Shares of consumer product giant and bellwether 3M sank after it forecast 2024 profits and sales growth that fell short of estimates, disappointing Wall Street after a major restructuring push had lifted results last year.

The company said that Adjusted EPS will be no more than $9.75 per share in 2024, missing the $9.81 consensus average with organic sales expected to be flat to up 2%; also missing the analyst estimate of up 2.7%. The cautious outlook was announced as 3M reported Q4 adjusted earnings that were well above Wall Street estimates, helped by the restructuring push: Adjusted EPS were $2.42, beating the $2.31 analysts estimate, even as the adjusted operating margin of 20.9% missed expectations of 21.2%. In addition, a higher tax rate and other expenses represented a 29-cent headwind to the company’s full-year earnings forecast, 3M President Monish Patolawala said.

According to the UBS, the 2024 guidance implies $200 million y/y net restructuring benefits, which can be seen as the low end of potential outcomes with 3M targeting $800 million in net savings in FY 2024 and H2 2023 annualizing about $300 mn net savings. Even adjusting for the restructuring, guidance implies FY 2024 underlying operating margin of 20.8%, which is below the 21.0% observed over the last three quarters despite expected volume leverage.

Commenting on the results, UBS analyst Chris Synder said he believes the market focus will be on Q1 and FY 2024 guidance, which both came in below both buyside bogeys, primarily on margins.

While 3M saw its profit margins and cash generation rebound in the second half of 2023 after it slashed thousands of jobs as part of the largest restructuring push in its history, the broader economic environment remains muted for the maker of Post-it notes, touch screen display materials and health care products, CEO Mike Roman said.

“While we have more work to do, our actions are helping us improve our operational performance and create a more competitive 3M,” Roman said during a conference call with analysts. And while slumping electronics markets are stabilizing, industrial demand is mixed, retail spending remains slow and China continues to be soft, Roman said.

“We’re not seeing meaningful changes in the end markets as we start 2024,” he said in an interview with Bloomberg.

Additionally, 3M expects to generate as much as $7.1 billion in adjusted operating cash flow in 2024. Prioritizing cash generation and wider profit margins amid lackluster demand will continue to be key priorities for the company, the CEO said.

“We’re coming off a year where we came out stronger, leaner, more focused,” he said. “We’re going to continue to build on that momentum.”

3M’s forecast “reflects some conservatism given still uncertain end market dynamics and could position the company to deliver on its outlook, supporting stock appreciation over time,” Citi analyst Andrew Kaplowitz said in a client note.

Sales growth will also be affected as the company discontinues some products with less attractive growth and margin prospects, Patolawala said. That and other factors amount to about a percentage point of organic growth, he said.

As Bloomberg reminds us, 3M last year "launched a sweeping restructuring push including thousands of job cuts to become more streamlined as it confronted sluggish sales and made progress tackling huge legal liabilities that have put many investors on the sidelines."

The company last year agreed to pay as much as $12.5 billion to resolve claims by drinking water utilities that so-called forever chemicals produced by 3M tainted water supplies across much of the US. Other sources of liability from 3M’s legacy producing the substances remain unresolved. 3M also agreed to pay $6 billion to settle hundreds of thousands of lawsuits alleging it supplied defective earplugs to US combat troops.

The cost of funding those payouts have raised questions about whether it will need to dial back its practice of paying out rich dividends compared with other industrial companies.

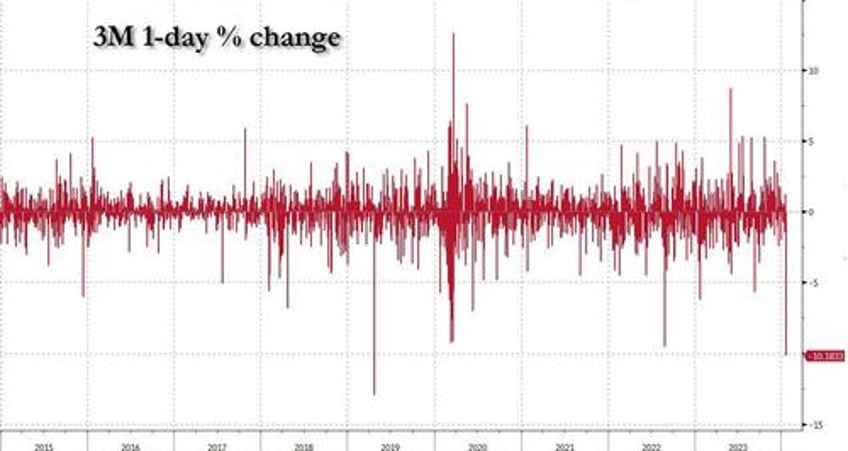

Shares of the St. Paul, Minnesota-based manufacturing giant had declined 12% over the 12 months ending with Monday’s close, well behind the 21% gain notched by the S&P 500 Index in the same period. That decline nearly doubled as of Tuesday morning, when 3M dropped by more than 10% to $97, the biggest intraday plunge since April 2019.