Hershey Co. shares surged the most in years after a Bloomberg report revealed that Mondelez International has mulled over a potential takeover of the chocolate maker for the second time in nearly a decade.

According to the people familiar with the situation who asked not to be identified, the Chicago-based Ritz crackers and Oreo cookies maker made a "preliminary approach about a possible combination" of Pennsylvania-based Hershey. They said deliberations are in the early stages.

Bloomberg data shows Hershey's market value, including debt, was approximately $46 billion. Mondelez's buyout proposal was not detailed in the report.

Even if Mondelez offered Hershey a sweet deal, it would require the support of Hershey Trust, which holds 80% of the Class B voting stock. Bloomberg noted, "The trust has slowly been selling some of its Hershey Co. shares in an effort to diversify its holdings."

In 2016, Mondelez approached Hershey about purchasing the company but walked away from the table after the trust rejected its $23 billion bid.

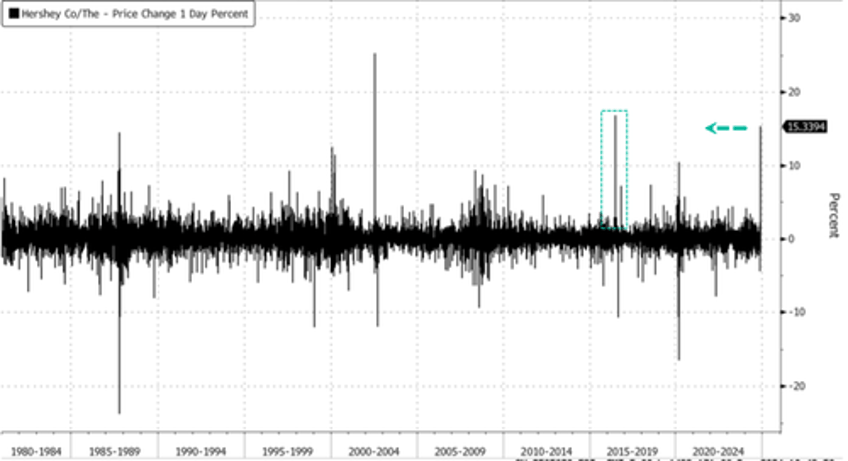

Shares in Hershey spiked as much as 19% for their biggest intraday gain since the 25% spike on July 25, 2002.

Shares are up 15% around 1045 ET, at about the same level on June 30, 2016, when Mondelez made the first buyout attempt.

"The packaged-food industry has been grappling with declining volumes, slowing growth and a weakening global consumer. Companies are looking to innovation and new markets to bolster sales as shoppers start to push back on price hikes and become more health-conscious — a trend that could lead to consolidation," Bloomberg noted.

One can only imagine what might happen to junk food industry when Robert F. Kennedy Jr. leads the Department of Health and Human Services next year. We cited a Goldman note on Sunday that provided readers with insight into the 'RFK Jr. Effect' pressuring healthcare companies lower.