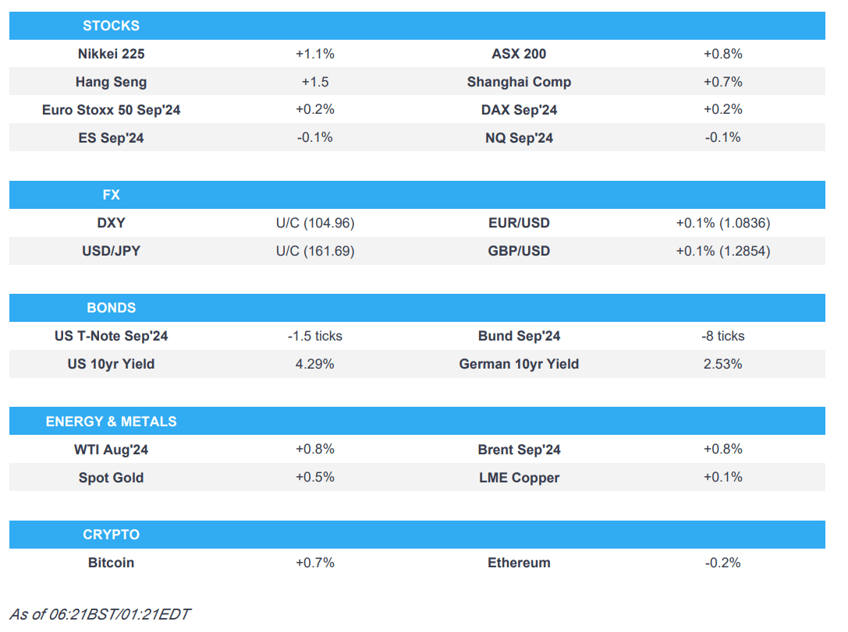

- APAC stocks took impetus from Wall St where the S&P 500 and Nasdaq rose to fresh record highs once again.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 future +0.2% after the cash market closed up by 1.1% on Wednesday.

- DXY sits just below the 105 mark, antipodeans lead, Cable has held onto recent gains and USD/JPY continues to edge higher.

- BoE's Mann said that wage growth is still far away from being consistent with the inflation target.

- Looking ahead, highlights include UK GDP, US CPI, IJC, Comments from Fed’s Bostic & Musalem, Supply from UK, US & Italy.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks rallied in which the S&P 500 and Nasdaq printed fresh record highs again with gains led by outperformance in tech after semis were buoyed by strong TSMC sales and Apple caught a bid on reports it aims to boost iPhone 16 shipments. Attention was also on Fed Chair Powell's second day of testimony to Congress where he largely stuck to the script and noted more good data was needed to be convinced inflation is returning to the target in a sustainable way, as well as repeated that risks to both sides of the mandate have come back into better balance.

- SPX +1.02% at 5,633, NDX +1.09% at 20,675, DJI +1.09% at 39,721, RUT +1.10% at 2,051.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Cook (voter) said the baseline outlook is for a continued fall in inflation without a significant increase in unemployment and US data is consistent with a soft landing. Cook added they are very attentive to what is happening with the unemployment rate and would be responsive if the situation changes quickly.

- WSJ’s Timiraos wrote "Federal Reserve Chair Jerome Powell made the beginning of a pivot on interest rates that might prove more durable than one that sparked a big market rally at the end of last year".

- A senior Biden team is to brief US senators at lunch on Thursday, according to Reuters citing a senate democratic leadership source. It was later reported that the meeting between Biden's advisers and Senate Democrats on Thursday is for Senate Democrats to express to the Biden team their reservations about the President, according to Fox News.

- US Senate Majority Leader Schumer is privately signalling to donors he is open to a democratic presidential ticket that isn't led by President Biden, according to Axios.

- US House Oversight Panel subpoenaed top Biden aides over his mental fitness, according to Axios.

- US House Democrat Leader Jeffries told lawmakers he will relay their concerns about Biden's electability, according to Politico.

APAC TRADE

EQUITIES

- APAC stocks took impetus from Wall St where the major indices rallied as outperformance in tech spear-headed the S&P 500 and Nasdaq to fresh record highs once again following TSMC's record quarterly sales and as Apple aims to boost iPhone shipments.

- ASX 200 gained with all sectors in the green and notable strength in tech, real estate, and heavy industries.

- Nikkei 225 continued its record-setting streak and advanced above the 42,000 level for the first time.

- Hang Seng and Shanghai Comp. conformed to the broad constructive mood amid the rising tide across equities despite NATO's firm rhetoric on China which it called a decisive enabler of Russia’s war effort in Ukraine, while sentiment was also unfazed by reports that Germany is to cut Huawei from its mobile networks.

- US equity futures plateaued after yesterday's tech-driven advances and with CPI data on the horizon.

- European equity futures indicate a mildly positive open with Euro Stoxx 50 future +0.2% after the cash market closed up by 1.1% on Wednesday.

FX

- DXY traded uneventfully and languished just beneath the 105.00 level as participants braced for CPI data.

- EUR/USD continued its gradual rebound from this week's floor near 1.0800 as the ECB enters a quiet period.

- GBP/USD held onto its recent gains as attention in the UK turns to monthly GDP and output data.

- USD/JPY traded indecisively after mixed Machinery Orders although found support at the 161.50 level.

- Antipodeans benefitted in tandem with the positive risk environment and mild CNY strength.

- PBoC set USD/CNY mid-point at 7.1339 vs exp. 7.2730 (prev. 7.1342).

FIXED INCOME

- 10-year UST futures lacked direction after yesterday's indecision heading into US CPI and a 30-year auction.

- Bund futures were contained after having recently pulled back from resistance near the 131.50 level.

- 10-year JGB futures traded rangebound following mixed Machinery Orders data and with only brief support seen following the stronger results at the latest 20-year JGB auction.

COMMODITIES

- Crude futures extended on gains amid the positive risk sentiment and following recent inventory data.

- US Energy Department announced a new solicitation for up to 4.5mln barrels of oil for delivery to the Strategic Petroleum Reserve's Bayou Choctaw site from October through December.

- Spot gold gradually edged higher but remained within the prior day's parameters ahead of inflation data.

- Copper futures were little changed and only slightly benefitted from the mostly constructive mood.

CRYPTO

- Bitcoin traded indecisively and ultimately faded an initial rally above the USD 58,000 level.

NOTABLE ASIA-PAC HEADLINES

- US Treasury Undersecretary Shambaugh said the US may need to take further action to protect US industries from China's industrial overcapacity and more creative approaches beyond Section 301 tariff adjustments may be necessary against China's overproduction and exports.

- BoK kept its base rate unchanged at 3.50%, as expected, with the decision made unanimously. BoK said it will maintain a restrictive policy stance for a sufficient period of time and will examine the timing of a rate cut, while it dropped the phrase that 'upside risks to inflation forecasts have increased' in its policy statement and said inflation could be slower than forecast. BoK Governor Rhee said they need to assess how a rate cut would affect financial stability and that a cut could adversely affect financial stability. Furthermore, he commented "time to prepare pivot rate cuts" and that two board members said they could consider a rate cut within the next three months, although he added that market expectations for policy rate cuts are a little excessive.

DATA RECAP

- Japanese Machinery Orders MM (May) -3.2% vs. Exp. 0.8% (Prev. -2.9%)

- Japanese Machinery Orders YY (May) 10.8% vs. Exp. 7.2% (Prev. 0.7%)

GEOPOLITICAL

MIDDLE EAST

- Israeli Defence Minister Gallant and IDF Chief of the General Staff Halevi both said they are in favour of a hostage deal with Hamas, according to Kann News.

- Israel is close to agreeing to withdraw from the Rafah crossing and there are attempts to open the Rafah crossing by the end of July after the full Israeli withdrawal. However, there are sticking points regarding the identification of the Palestinian parties that will operate the Rafah crossing, according to Al Arabiya citing Arabic sources.

- Tel Aviv agreed in the Cairo meeting that Palestinian parties would take over the management of the Rafah crossing, according to Israeli media. Solutions proposed during the Cairo meeting do not include an Israeli presence on the ground in Gaza, while Tel Aviv requested guarantees from Washington that it could attack the Gaza Strip again if it was proven that militants had returned to its north.

- White House's Kirby says he is cautiously optimistic things are moving in the right direction on Gaza ceasefire talks, according to CNN.

- US is to begin shipping 500-pound bombs to Israel, according to a report by WSJ.

OTHER

- US is to start deploying long-range fire capabilities in Germany in 2026 in an effort to demonstrate its commitment to NATO and European defence, according to a joint statement from Germany and the US.

- China's mission to the EU said the declaration of the NATO summit in Washington is full of 'Cold War mentality and belligerent rhetoric,' and the China-related content is full of provocations, 'lies, incitement, and smears'

- Taiwan is to strengthen its civil defence to prepare against China's threat with the government working to prepare public services and infrastructure to function in wartime as China’s aggressive stance fuels concerns about the risk of open conflict, according to FT.

EU/UK

NOTABLE HEADLINES

- BoE's Mann said the supply side of the economy is growing very slowly, while she still sees labour market tightness and stated that wage growth is still far away from being consistent with the inflation target.

- UK PM Starmer said the special relationship with the US is so important and stronger than ever.

- India warned the UK not to impose a deadline on trade talks, while India's Commerce Minister said India and the UK are 'on board' on the major details, according to FT.

DATA RECAP

- UK RICS Housing Survey (Jun) -17.0 vs. Exp. -15.0 (Prev. -17.0)

To download the report, please click here If you would like to subscribe to receive the research sheets directly in your inbox, you can now do so under the Research Suite section of the portal. To subscribe simply check the box next to "Email these reports" under the desired category.