'This is easy!'

VIX set a new post-COVID closing low last week of 12.82, defying seasonal norms and leading to renewed calls from some to “buy vol".

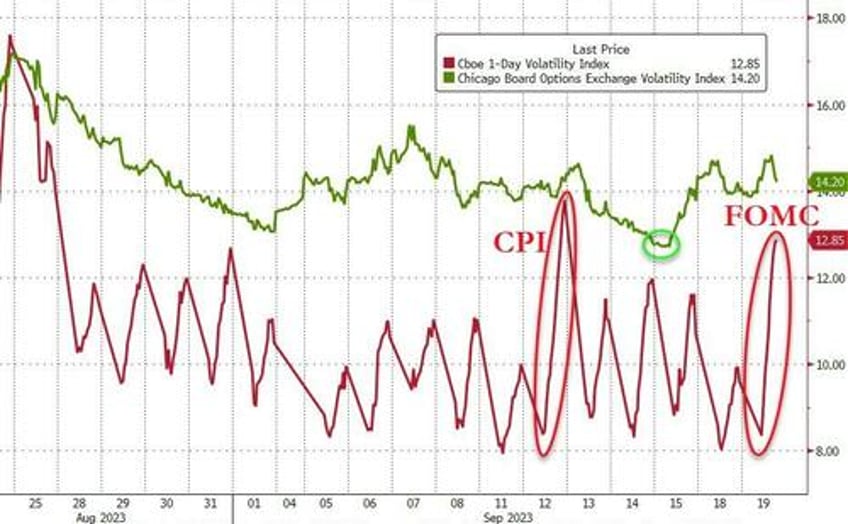

And while 0-DTE vol has spiked into today's FOMC (as it does into events - see CPI last week), the overall vol term structure shows there is little fear after this event risk catalyst passes...

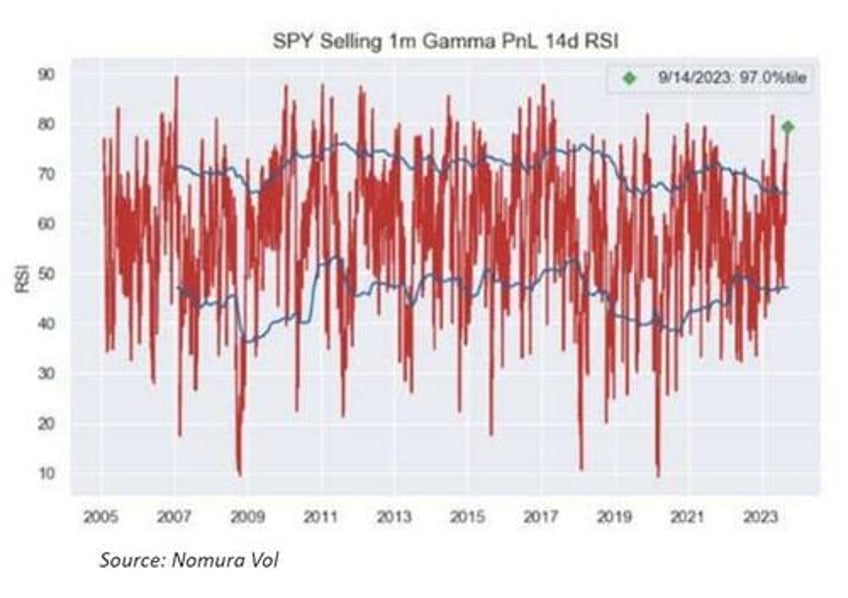

In fact, as Nomura's Charlie McElligott points out, selling Vol / Gamma / Straddles for income has been an absolute profitability machine of late...

Both for 1m Gamma-selling, Nomura highlights that SPY PnL 14-day RSI at 97th %ile...

And for 0-DTE, BofA highlights the stunning fact that the S&P variance risk premium (VRP) - measured as the spread between the VIX and the subsequent realized variance of the S&P – has been positive every trading day this year...

As the chart above shows, the current streak of consecutive trading days with a positive SPX VRP is not (yet) a record. Nor is it atypical for the VRP to re-establish itself after a market crisis, as implied vol tends to retain a premium to falling realized vol.

All of which is a long way of saying - traders selling straddles day after day are relaxing in the sun saying "this is easy"... for now.

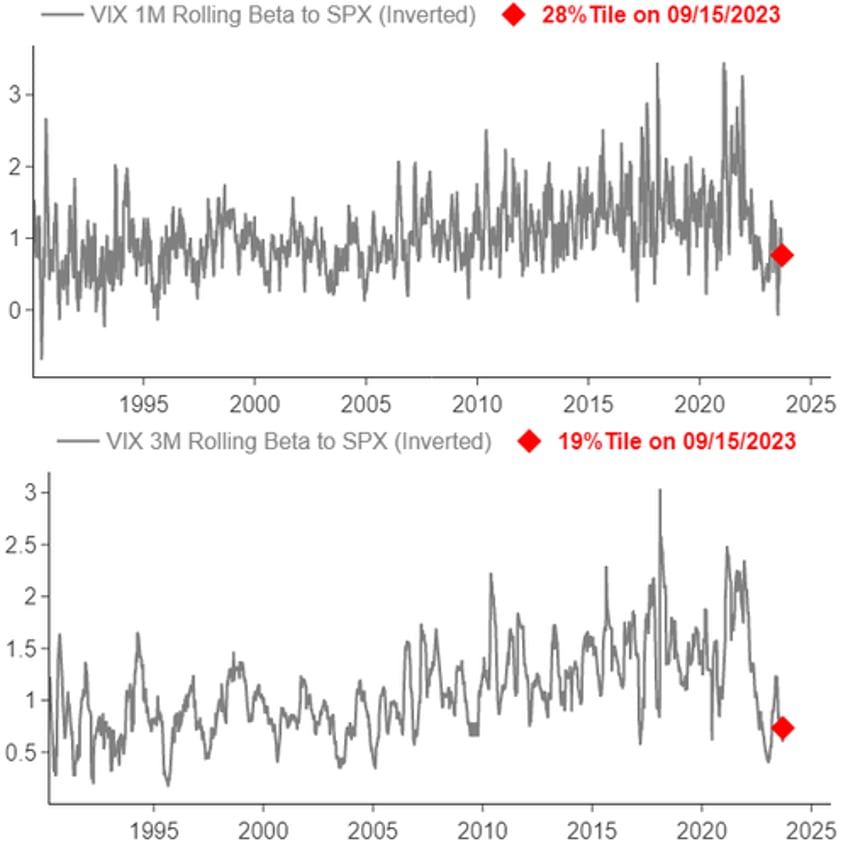

Additionally, there is barely any sensitivity in the VIX complex to SPX on pullbacks, with VIX 3m rolling beta to SPX at 19%ile / 1m rolling beta at 28%

However, as BofA notes, as the visibility around a soft vs. hard landing (or no landing at all) has hardly improved, we see the decreasing sensitivity of US equities to macro this year as further evidence of reflexive psychology at work (e.g. why react to bad data if no one else is?), rather than any clairvoyance of the stock market around the certainty of a soft landing.

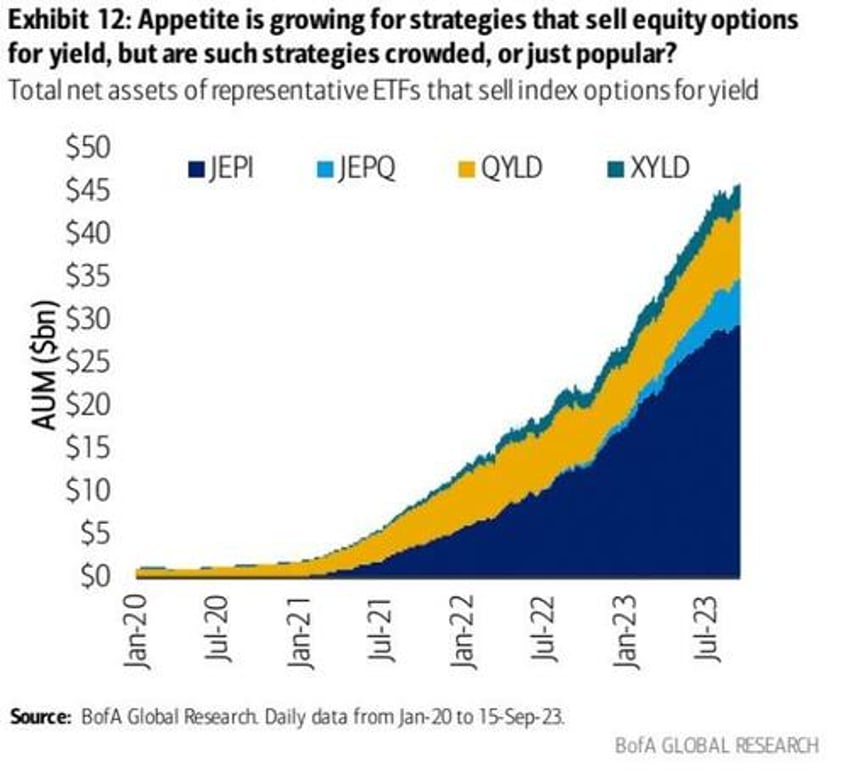

Timing when macro might matter again for US equities, or exactly when option selling strategies will have become "too crowded", is of course difficult, but one can't help but look at the rising popularity of ETFs that sell US equity index options for yield and feel like the clock is ticking...

This huge surge in volume is also leading to growing fears that they (together with other discretionary & tactical sellers of fixed strike vol) are distorting US equity and equity vol markets.

But, for now, as Bloomberg reports, the world and his pet rabbit is jumping on the band-wagon - especially in the low-priced 0-DTE options markets, where the notional trading volume of 0DTE for the S&P 500 currently averages a beefy $516 billion a day, according to data compiled by Cboe Global Markets.

Yet the actual amount of money paid out for them, or the premium, is only $520 million.

Put another way, traders are getting $1,000 of stock exposure for every dollar they spend on 0DTE. They would need to spend 10 times that to get the same equity position using derivatives with a longer lifespan, a Bloomberg analysis on Cboe’s data shows.

“They are the fantasy football of option trading,” said Dennis Davitt, co-manager of the MDP Low Volatility Fund.

“You spend a dollar and you see if it goes your way. Then you’re done at the end of the day.”

The arguments about whether 0-DTE trading destabilizes markets (leverage) or stabilizes them (intraday mean-reversion) continues.

Regardless, to the likes of Rocky Fishman, the small investment on top of the frenzied trading is a sign that zero-day options are largely a gadget of stock speculation pure and simple.

“There is huge trading volume in these mini-probability trades,” said the founder of derivatives analytical firm Asym 500.

“That’s not the only thing happening in 0DTE but it’s probably the biggest thing.”

What's different this time, however, is the calendar. It's that time of year again.

On average, over the past 95 years, SPX realized volatility has increased 27% from August to October.

Since 1928, October SPX realized volatility has averaged 18 vol vs. 15 vol for other months. High October volatility is visible in each major index and sector over the recent 30 years.

Can the unprecedented Sharpe ratios of 0-DTE and 1m vol-sellers stand up to that seasonality?