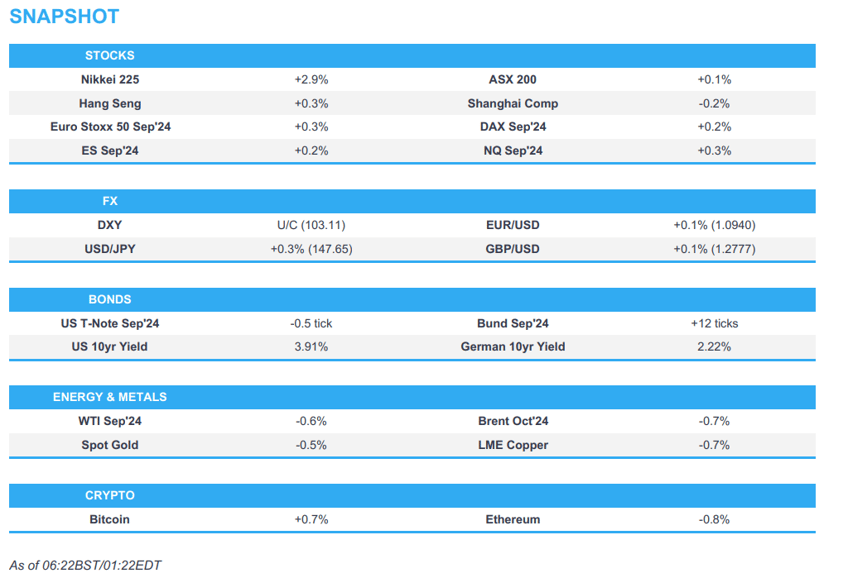

- APAC stocks followed suit to the mixed lead from the US ahead of key data.

- European equity futures indicate a firmer open with the Euro Stoxx 50 future up 0.3% after the cash market finished with losses of 0.1% on Monday.

- DXY is steady just above 103, havens lag vs. the USD, whilst risk currencies outperform.

- White House's Kirby said the timing of Iran's attack on Israel could be this week and they have to be prepared for what could be significant attacks.

- Looking ahead, highlights include UK Unemployment, German ZEW, US PPI, Comments from Fed’s Bostic, Supply from UK & Germany

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished mixed with the Nasdaq kept afloat by tech outperformance and the small-cap Russell 2000 tumbled, while the majority of sectors took a hit and price action for the major indices was rangebound amid a lack of catalysts, lingering geopolitical risks and ahead of key data.

- SPX flat at 5,344, NDX +0.16% at 18,542, DJIA -0.36% at 39,357, RUT -0.91% at 2,062.

- Click here for a detailed summary.

NOTABLE HEADLINES

- White House official said US President Biden would sign a proposal to bar tax on tips.

APAC TRADE

EQUITIES

- APAC stocks followed suit to the mixed lead from the US ahead of key data and as markets continue to brace for Iran's retaliation.

- ASX 200 traded indecisively after mixed data releases and as gains in financials, real estate and the commodity-related sectors were counterbalanced by losses in tech, telecoms and defensives.

- Nikkei 225 surged on return from the long weekend and reclaimed the 36,000 status after returning to last week's pre-turmoil levels.

- Hang Seng and Shanghai Comp. were indecisive with the former supported in energy stocks after yesterday's oil rally, while the mainland index oscillated between gains and losses in a tight range owing to the lack of fresh macro drivers.

- US equity futures traded sideways as participants await the looming data releases stateside.

- European equity futures indicate a firmer open with the Euro Stoxx 50 future up 0.3% after the cash market finished with losses of 0.1% on Monday.

FX

- DXY traded rangebound just above the 103.00 level amid light catalysts and as participants look ahead to key data releases including US PPI on Tuesday, CPI on Wednesday and Retail Sales on Thursday.

- EUR/USD remained afloat but with price action kept to within a tight range above the 1.0900 level amid a lack of drivers.

- GBP/USD eked slight gains in quiet trade and as UK Unemployment and Average Earnings data releases loom.

- USD/JPY gradually edged higher after rebounding off support near the 147.00 level and as Japanese stocks outperformed.

- Antipodeans were positive but with gains capped after mixed Wage Price data and Business Confidence survey from Australia, while participants await tomorrow's RBNZ policy decision.

- PBoC set USD/CNY mid-point at 7.1479 vs exp. 7.1760 (prev. 7.1458)

FIXED INCOME

- 10-year UST futures took a breather after gaining yesterday on heightened geopolitical risks and as the focus turns to upcoming data.

- Bund futures were contained within a narrow range amid a lack of catalysts and with German ZEW data due later.

- 10-year JGB futures lacked firm demand amid gains in Japanese stocks and the absence of additional BoJ purchases, while the latest Japanese PPI data printed in line with expectations.

COMMODITIES

- Crude futures pared some of the prior day's firm advances after rallying alongside the ongoing geopolitical risks which saw WTI briefly climb above the USD 80/bbl where it then hit resistance.

- US Department of Energy said the US seeks to buy 6mln bbls of oil to help replenish the SPR.

- Spot gold partially faded recent gains but with the pullback limited ahead of key data releases.

- Copper futures were on the back foot after yesterday's upward momentum waned and amid the mixed overnight sentiment.

CRYPTO

- Bitcoin gradually retreated to beneath the USD 59,000 level amid the mostly flimsy risk appetite in Asia.

NOTABLE ASIA-PAC HEADLINES

- China's Vice Premier Liu called for efforts to minimise damage to agricultural production caused by torrential rains and flooding, as well as urged efforts to improve the agricultural sector's capacity for disaster prevention and mitigation. China's Vice Premier also said they need to step up financial support for the restoration of agricultural production, according to Xinhua.

- China's Hesai is to be removed from the US Defence Department blacklist, according to FT.

- Hong Kong chip fab which is being led by a Chinese scientist who worked on developing photonic technology for the US military, has raised US research security concerns, according to a report cited by Nikkei.

- Japan's parliament is to hold a special session at the Lower House committee on August 23rd to discuss the BoJ rate hike, while BoJ Governor Ueda is likely to be asked to attend the special session, according to sources cited by Reuters.

DATA RECAP

- Japanese Corp Goods Price MM (Jul) 0.3% vs. Exp. 0.3% (Prev. 0.2%)

- Japanese Corp Goods Price YY (Jul) 3.0% vs. Exp. 3.0% (Prev. 2.9%)

- Australian Wage Price Index QQ (Q2) 0.8% vs. Exp. 0.9% (Prev. 0.8%)

- Australian Wage Price Index YY (Q2) 4.1% vs. Exp. 4.0% (Prev. 4.1%)

- Australian Consumer Sentiment (Aug) 2.8% (Prev. -1.1%)

- Australian NAB Business Confidence (Jul) 1.0 (Prev. 4.0)

- Australian NAB Business Conditions (Jul) 6.0 (Prev. 4.0)

GEOPOLITICAL

MIDDLE EAST

- Israeli military said they are at the highest state of alert. It was separately reported that Israeli forces stormed the city of Nablus in the northern West Bank from the Al-Tur military checkpoint, according to Al Jazeera.

- Iran has made significant deployment steps in its missiles and drone systems, similar to those it took before the attack on Israel in April, according to Israeli and US officials cited by Axios's Ravid.

- Source close to Hezbollah said Iran expressed concern that Israel and the US may strike its nuclear program and fears they will use the outbreak of any large-scale conflict as a pretext to neutralise Iran's nuclear deterrence, according to a report by The Washington Post.

- US and Israeli officials said their assessment was that the Iranian attack wouldn't happen on Monday night, while President Biden's top Middle East adviser will travel to Cairo for talks on security arrangements along the Egypt-Gaza border which is critical for a hostage deal, according to Axios's Ravid.

- White House's Kirby said the timing of Iran's attack on Israel could be this week and have to be prepared for what could be significant attacks. It was separately reported that US forces in the Middle East have been standing by expecting that Iran and Hezbollah's retaliation could happen since Saturday, while it was noted that no one seems to know when it will occur, according to BBC.

- US President Biden discussed with European leaders the Gaza hostage release, while it was separately reported that the US State Department said it fully expects the Gaza peace talks to move forward as planned and believes a ceasefire agreement is still possible.

- US State Department said Secretary of State Blinken discussed in a call with his Turkish counterpart the importance of Hamas's return to negotiations in the middle of this month, while Blinken stressed the importance of completing the framework agreement for an immediate and permanent ceasefire in Gaza and the release of hostages, according to Al Jazeera.

- FBI was reportedly investigating suspected hacking attempts by Iran in the Biden and Trump campaigns, according to Reuters and The Washington Post.

OTHER

- Russian forces took control of the settlement of Lyscychne in Ukraine, according to RIA.