors eager to hear insights from Buffett, widely regarded as one of the most successful investors in history. This year’s conference, held in Omaha, Nebraska, saw Buffett joined by Berkshire Hathaway vice chairs Ajit Jain and Greg Abel on the panel.

Prior to the conference, Berkshire Hathaway reported impressive financial results, including a record cash and Treasuries pile of $189 billion, marking a 13 percent increase in just three months. The company also experienced a 39 percent year-over-year surge in operating profits, reaching $11.22 billion.

Read more at Quartz here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship.