Earlier today we discussed how two of the biggest technical drivers behind the recent market selloff - a massive $100 billion in sales by CTAs and the most bearish dealer gamma on record - had waned rapidly after hitting a crescendo late last week. Indeed, as both Goldman and UBS explained, absent a total collapse in risk, the next technical thrust is most likely higher, especially once most stock buybacks emerge from the current blackout period in about 2-3 weeks.

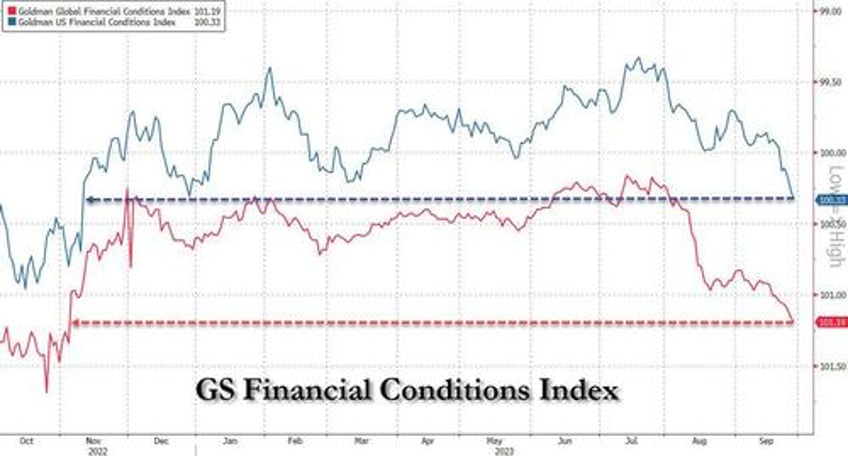

That said, while these two tecnicals may no longer be a tailwind for the bears for the immediate future, the “Macro Three Horsemen” as Nomura's Charlie McElligott calls them (latest note here), have again emerged as key drivers in the new quarter, with 1) Dollar following 2) higher Nominal- and Real- Yields—and yet again, 3) early Crude Oil strength (which however faded sharply later in the day as hedge funds piled shorts on their favorite recession hedge) all acting in concert to tighten FCI and lean on Risk out of the gates...