By Simon White, Bloomberg markets live reporter and strategist

The week has started with the market taking a softer tone on the Israel-Gaza conflict, with Asian equities up again today after a strong close on Friday. The focus this week has shifted to US earnings, the Federal Reserve’s rate-setting meeting, and the Treasury’s quarterly refunding announcement (QRA), the latter two both on Wednesday. But it’s the BOJ, meeting on Tuesday, which has the biggest potential for a global macro upset.

There’s a lot of focus on the QRA this quarter, after the first step-up in issuance in two years at the last announcement in August helped catalyze the latest leg up in Treasury yields, to their post-GFC highs. The unusual amount of attention on the QRA, though, suggests it might end up being a bit of a non-event. Ditto the Fed, where they’re widely expected to remain on hold.

However, the BOJ has the bigger capacity for a surprise. The bank is expected to begin tightening policy at some point, by raising rates, taking them out of positive territory, and loosening yield-curve control. No change is expected at this week’s meeting, based on Bloomberg’s survey, but the BOJ pay less attention to market expectations than, say, the Fed (see "Yen Soars After Nikkei Report BOJ Considers Tweaking YCC Again To Allow 10Y Yields To Exceed 1%").

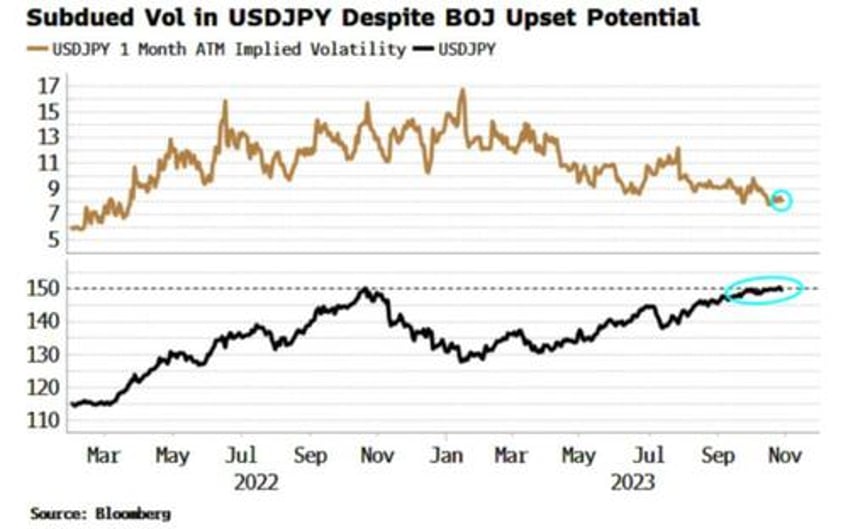

Dollar-yen has been bumping around the 150 level through most of October. The carry is a strong pull higher on the currency pair, but there is an enormous potential for a strong yen rally and even higher global yields when the BOJ tightens. The fall in vol adds to the potential for a larger upset.

A drop in yield curve control would make JGBs relatively more attractive at the margin. This, plus FX-hedge ratios that have been allowed to lapse while the yen has been weakening, would trigger a self-reinforcing yen rally that might catch many unawares in its speed and extent.

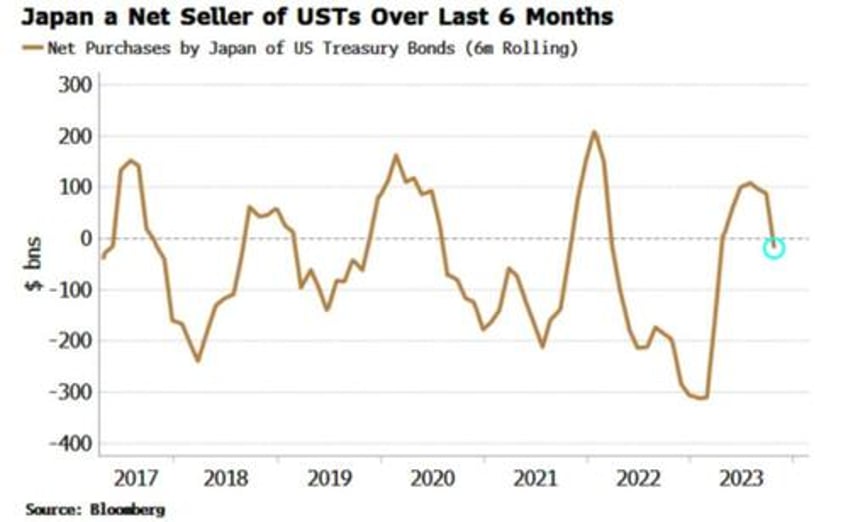

Further, global yields would be prone to rising more as Japanese investors sold some of their holdings. They have already been buying fewer USTs, with net purchases now negative over the last six months (FX hedging costs have made other DM debt less attractive to Japanese investors).

Ultimately, this will create a further problem for the Treasury as the largest foreign holder of USTs rows back on its ownership. US households have been the only net buyer of Treasuries. Given they anticipate higher inflation than the market, the government may have to get used to a much steeper yield curve to pay up for borrowing longer-term, or play the bill-issuance game a bit longer, which will get more problematic the closer the RRP (reverse repo) facility is to getting emptied.