Amid rising fears that the Fed's next move may be a rate hike instead of a cut, it appears that bond buyers - and especially foreign bond buyers - did not get the memo, and instead today's just concluded sale of $69 billion in 2Y paper was one of the strongest on record.

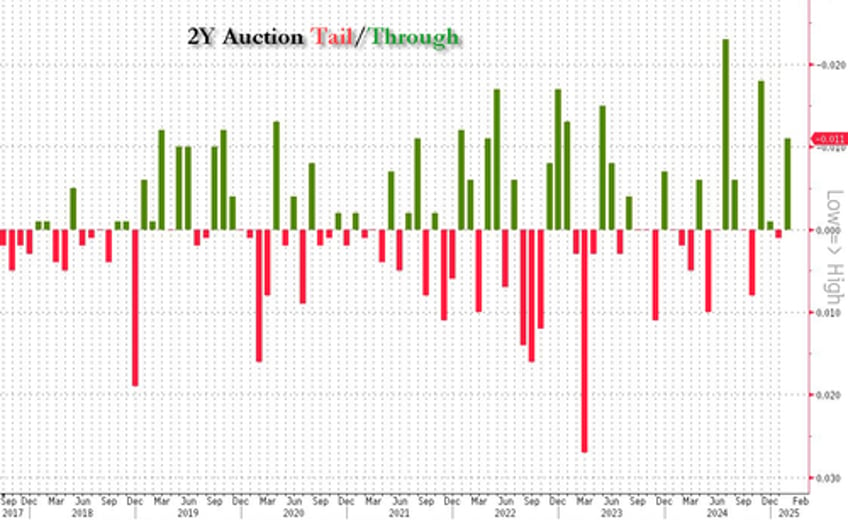

Starting at the top, the auction stopped at 4.169% at its 1pm close out time; this was down from 4.211% last month and also stopped 1.1bps through the 4.18% When Issued, following last month's modest tail. This was the third biggest stop through in the past two years as shown in the chart below.

The Bid to Cover was less exciting: at 2.56% it was down 10bps from last month's 2.66% and was the lowest since October, which is why it was well below the six-auction average of 2.66%.

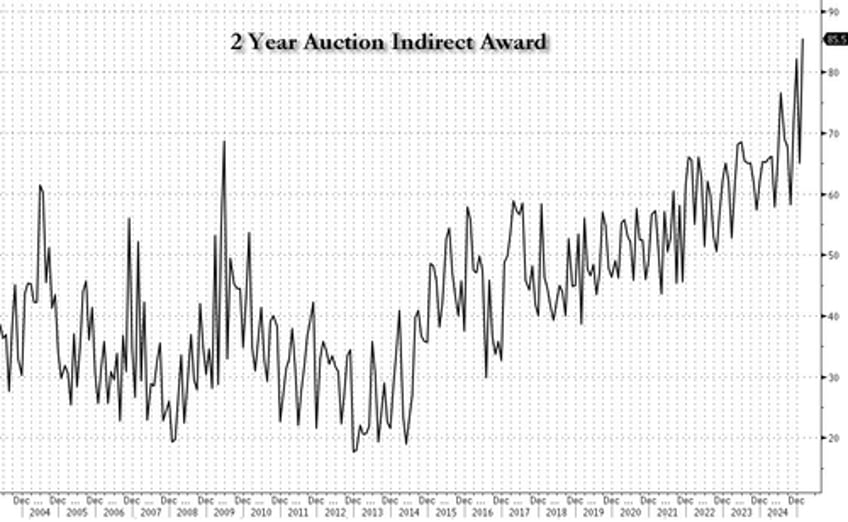

But what the auction lacked in BTC, it more than made up for thanks to foreign demand, because with 85.5% of the auction awarded to Indirects, i.e., foreign buyers, this was the highest Indirect award on record.

And with Directs awarded 7.6%, Dealers were left holding just 6.9% of the auction, the lowest on record!

Overall, this was a stellar auction, and on news of the break the 10Y yield, already near session lows, dropped to a fresh low for the day, just below 4.40% and likely set to drop even more.