With less than three full weeks left until the end of the year, we are rapidly running out of key macro events, although Wednesday’s US CPI will be a key determinant if the Fed cuts later this month, and whether it will be forced to hike in 2025.

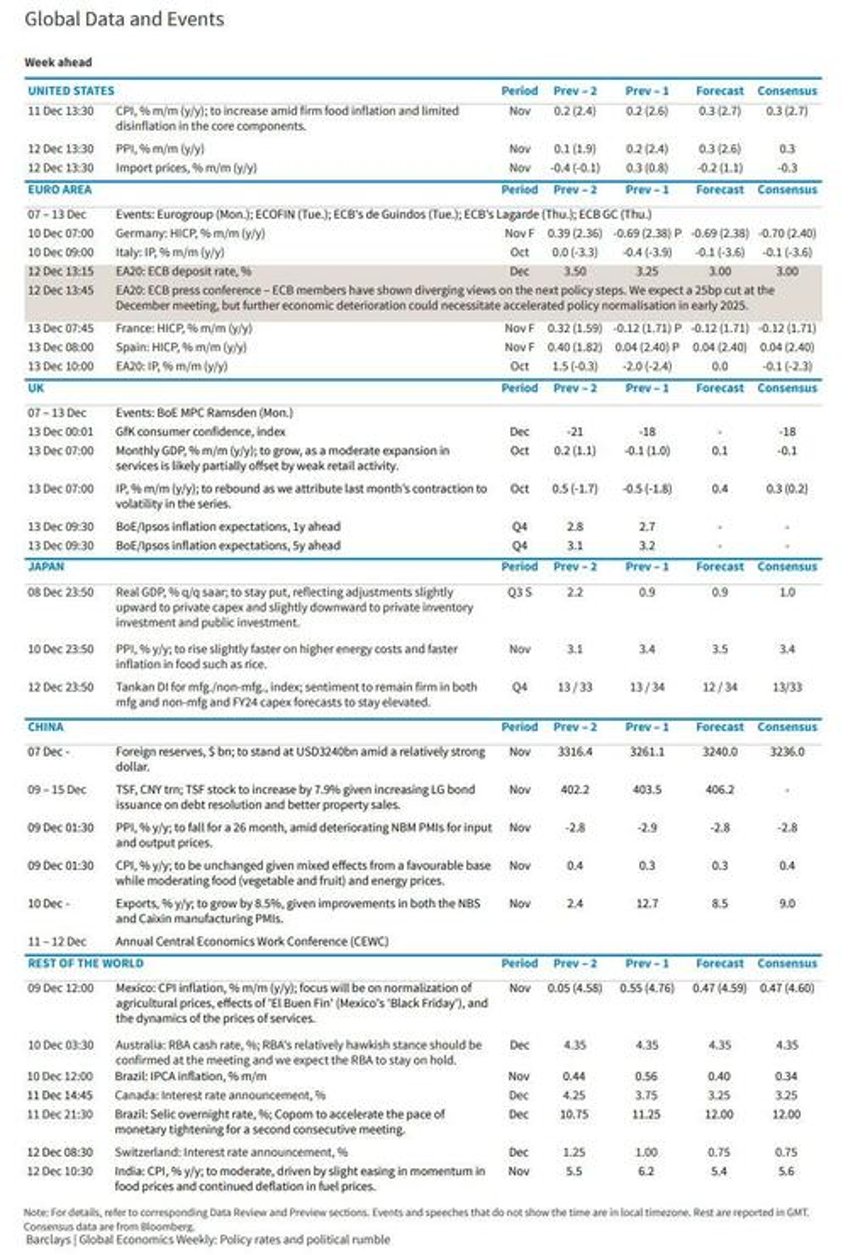

After Friday’s mixed payrolls report, the odds of a December cut went up from around 70% to 85% at the close. So the CPI will be the main event of the week according to DB's Jim Reid. The ECB meeting the following day will also be a key event with markets pricing in a small chance of a 50bps cut but with 25bps nailed on. Elsewhere the key events of note will be the RBA decision (hold expected), China trade data and Danish and Norwegian CPI tomorrow, the BoC decision on Wednesday (possible consecutive 50bps cut), the Brazilian rate decision (75bps hike to 12% expected), alongside a 10yr UST auction, US PPI, the SNB decision and a 30yr UST auction on Thursday, and the BoJ Tankan quarterly survey on Friday ahead of an "in the balance" BoJ meeting on December 19th where the market is expecting a 36% probability of a hike. See the full week ahead at the end as usual but now we'll preview the US CPI and the ECB decision in more detail.

For US CPI on Wednesday, DB's economists expect headline CPI growth to pick up to +0.30% (+0.24% in October), in line with the median forecast on Bloomberg, and see core printing at +0.27% (+0.28%) also in line with consensus. The headline YoY rate will therefore likely move up one-tenth to 2.7%, with core staying at 3.3%. The PPI report will follow on Thursday and our economics team forecast the headline to grow by +0.3% MoM (+0.2%). As ever the components that feed into core PCE will be the main thing to watch.

For the ECB, DB expects a 25bp cut to 3.00% in December. This will be the fourth cut since the start of the easing cycle, making it 100bp of cuts so far in this cycle. The team expect the December ECB press conference to emphasize uncertainty and the Governing Council to reach a compromise on communications that creates more policy optionality. There is considerable uncertainty going forward, not least around the timing, extent and impact of US tariffs, and as such the Governing Council is likely to want to keep its policy options wide open in 2025.

Elsewhere, it's been a weekend full of interesting news with Syrian President Assad's reign collapsing as rebel forces ousted him. With Russia and Iran historically backing the Assad government but being distracted by other conflicts on their own doorstep, the rebel forces have taken their opportunity. While many countries will be happy to see the current regime fall, the big question mark is what happens next. The rebels have been led by HTS, who spun out of al-Qaeda in 2016, so there will remain question marks about the succession. The situation probably isn't market moving at the moment (Crude up 0.4% overnight) but has longer-term implications for a lot of the current geopolitical hotspots dominating the world at the moment.

Meanwhile Trump spoke to NBC's "Meet the Press" yesterday and said he had no plans to replace Powell as Fed Chair and said "tariffs are going to make our country rich. Tariffs are going to help us pay off $35 trillion in debt". The trade comments didn't have a lot of extra substance beyond that so hard to get too much from it at the moment.

Courtesy of DB, here is a day-by-day calendar of events

Monday December 9

- Data: US October wholesale trade sales, November NY Fed 1-yr inflation expectations, China November CPI, PPI, Japan November Economy Watchers survey, M2, M3, October trade balance and current account (Tokyo time), November bank lending (Tokyo time)

- Central banks: BoE's Ramsden speaks

- Earnings: Oracle

Tuesday December 10

- Data: US November NFIB small business optimism, China November trade balance, Japan November machine tool orders, PPI, Italy October industrial production, Sweden October GDP indicator, Denmark and Norway November CPI

- Central banks: RBA decision

- Auctions: US 3-yr Notes ($58bn)

Wednesday December 11

- Data: US November CPI, federal budget balance

- Central banks: BoC decision

- Earnings: Adobe, Inditex

- Auctions: US 10-yr Notes (reopening, $39bn)

Thursday December 12

- Data: US November PPI, Q3 household change in net worth, initial jobless claims, Japan BoJ's Tankan survey (GMT time), UK November RICS house price balance, Germany October current account balance, Italy Q3 unemployment rate, Canada October building permits, Australia November labour force

- Central banks: ECB decision, SNB decision

- Earnings: Broadcom, Costco

- Auctions: US 30-yr Bonds (reopening, $22bn)

Friday December 13

- Data: US November import and export price index, UK December GfK consumer confidence, October monthly GDP, Japan October capacity utilisation, Germany October trade balance, November wholesale price index, Canada October manufacturing sales, Q3 capacity utilisation rate

- Central banks: ECB's Holzmann speaks, BoE inflation attitudes survey, Bundesbank's semi-annual forecasts

Finally, looking at just the US, Goldman writes that the key economic data release this week is the CPI report on Wednesday. Fed officials are not expected to comment on monetary policy this week, reflecting the blackout period ahead of the December FOMC meeting.

Monday, December 9

- 10:00 AM Wholesale inventories, October final (consensus +0.2%, last +0.2%)

Tuesday, December 10

- 06:00 AM NFIB small business optimism, November (consensus 94.5, 93.7)

- 08:30 AM Nonfarm productivity, Q3 final (GS +2.2%, consensus +2.2%, last +2.2%): Unit labor costs, Q3 final (GS +0.9%, consensus +1.2%, last +1.9%)

Wednesday, December 11

- 08:30 AM CPI (MoM), November (GS +0.28%, consensus +0.3%, last +0.2%); Core CPI (MoM), November (GS +0.28%, consensus +0.3%, last +0.3%); CPI (YoY), November (GS +2.70%, consensus +2.7%, last +2.6%); Core CPI (YoY), November (GS +3.27%, consensus +3.3%, last +3.3%): We estimate a 0.28% increase in November core CPI (month-over-month SA), which would leave the year-over-year rate unchanged on a rounded basis at 3.3%. Our forecast reflects an increase in used car prices (+2.0%) reflecting a rebound in auction prices, another increase in airfares (+1.0%) reflecting strong pricing trends, and a rebound in the car insurance category (+0.5%) based on continued—albeit decelerating—increases in premiums in our online dataset. We expect the shelter components to slow on net (OER +0.33% vs. +0.40% in October; primary rent +0.28% vs. +0.28% in October). We forecast a 0.5% increase in the apparel component (vs. -1.5% in October) and a 0.1% increase in the household furnishings and operations component (vs. -0.1%) reflecting weaker readings in the prior month and mixed data on holiday discounting. We expect seasonal distortions to weigh on the communications category (GS forecast -0.5%). We estimate a 0.28% rise in headline CPI, reflecting higher food (+0.25%) and energy (+0.3%) prices. Our forecast is consistent with a 0.20% increase in core PCE in November. We will update our core PCE forecast after the CPI is released and again after the PPI is released.

Thursday, December 12

- 08:30 AM PPI final demand, November (GS +0.2%, consensus +0.3%, last +0.2%); PPI ex-food and energy, November (GS +0.2%, consensus +0.2%, last +0.3%); PPI ex-food, energy, and trade, November (GS +0.2%, consensus +0.3%, last +0.3%)

- 08:30 AM Initial jobless claims, week ended December 7 (GS 235k, consensus 220k, last 224k): Continuing jobless claims, week ended November 30 (last 1,871k): We expect initial jobless claims to increase by 11k to 235k in the week ended December 7th, reflecting difficulties with seasonal adjustment around the holidays.

Friday, December 13

- 08:30 AM Import price index, November (consensus -0.2%, last +0.3%): Export price index, November (consensus -0.2%, last +0.8%)

Source: DB, Goldman, Barclays