Just as we warned last week, the short squeeze is back again, perhaps as traders relished the start of the Fed blackout period (ahead of the Feb 1 FOMC) and the coming start of buybacks, with buyback blackout ending next weekend.

And the squeeze. Rinse. Repeat https://t.co/1yBrWiXPOC

— zerohedge (@zerohedge) January 23, 2023

...and adding to this re-reversal in sentiment, is the latest note from Goldman prime (also available to pro subs), according to which there has been a notable shift in market sentiment as "hedge funds net bought US Info Tech stocks for a second straight week led by Semis & Semi Equip names (after being sold in 10 of the 11 prior weeks)."

Evident in the dramatic outperformance grab in Nasdaq today...

The S&P has extended its gains above the 200-day moving-average...

And is now set to test its longer-term downtrend line...

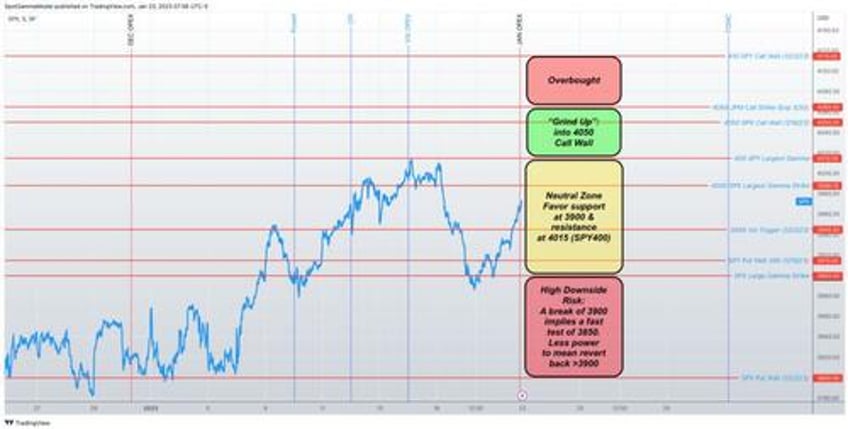

As SpotGamma notes, this week starts the Fed blackout period into 2/1 which may help reduce “tape bombs”.

Key earnings kick off this week which may shift traders focus to single stock stories.

Much of short term market movement may now key off of “recessionary” earnings narratives.

Overall, while levels look fairly similar to last week, OPEX served to weaken them.

The fairly large Jan OPEX also reduces some of the upside bias (calls) in single stocks.

We do not anticipate a high volatility session today, within 3900 holding as support, and 4000 resistance. There doesn’t appear to be any skew to favor a break of one side or the other.

SpotGamma's models turn bullish on a close over 4000, with room to move up to 4050.

A break of 3900 flips positioning much more put-heavy, which suggests that markets lose their ability to bounce.

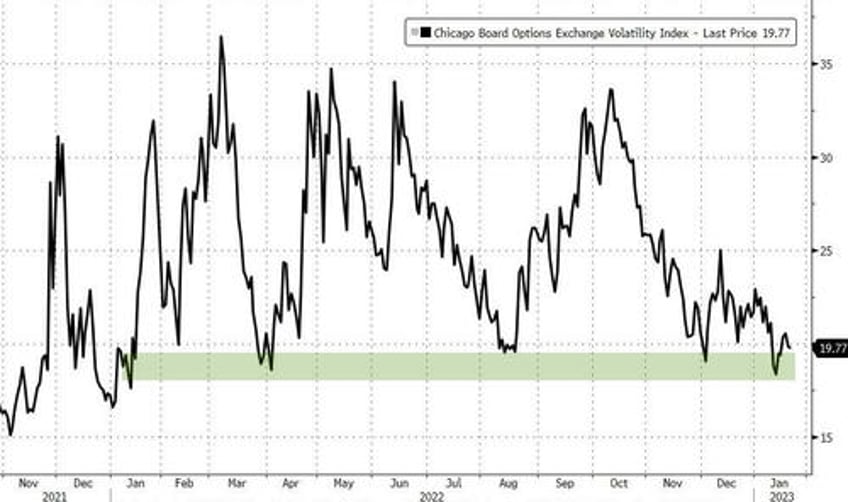

Finally, we note that implied volatility remains near the low end of its “fair value” and this may reduce vanna as a key driver of upside movement – particularly over 4000.

This does not mean that IV has to suddenly spike, and is unlikely to do so while the SPX is >3900. Arguably traders have some incentive to sell pre-FOMC IV, which should support markets as a test of 3900 (as traders sell relative spikes in puts/IV).