- APAC stocks followed suit to the gains on Wall St where sentiment was underpinned amid a softer yield environment and the lack of trade war escalation.

- US Treasury Secretary Bessent said Trump wants lower 10-year yields; is not calling for the Fed to lower rates.

- European equity futures indicate a positive cash open with Euro Stoxx 50 future up 0.5% after the cash market closed with gains of 0.1% on Wednesday.

- DXY is sub-108, antipodeans lag, EUR/USD has returned to a 1.04 handle, JPY supported by hawkish BoJ comments.

- Looking ahead, highlights include Swedish CPI, EZ Retail Sales, US Jobless Claims, BoE, CNB & Banxico Policy Announcements, BoE DMP, BoE Governor Bailey, Fed’s Waller, Daly, Jefferson & BoC's Macklem, Supply from Spain & France.

- Earnings from ING, ArcelorMittal, Oersted, Carlsberg, Maersk. Compass, AstraZeneca, Société Generale, Vinci, L'Oréal, Eli Lilly, Roblox, Amazon & Affirm.

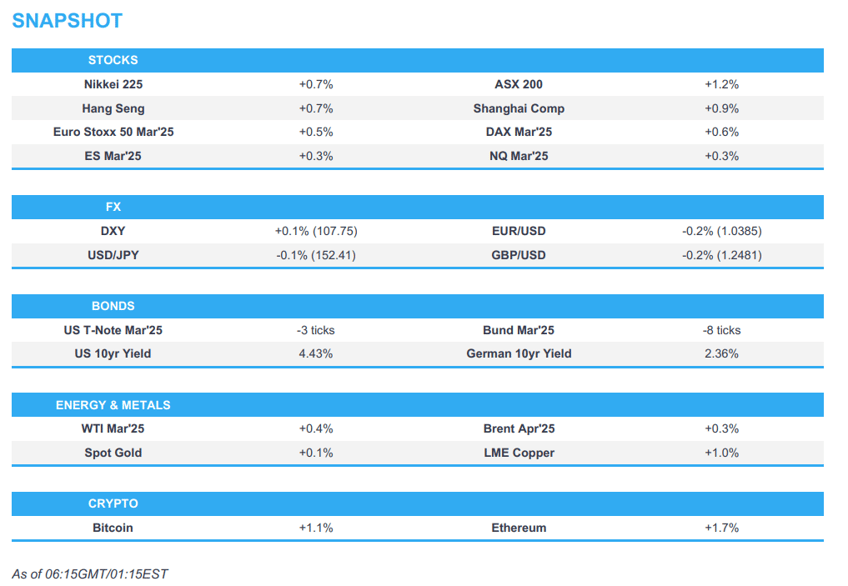

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were bid throughout the entirety of the US session amid a lack of trade war escalation with all major indices in the green and outperformance in the Russell 2000. Sectors were predominantly higher with outperformance in Tech as NVDA and chip names were buoyed by the strong Google (GOOG) CapEx guidance but the overall downbeat earnings saw Google (GOOGL) slump which weighed on the Communication sector.

- SPX +0.39% at 6,061, NDX +0.42% at 21,658, DJIA +0.71% at 44,873, RUT +1.14% at 2,316.

- Click here for a detailed summary.

TARIFF/TRADE

- China initiated a WTO dispute complaint regarding US tariffs, while Hong Kong is also considering a WTO complaint related to Trump tariffs, according to SCMP.

NOTABLE HEADLINES

- Fed's Jefferson (voter) said they need to look at the totality of the net effect of the Trump administration's influence on policy goals and he is happy to keep policy at the current level of restrictiveness until there is a better sense of the totality of impacts. Jefferson also stated that even with a 100bps decline, the Fed's rate is still restrictive, which allows the Fed to be patient and wait to see the net effect of policy changes.

- Fed's Goolsbee (2025 voter) said if inflation rises or progress stalls, the Fed will need to figure out if it's from overheating or tariffs, while he added that distinguishing the cause of any inflation will be critical for deciding when or even if the Fed should act.

- US Fed released 2025 stress test scenarios which include heightened stress in commercial and residential real estate, as well as corporate debt markets.

- US Treasury Secretary Bessent said the Trump administration wants to make the 2017 tax cut permanent, while he added that Trump wants lower interest rates and is focused on the 10-year treasury yield. Furthermore, he said Trump is not calling for the Fed to lower interest rates and interest rates will take care of themselves if they get energy costs down and deregulate economy.

APAC TRADE

EQUITIES

- APAC stocks followed suit to the gains on Wall St where sentiment was underpinned amid a softer yield environment and the lack of trade war escalation.

- ASX 200 outperformed with the index led higher by strength in financials, consumer discretionary and gold-related stocks.

- Nikkei 225 advanced at the open and reclaimed the 39,000 level but then briefly pared the majority of the gains owing to yen strength and comments from hawkish BoJ board member Tamura.

- Hang Seng and Shanghai Comp conformed to the constructive mood in the region amid a lack of major escalation on the trade front with the US Postal Services flip-flopping on suspending parcels from Hong Kong and China, while China initiated a WTO dispute complaint regarding US tariffs although this was as previously announced.

- US equity futures (ES +0.3%) remained afloat after yesterday's advances but with the upside capped amid light fresh catalysts.

- European equity futures indicate a positive cash open with Euro Stoxx 50 future up 0.5% after the cash market closed with gains of 0.1% on Wednesday.

FX

- DXY languished beneath the 108.00 level amid softer yields, optimism around trade relations and mixed data releases, while there were several Fed comments including from Jefferson who said they need to look at the totality of the net effect of the Trump administration's influence on policy goals and he is happy to keep policy at the current level of restrictiveness until there is a better sense of the totality of the impacts.

- EUR/USD partially faded yesterday's gains with the single currency back beneath the 1.0400 handle in uneventful trade, while recent ECB comments were somewhat mixed as ECB's Lane suggested a data-dependent and meeting-by-meeting basis and to not pre-commit to any particular rate path, while Centeno hopes to get to a 2% deposit rate sooner rather than later.

- GBP/USD traded little changed and just about gave back the 1.2500 status as participants awaited the BoE rate decision with the central bank widely expected to cut the Bank Rate by 25bps to 4.50%.

- USD/JPY continued to trickle lower and briefly tested the 152.00 level to the downside following comments from hawkish BoJ board member Tamura who stated they must raise rates to at least around 1% in the latter half of fiscal 2025.

- Antipodeans softened after the prior day's cyclical outperformance and with demand muted amid the holiday in New Zealand.

- PBoC set USD/CNY mid-point at 7.1691 vs exp. 7.2535 (prev. 7.1693).

FIXED INCOME

- 10yr UST futures stalled overnight after yesterday's bull-flattening with a focus on the QRA, Fed speak and data.

- Bund futures held on to most of their recent spoils with a firm footing above the 133.00 level amid softer global yields.

- 10yr JGB futures traded rangebound as hawkish comments from BoJ's Tamura counterbalanced the tailwinds from a slightly better-than-previous 30yr JGB auction.

COMMODITIES

- Crude futures were contained following the prior day's losses owing to soft data and bearish inventories.

- Spot gold traded rangebound after marginally pulling back from its record highs.

- Copper futures surged shortly after the reopening amid the positive risk environment and potential technical buying.

CRYPTO

- Bitcoin rebounded overnight and gradually extended above the USD 97,000 level.

NOTABLE ASIA-PAC HEADLINES

- BoJ Board Member Tamura said they need to raise rates in a gradual and timely manner and that a 0.75% rate would still be negative in real terms, while he added the BoJ must raise rates to levels deemed neutral on a nominal basis which is at least around 1% and must raise rates to at least around 1% in the latter half of fiscal 2025. Tamura said he personally does not think BoJ's past massive monetary easing had a positive effect as a whole given its strong side effects and they must scrutinise whether prolonged monetary easing could cause problems such as excessive yen falls and housing price spikes. Furthermore, he said the BoJ shouldn't persist in achieving 2% inflation as long as Japan is experiencing moderate price rises, as well as commented that he has no preset idea about the pace of interest rate hikes and the pace of interest rate hikes may not necessarily be once every half year.

- TikTok owner ByteDance is reportedly slow-rolling negotiations for a sale while waiting for a green light from the Chinese government, according to The Washington Post.

DATA RECAP

- Australian Balance on Goods (AUD)(Dec) 5.1B vs. Exp. 7.0B (Prev. 7.1B)

- Australian Goods/Services Exports (Dec) 1.10% (Prev. 4.80%)

- Australian Goods/Services Imports (Dec) 5.90% (Prev. 1.70%)

GEOPOLITICS

MIDDLE EAST

- Israeli occupation forces stormed Balata refugee camp east of Nablus in the West Bank, according to Al Jazeera.

- Israeli PM Netanyahu questioned what was wrong with the idea of allowing Gazans to leave, while he added that the idea should be pursued and done.

- White House said US President Trump has not committed to putting US troops in Gaza.

OTHER

- US Defense Secretary Hegseth held a call with Panama's President Mulino and they agreed to expand cooperation between the US military and Panama's security forces. It was separately reported that the State Department announced that US government vessels can now transit the Panama Canal without charge fees although the Panama Canal Authority later said it has not made any changes to charge fees.

EU/UK

NOTABLE HEADLINES

- French PM Bayrou survived the first no-confidence vote in parliament.

- ECB's Centeno said any further bank consolidation moves in Portugal should be approached with caution.

- ECB's Cipollone says there is still room for adj. rates downward. US tariffs on China could force the dumping of goods in Europe, weighing on growth and inflation. Soft landing remains the main scenario, no recession seen.