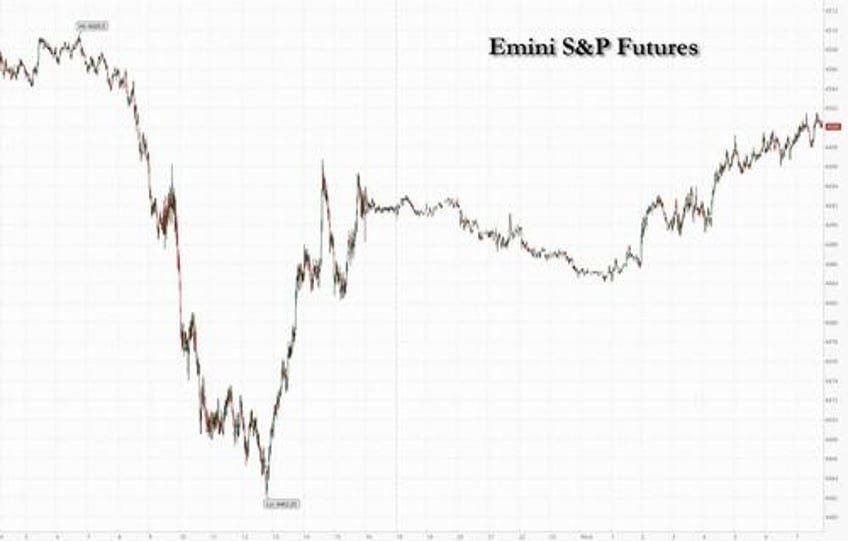

US equity futures rose, alongside European markets, as traders awaited the Fed's rate decision that will be scrutinized for the policy outlook and "dots" rather than the widely expected pause in hikes. As of 7:45am ET, contracts on the S&P 500 and the Nasdaq 100 both added about 0.2%, with spoos trading up to 4,500. Treasury yields fell across the board, taking their cue from sliding UK rates after inflation unexpectedly slowed and printed far below expectations (CPI core 6.2%, Exp. 6.8%, CPI MoM 0.3%, Exp. 0.7%). The Bloomberg Dollar Spot Index traded near the lows of the day, lifting most Group-of-10 currencies. Brent crude reversed earlier losses after it retreated from $95. Gold was little changed, while Bitcoin declined for the first time in three days.

In premarket trading, major technology and internet stocks were mostly higher. Instacart slipped as much as 5%, one day after surging following one of the year’s biggest US initial public offerings but closing at session lows. Intel shares pared an earlier decline as analysts said that the chipmaker showed some progress in its Innovation conference. However, there was disappointment that the event lacked a new customer announcement for the firm’s 18A semiconductor manufacturing process. Here are some other notable premarket movers:

- ARS Pharmaceuticals shares drop as much as 47% in US premarket trading, set for their biggest fall on record if the move holds, after the biotech said that the FDA has issued a letter requesting additional study for neffy — an epinephrine nasal spray to treat allergic reactions — in order to support drug approval, according to a statement.

- Pinterest shares rise 3.4%. Analysts were impressed by Tuesday’s investor day, saying that the social networking company was upbeat and that the long-term targets look achievable.

- Taysha Gene Therapies shares drop as much as 5.8%, after the biotech scrapped the development of its TSHA-120 gene therapy program to treat a rare neurodegenerative disorder following feedback from the FDA. Analysts cut their price targets on the stock, saying that while the update was disappointing, investors were focused on the company’s development of a treatment for Rett syndrome.

As previewed overnight, today all eyes will be on the Fed's 2pm decision (and Powell's presser) which is expected to hold for the second time this year following a slowing in inflation, while leaving the door open for another increase as early as November. Wall Street will be focused on whether Fed officials’ forecasts for interest rates, the so-called dot plot, show whether they seem determined to hike again.

“While rates should remain steady, a question mark remains over the longer-term outlook,” said Richard Flynn, UK Managing Director at Charles Schwab. “Now that inflation has peaked, we are likely to see the Fed shift to a more surgical approach. There continues to be a possibility of a hike later this year as central bankers target remaining sticky areas, but one more boost is unlikely to trouble the market.”

Britain’s CPI rose 6.7% from a year earlier in August, the slowest pace in 18 months, and less than the 7% expected by economists. The probability of a quarter-point rate increase by the BOE at its meeting on Thursday — almost guaranteed earlier this week — fell to less than 50%, according to swap pricing. Gilt yields tumbled, and US Treasury yields dipped in sympathy after rates on both the five- and 10-year notes hit the highest levels since 2007 on Tuesday.

In Europe, stocks rose and the pound weakened after British inflation slowed unexpectedly. The Stoxx 600 rose 0.6%, with retail and real estate leading gains. Sterling fell as much as 0.5% against the dollar to its lowest level since May as traders bet that the Bank of England is nearing the end of its hiking cycle. UK bonds soared. Here are Europe's top movers

- Delivery Hero shares gain as much as 8.2% as Hauck & Aufhaeuser starts coverage of the food-delivery company with a buy rating, while two other analysts reiterated their bullish stance after the stock dropped to the lowest since May following first-half earnings last month.

- UK stocks outperform, with midcaps leading the charge, after data showed that inflation fell unexpectedly to the lowest level in 18 months, easing pressure for further interest-rate increases from the Bank of England.

- Ypsomed shares rise as much as 5.3% to a record high after the Swiss pharmaceutical company announced a long-term supply agreement with Novo Nordisk for large quantities of auto injectors. The pact has “very significant” earnings potential for Ypsomed, according to ZKB.

- M&G shares gain as much as 4.6% after the UK fund manager reports forecast-beating operating profits for the first half-year of 2023.

- Clariant shares rise as much as 3.6% after Jefferies raised the recommendation on the stock to buy from hold, saying the Swiss specialty chemical company’s increased urgency to resolve the performance of its Sunliquid biofuel unit is a “key positive.”

- Self Storage shares soar as much as 66% to NOK39.9, as T-C Storage HoldCo, an indirect subsidiary of Teachers Insurance and Annuity Association, agrees to launch a recommended voluntary cash tender offer for 100% of the company at NOK40 per share.

- Finsbury Food shares rise as much as 23% to 109.5p after Dbay agrees to buy the UK specialty bakery company in a deal valuing the company’s share capital at about £143.4 million.

- Baloise shares drop as much as 9.9% after the Swiss insurer’s profit figures came in somewhat below expectations, according to analysts, and Vontobel says higher claims in non-life will hit earnings in 2H.

- Talanx shares fall as much as 7.6% after an offering of 4.88m shares by the German reinsurance company priced at €61.50 apiece, representing about a 6.5% discount to Tuesday’s close.

- Air Liquide shares decline as much as 3.4% after Stifel cites comments from CEO, CFO in a London sell-side meeting late Tuesday, saying trading might be more difficult in second half than 1H, especially in Electronics and Industrial Merchant units.

Earlier in the session, Asian stocks fell for a third day as caution prevailed ahead of the Federal Reserve’s policy decision, with surging oil prices driving inflation and raising the possibility of higher-for-longer interest rates. The MSCI Asia Pacific Index dropped as much as 0.6% on Wednesday, led by health-care and energy shares. Japanese and Australian stocks slipped. Brent held close to $94 per barrel, setting the stage for another interest-rate hike by the Fed this year.

- Chinese equities dipped after the nation’s lenders kept their benchmark lending rates unchanged, following the central bank’s move last week to hold policy rates steady as officials assess the economic impact of existing stimulus. The CSI 300 Index is edging closer to the lowest level this year.

- Japan's Nikkei 225 gradually weakened after the latest trade data showed Japanese exports and imports remained in contraction territory, albeit not as bad as feared.

- Indian stocks declined the most in two months and were the worst performers in the region led by a selloff in index majors including HDFC Bank and Reliance Industries. The S&P BSE Sensex fell 1.2% to 66,800.88 on Wednesday, while the NSE Nifty 50 Index declined by the same magnitude. The MSCI Asia Pacific Index was down 0.7%. HDFC Bank contributed the most to the Sensex’s decline, decreasing 4%, following a downgrade by Nomura on rising concerns over private sector lender’s margins post merger with parent HDFC. All but one sectoral index on the BSE closed with losses amid a broad selloff in the market as traders exercised caution ahead of Federal Reserve’s rate-setting meeting. Out of 30 shares in the Sensex index, seven rose and 23 fell.

- Australia's ASX 200 was dragged lower by the commodity-related sectors including energy after oil prices eased back from YTD highs although losses were cushioned by resilience in consumer stocks.

In FX, the Bloomberg Dollar Spot Index is flat ahead of the Fed decision later on Wednesday. the yen touched the psychological level of 148 per dollar, the lowest in more than 10 months. The pound traded as much as 0.5% lower to $1.2334 after UK inflation report; money markets price a 52% chance of a quarter-point hike on Thursday, compared with about 90% yesterday.

In commodities, crude futures decline, with WTI falling 1.4% to trade near $89.90. Spot gold drops 0.1%. Goldman analysts raised their forecast for crude back to triple digits as worldwide demand hits unprecedented levels and OPEC+ supply curbs continue to tighten the market. The Wall Street bank pushed up its 12-month forecast for Brent to $100 a barrel from $93. However, most of the rally “is behind us,” the bank said in a note.

Bitcoin is under modest pressure but resides in particularly narrow parameters and is yet to meaningfully deviate away from the USD 27k handle pre-FOMC.

In rates, treasuries were underpinned by gilts, with futures paring portion of Tuesday’s losses led by belly of the curve. US yields are lower by as much as 3bp in belly of the curve with 5s30s steeper and 2s5s30s fly richer by ~2bp on the day; 10-year yields near 4.34% trail gilts by ~7bp in the sector. UK 2s richer by 14.5bp on the day, lowest yield since July. FOMC expected to keep rates unchanged at the 2pm announcement; the dot-plot update is expected to indicate another hike before year-end in a close call. Gilts outperform in an aggressive bull-steepening move after an unexpected drop in UK inflation opened the door for Bank of England to pause rate hikes in Thursday’s decision. US session includes Fed rate decision at 2pm New York time, released with latest staff projections.

Looking to the day ahead now, and the main highlight will be the Fed’s latest policy decision and Chair Powell’s press conference. Other central bank speakers include the ECB’s Elderson. Data releases include the UK CPI and German PPI for August. Lastly, today’s earnings releases include FedEx.

Market snapshot

- S&P 500 futures up 0.1% to 4,496.25

- STOXX Europe 600 up 0.6% to 459.08

- MXAP down 0.8% to 161.48

- MXAPJ down 0.6% to 500.28

- Nikkei down 0.7% to 33,023.78

- Topix down 1.0% to 2,406.00

- Hang Seng Index down 0.6% to 17,885.60

- Shanghai Composite down 0.5% to 3,108.57

- Sensex down 1.2% to 66,775.50

- Australia S&P/ASX 200 down 0.5% to 7,163.33

- Kospi little changed at 2,559.74

- Brent Futures down 1.2% to $93.21/bbl

- Gold spot down 0.1% to $1,929.80

- U.S. Dollar Index little changed at 105.09

- German 10Y yield little changed at 2.74%

- Euro up 0.1% to $1.0695

Top Overnight News from Bloomberg

- The PBOC said it has sufficient policy space to support the Chinese economy, adding to expectations there may be more easing to come, including rate cuts, after this month's pause. The comments came shortly after Chinese banks left their benchmark loan rates unchanged. BBG

- The European Union is “very far” from imposing new tariffs on Chinese electric cars, a top official told CNBC, just days after the bloc launched an investigation into subsidies given by Beijing. CNBC

- UK inflation undershoots the Street by a wide margin, w/headline coming in at +6.7% (down from +6.8% in Jul and below the Street’s +7% forecast) and core at +6.2% (down from +6.9% in Jul and below the Street’s +6.8% forecast). BBG

- The UAW weighed an expansion of its strikes against Detroit’s automakers on, after union President Shawn Fain said more plants faced walkouts if carmakers didn’t sweeten their offers. The union will have a Facebook Live event today at 10 a.m. local time in Detroit, where it will likely discuss whether more plants will join the strike. BBG

- The United States is discussing terms of a mutual defense treaty with Saudi Arabia that would resemble military pacts with Japan and South Korea, according to American officials. The move is at the center of President Biden’s high-stakes diplomacy to get the kingdom to normalize relations with Israel. NYT

- Republicans are working on Plan Bs to avoid to a shutdown after days of chaos (some of those Plan Bs involve asking Democrats for help), but time is of the essence and there is still enormous division within the caucus. The Hill

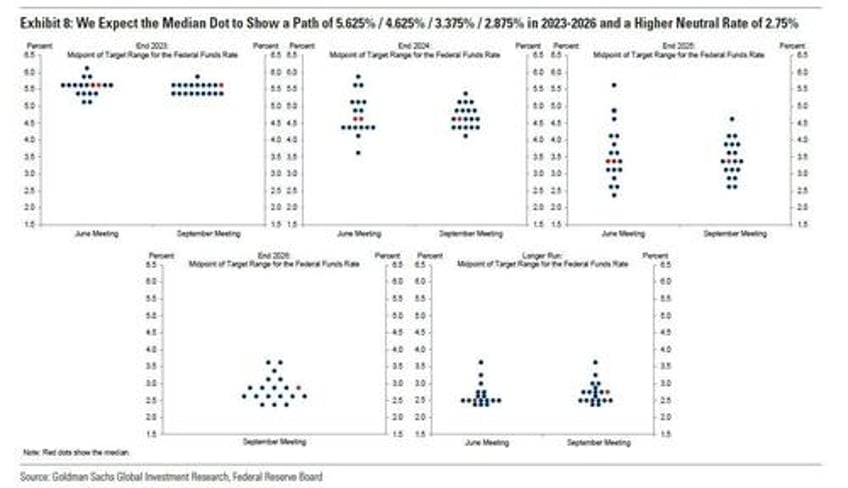

- At today's meeting Fed officials are likely to make fairly straightforward revisions to their economic projections. For 2023, we expect a substantial upward revision to GDP growth (+1.1pp to +2.1%) and moderate downward revisions to the unemployment rate (-0.2pp to 3.9%) and core inflation (-0.4pp to 3.5%). For November, we think that further labor market rebalancing, better news on inflation, and the likely upcoming Q4 growth pothole will convince more participants that the FOMC can forgo a final hike this year, as we think it ultimately will. On neutral, we expect the median longer run rate dot to finally rise a bit to 2.75%. GIR

- Pimco warned markets may be underestimating the risks of both one more Fed hike and a US recession, making haven assets a preferred play. Money manager Geraldine Sundstrom recommends sticking to assets that offer a pickup in yields, including US agency mortgages and some financial credits. BBG

- US stockpiles fell by 5.25 million barrels last week, the API is said to have reported. That would bring holdings to the lowest in more than nine months if confirmed by the EIA today. Inventories at Cushing also slid. BBG

- We have nudged up our 12-month ahead Brent forecast from $93/bbl to $100/bbl as we now expect modestly sharper inventory draws. The key reason is that significantly lower OPEC supply and higher demand more than offset significantly higher US supply. Overall, we believe that OPEC will be able to sustain Brent in an $80-$105 range in 2024 by leveraging robust Asia-centric global demand growth (1.8mb/d) and by exercising its pricing power assertively. GIR

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower with risk appetite dampened ahead of the incoming deluge of central bank policy announcements including the latest FOMC rate decision and dot plot projections. ASX 200 was dragged lower by the commodity-related sectors including energy after oil prices eased back from YTD highs although losses were cushioned by resilience in consumer stocks. Nikkei 225 gradually weakened after the latest trade data showed Japanese exports and imports remained in contraction territory, albeit not as bad as feared. Hang Seng and Shanghai Comp conformed to the subdued mood after the PBoC unsurprisingly maintained its benchmark 1-year and 5-year Loan Prime Rates at 3.45% and 4.20%, respectively, while Country Garden’s dollar bondholders have been left in the dark regarding a coupon payment which was due on Monday although the developer still has a 30-day grace period.

Top Asian News

- Chinese Loan Prime Rate 1Y (Sep) 3.45% vs. Exp. 3.45% (Prev. 3.45%); 5Y (Sep) 4.20% vs. Exp. 4.20% (Prev. 4.20%)

- PBoC official said China's monetary policy still has ample policy room to respond to unexpected challenges and changes, while they will continue to implement prudent monetary policy and step up counter-cyclical adjustments. Furthermore, the PBoC will keep liquidity reasonably ample and enhance the stability of credit growth, according to Reuters.

- NDRC Vice Chairman Cong Liang said China's macroeconomic policies have been effective and that China's economy faces a lot of difficulties and challenges, while he added that economic positives are increasing and those shorting China will surely be proven wrong.

- US State Department said Climate Envoy Kerry met with Chinese Vice President Han and emphasised the need for China to raise ambition in efforts to accelerate decarbonisation and reduce emissions of methane, according to Reuters.

- China exported zero germanium and gallium products in August which are materials key to the semiconductor industry, according to customs data.

European bourses are in the green, Euro Stoxx 50 +0.5%, with the FTSE 100 +0.7% outperforming after sub-forecast inflation data and associated GBP softness. Sectors are primarily firmer, Real Estate and Banking names are outperforming on the UK data while Energy and Basic Resources lag with benchmarks mixed/softer. Stateside, futures are essentially flat across the board ahead of the FOMC, ES +0.1%, NQ +0.1%;

Top European News

- ECB's Schnabel says new supply-side shocks may pose upside risks to inflation; Dynamics in wage growth remain strong, while labour shortages persist; Energy shock threatens to leave permanent scars in the euro area. via a slide release

- The Times' Shadow MPC voted 7-2 in favour of a 25bps hike to the Bank Rate to "ensure inflation is finally under control".

- Swedish Finance Ministry says new spending in the 2024 budget totals SEK 39bln (exp. ~40bln); prioritising fighting inflation and supporting households/welfare.

- Swiss Government Forecasts (SECO): downgrades 2023 CPI (2.2%), upgrades 2024 CPI (1.9%); upgrades 2023 GDP, downgrades 2024 GDP; says global economy likely to take longer to recover from challenges assumed in the June forecast. Click here for more detail.

- UK PM Sunak has reportedly summoned his cabinet, according to Sun reporter Cole; "Looks like we may be hearing the new Net Zero plan today".

FX

- Sterling undermined by softer than forecast UK CPI metrics pre-BoE as casts doubt over 25 bp rate hike, Cable retreats from 1.2397 to 1.2335 before recovering.

- Yen finally relents in battle to say above 148.00 vs. Dollar regardless of verbal intervention from a top Japanese FX diplomat.

- DXY regroups, but remains cautious within the 105.00-260 range awaiting Fed guidance.

- Euro retains sight of 1.0700 against Greenback and is flanked by option expiries.

- Loonie loses post-Canadian inflation data thrust as crude prices retreat, Usd/Cad straddles 1.3450 ahead of BoC minutes and conscious of 1.1 bn expiry interest nearby.

- PBoC set USD/CNY mid-point at 7.1732 vs exp. 7.2926 (prev. 7.1733)

- PBoC official Zou said the global FX market has seen great volatility this year and said more attention will be paid to changes in the yuan exchange rate against a basket of currencies. Zou added there is a solid foundation to keep the yuan exchange rate basically stable and said they will resolutely correct one-sided pro-cyclical behaviour for the yuan exchange rate, while they will resolutely curb disruptions to market order and guard against exchange rate overshooting risks.

- US Treasury Secretary Yellen said the Treasury generally understands the need to smooth out volatility in exchange rates but not to influence forex levels, while she added that the view on any Japanese yen intervention would depend on the circumstances, according to Reuters.

- Japan's top FX diplomat Kanda says excessive yen moves are not desirable and watching FX with a high level of urgency, while they will take appropriate steps on FX as needed and are closely communicating with US and overseas FX

Fixed Income

- Gilts front-run debt recovery before Central Bank cavalry arrives as softer than consensus UK inflation data calls 25 bp BoE hike into question.

- 10-year bond extends to 96.49 from 95.99, Bunds and T-note tag along within 127.74-30 and 109-10/03+ respective ranges awaiting FOMC.

Commodities

- Crude benchmarks pressured after seven consecutive sessions of upside and ahead of multiple days of broader macro risk events, with pressure potentially also emanating from the downbeat APAC tone.

- Dutch TTF has trimmed initial upside and has reverted back to the sub-37.50/MWh trough, as participants continue to focus on Australian updates. Most recently, downside came alongside Offshore saying negotiations resulted in some concession on both sides.

- Spot gold is flat with numerous technicals in close proximity, Palladium outperforms potentially on EU auto registration numbers while base peers have managed to lift off of initial lows.

- US Energy Inventory Data (bbls): Crude -5.3mln (exp. -2.2mln), Gasoline +0.7mln (exp. +0.3mln), Distillate -0.3mln (exp. +0.2mln), Cushing -2.6mln.

- Goldman Sachs raises its 12-month ahead Brent forecast to USD 100/bbl (prev. USD 93/bbl), expects modestly sharper inventory draws. Click here for more detail.

- Chevron (CVX) says no agreement has been reached with unions following further consultation sessions held this week with the Fair Work Commission. Ongoing lack of agreement reinforces the view that there is "no reasonable prospect of an agreement between the parties". Engaged in meaningful negotiations to finalise enterprise agreements with market competitive remuneration and conditions. However, unions continue to ask for terms significantly higher than the market.

- Australia's Offshore Alliance says negotiations before the commissioner were useful and resulted in some concessions on both sides; adds that members remain open to compromise but Chevron must table a viable offer.

- China's state planner NDRC to increase retail prices of gasoline and diesel by CNY 385/t and CNY 370/t respectively from September 21st.

Geopolitics

- Gulf Cooperation Council Countries and the US called for the completion of the demarcation of Kuwaiti-Iraqi maritime borders and urged Iraq to settle its internal legal status to ensure regulation of maritime in the Khor Abdallah Waterway, while they also urged Iran to fully cooperate with the IAEA, according to a joint statement.

- Iranian President Raisi said Washington should prove its goodwill and determination for the revival of the 2015 nuclear pact, while he reportedly demanded that the US end its sanctions on Iran.

- US military official says the joint military exercises with Armenia will begin today on time.

- Ceasefire has reportedly been announced in Karabakh, according to Sputnik Armenia and Ifax; Karabakh Armenians to meet with Azeri authorities on September 21st, Ifax reports; Armenian Deputy Foreign Minister says Yerevan could theoretically live under Azerbaijan but dialogue is crucial.

- Russia's Kremlin says Russian President Putin is to meet China's top diplomat Wang Yi.

US Event Calendar

- 07:00: Sept. MBA Mortgage Applications, prior -0.8%

- 14:00: Sept. Interest on Reserve Balances R, est. 5.40%, prior 5.40%

- 14:00: Sept. FOMC Rate Decision (Lower Boun, est. 5.25%, prior 5.25%

- 14:00: Sept. FOMC Rate Decision (Upper Boun, est. 5.50%, prior 5.50%

DB's Jim Reid concludes the overnight wrap

The long-term study shows how this has been the worst start to a decade for US Treasuries since our data begins in 1800 and yesterday incrementally added to this as 10yr US yields hit 15-plus year highs, with 2yrs at 16-year highs, just as we approach an important trio of central bank meetings. That starts with the Federal Reserve tonight, before we hear from the Bank of England tomorrow, and then the Bank of Japan on Friday morning. But despite all the recent speculation that central banks are near the end of their tightening cycles, the backdrop this week has been a much more hawkish one. For instance, oil prices hit new 10-month highs intra-day though they were marginally lower on the day by the close. We also had an upside surprise from Canada’s CPI, which added to the sense that rate cuts weren’t coming anytime soon.

Of course, the main focus today will be on the Federal Reserve’s decision tonight, along with Chair Powell’s subsequent press conference. In terms of the actual decision, they’re widely expected to leave rates unchanged, so the bigger focus is likely to be on their latest Summary of Economic Projections, which includes the dot plot for where officials see rates over the years ahead. At the last quarterly release in June, the dot plot pointed to two further rate hikes by year-end, and we got one of them at the most recent meeting in July. Our US economists still expect the Fed to signal one further hike this year, but they think Powell will leave open the question of when that tightening could occur, and will lean heavily on a message of data dependency. And even though they expect the Fed’s forecasts to show softer inflation, they think that stronger growth and lower unemployment should counterbalance that, meaning that the 2024 dot will show one less rate cut in 2024 as well. See their full preview here.

We’ll see where things stand after the Fed’s decision, but a key story for much of yesterday was the continued rise in oil prices. Brent Crude almost reached $96/bl yesterday morning but it retreated to close a touch below Monday’s 10-month high (-0.10% to $94.34/bbl) and this morning is trading at $93.23/bbl as we go to print. So a big correction in the last 15 hours from the peaks.

Elsewhere on the energy front, we saw a sizeable spike in European natural gas prices. One month TTF gas futures were up +9.84% to EUR 37.4/MWh, their highest level in three weeks, amid delays to production at Norwegian gas fields.

In other inflationary news, we had another upside inflation surprise out of Canada, as CPI hit +4.0% in August (vs. +3.8% expected). That led investors to price in a much higher likelihood that the Bank of Canada would hike rates next month, with the likelihood up from 25% on Monday to 51% after the close yesterday. In turn, Canadian sovereign bonds significantly underperformed, with the 10yr yield up +11.4bps yesterday to a new post-2008 high.

Those inflationary developments led investors to price in higher rates for longer. Indeed, the rate priced in for the Fed’s December 2024 meeting hit a new high for the cycle at 4.63%. That means less than three 25bp cuts are now priced in by end-2024. That helped boost yields across the curve, with the 2yr Treasury yield (+3.7bps) closing at a new high for this cycle at 5.09%, and the 10yr yield (+5.6bps) also closed at a new cycle high of 4.36%. It was much the same story in Europe, where yields on 10yr bunds (+3.0bps) and BTPs (+0.7bps) hit a 6-month high, whilst yields on 10yr French OATs (+2.8bps) closed at their highest since 2012. The only exception to this pattern were yields on 10yr gilts (-4.9bps), which fell ahead of this morning’s CPI report for August. That’ll be released shortly after we go to press, and will be the last big data release ahead of the Bank of England’s decision tomorrow. Headline is expected to pick up two tenths to 7% YoY with core down a tenth to 6.8% YoY.

The prospect of higher rates provided a tough backdrop for equities, though the S&P 500 crept back up in the last few hours of trading from being down -0.8% at the early session lows to close 'only' -0.22% lower, albeit to a 3-week low. The moderate decline was a broad-based one, with 8 of 10 S&P 500 sector groups down on the day. The other major US indices saw similar declines, including the Dow Jones (-0.31%) and the NASDAQ (-0.23%), whilst the small-cap Russell 2000 (-0.42%) fell to its lowest level since late-June. In Europe the picture was a bit more positive, but the STOXX 600 still fell -0.04%.

In Asia, the Nikkei (-0.36%), Hang Seng (-0.58%), CSI (-0.31%), Shanghai Composite (-0.34%) and the KOSPI (-0.05%) are all slightly lower alongside S&P 500 (-0.11%) and NASDAQ 100 (-0.16%) futures.

Early morning data showed that Japan’s exports dropped -0.8% y/y in August (v/s -2.1% expected) and against a -0.3% in July, making it the second month of declines (even if better than expected) mainly due to weak exports to China (-11.0% y/y). Meanwhile, imports weakened -17.8% y/y in August less than the expected fall of -20.0% as against a revised decline of -13.6%.

In FX, the Japanese yen pared its initial gains against the dollar to trade at 147.81 (+0.03%) after US Treasury Secretary Janet Yellen stated that the US would show understanding over Japan’s intervention to support its currency if the measures are aimed at smoothing out undue volatility. You're unlikely to see anything ahead of the FOMC and BoJ (Friday) but this maybe makes intervention a bit easier going forward. Elsewhere, the People’s Bank of China (PBOC) left its 1-yr and 5-yr loan prime rates unchanged at 3.45% and 4.2%, respectively.

When it came to yesterday’s other data, US housing starts fell significantly more than expected in August, with an annualised rate of 1.283m (vs. 1.439m expected). That’s their lowest level since May 2020, when the economy was still affected by the initial wave of Covid-19. However, building permits moved up to an annualised 1.543m (vs. 1.440m expected), which is their highest level since October. Permits tend to be the more reliable data point so the uncertainty around housing continues after Monday's poor NAHB. Separately in the Euro Area, the final August CPI reading was revised down to +5.2%, compared with the initial flash reading at +5.3%.

To the day ahead now, and the main highlight will be the Fed’s latest policy decision and Chair Powell’s press conference. Other central bank speakers include the ECB’s Elderson. Data releases include the UK CPI and German PPI for August. Lastly, today’s earnings releases include FedEx.