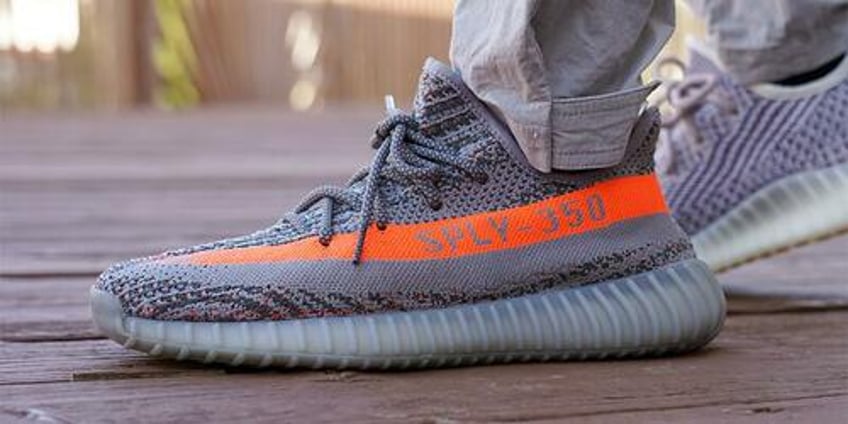

Adidas shares jumped Wednesday after the sportswear company boosted its full-year guidance and reported preliminary results of stronger-than-exected third-quarter earnings, primarily due to the sales of Yeezy sneaker inventory from its terminated partnership with Kanye West, also known as "Ye," after he made antisemitic comments about one year ago.

Adidas expects operating losses only to be around 100 million euros for 2023, a massive improvement from forecasts earlier this year of a 450 million euro loss.

Including the positive impact from the two Yeezy drops in Q2 and Q3, the potential write-off of the remaining Yeezy inventory of now around € 300 million (previously: € 400 million) and one-off costs related to the strategic review of up to € 200 million (unchanged), Adidas now expects to report an operating loss of around € 100 million in 2023 (previously: loss of € 450 million).

"While the company's performance in the quarter was again positively impacted by the sale of parts of its remaining Yeezy inventory, the underlying Adidas business also developed better than expected," the German sportswear giant said.

It "expects currency-neutral revenues to decline at a low-single-digit rate in 2023 (previously: decline at a mid-single-digit rate)."

The operating profit for the third quarter was reported at 409 million euros, a decline from the 564 million euros in the same quarter last year.

Adidas shares in Germany rose as much as 5% on the news of the turnaround led by selling 'canceled' Yeezy shoes. Shares are up 88% since breaching the 100 euro level last October.

Several Wall Street analysts had anticipated a favorable forecast from the company (list courtesy of Bloomberg):

Deutsche Bank, Adam Cochrane (buy)

- Says investor expectations have become more positive for Adidas due to the earnings momentum this year, and expects a better 3Q to maintain this with further upgrades

- "If we assume that the majority of the €100m (non-Yeezy) upgrade to guidance was achieved in 3Q this points to a better 4Q as well"

Warburg, Joerg Philipp Frey (hold)

- New guidance is closer to Frey's own estimates of €400m underlying operating profit and €200m reported Ebit, which includes the €200m restructuring charge

- "The guidance for the full year remains very conservative, in our view, particularly as we expect another Yeezy drop in 4Q and the full write-off of remaining Yeezy inventory is clearly very aggressive and we would thus only expect normal age-based inventory revaluations"

Bernstein, Aneesha Sherman (outperform)

- Outside of the Yeezy drop in August, the surprise was from a "greater than expected improvement in the underlying business"

- This suggests continued momentum into 2024, which is driven by an improvement in brand heat and inventory

Citi, Thomas Chauvet (buy)

- Estimates that excluding Yeezy, currency-neutral sales growth turned positive to +2% in 3Q and Ebit margin improved sequentially

- "This is a first step in a transition year toward a more positive 2024 outlook," he writes in a note to clients

RBC, Piral Dadhania (sector perform)

- Says that while he was anticipating a pre-announcement an annual outlook boost, "the details suggest 3Q is performing better than expected, both from an underlying perspective and also as it relates to Yeezy (which is positive for cash flow even if one-off in nature)"

The company's revitalization efforts are linked to the remaining sale of Yeezy inventory, indicating if the core bussiness does not accelerate, then it's a rocky path ahead for the company.