By Jane Foley, Senior FX strategist at Rabobank

The Israeli government confirmed that it had begun a new phase in its war against Hamas on Friday. Over the weekend Israel sent more troops and tanks into Gaza and has reported that more than 600 military targets in the strip had been attacked, supported by the deployment of fighter jets. Since the October 7 terror attack on Israel and the commencement of the war, there has been a clear market reaction.

However, so far investors have shied away from panic. Recent visits to Israel by President Biden and US Secretary of State Blinken, in addition to Qatar-led negotiations between Israel and Hamas aimed at de-escalation, plus the deployment of US military equipment and troops to the region to disincentivise Iranian backed militia from opening new fronts have allowed markets to remain relatively calm. On Friday, crude oil touched their highest levels of the week as the market positioned itself for the weekend newsflow.

By contrast, oil prices have dropped back this morning on the view that the conflict has remained contained. Clearly, there is a risk that this view proves optimistic. Yesterday US National Security Secretary Sullivan commented that he sees “elevated risk” of a regional spillover from the war. In reference to the retaliation action taken on Friday by US fighter jets against weapons and communication facilities of Iranian backed militia, Sullivan warned that the US will keep responding to attacks on its troops by Iranian proxies. In response to Israel’s incursion in Gaza, Iranian President Ebrahim Raisi has warned that the action “may force everyone to act”.

National Security Adviser Jake Sullivan tells @margbrennan: “And we are vigilant, because we are seeing elevated threats against our forces throughout the region, and an elevated risk of this conflict spreading to other parts of the region.” https://t.co/i9UVikt5aJ

— annmarie hordern (@annmarie) October 29, 2023

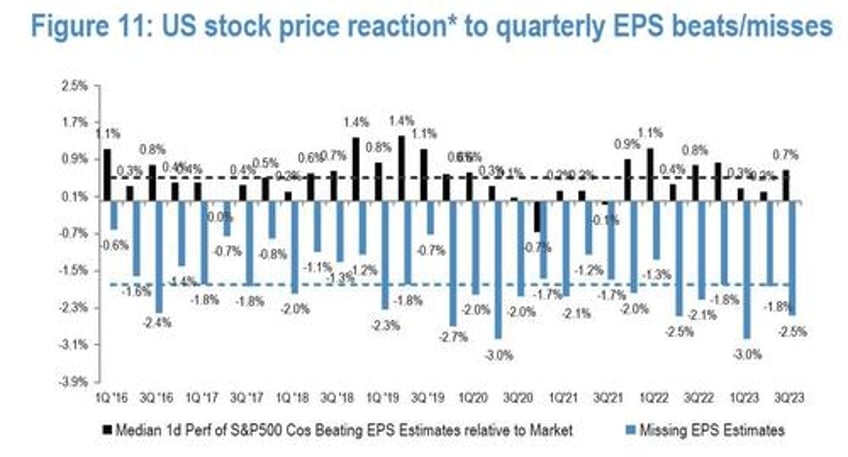

Gold prices pushed higher into the weekend but have edged lower in early trade this morning. Similarly, US and European stock markets ended the session on Friday in the red, although US futures are performing better so far today. Friday’s drop in stocks saw the S&P 500 falling 10% below its July peak, which technically put it into ‘correction’ territory. Q3 corporate earnings have been reported to be broadly in line with expectations so far. However, it appears that the share prices of those that have disappointed have been hit with particularly sharp falls. This coincides with reports that stock analysts are on heightened alert for companies most sensitive to higher rates.

The yield on the 10 yr treasury edged lower into the close on Friday after the US September PCE deflator registered 3.4% y/y in line with expectations and matching the August reading which was revised down from 3.5%. The data were sufficient to reinforce speculation that the Fed will leave rates on hold at this week’s FOMC meeting. Short covering amid a pre-weekend flight to safety may also have been supportive factors for US treasuries on Friday, though in the week ahead investors will have to confront the issue of supply.