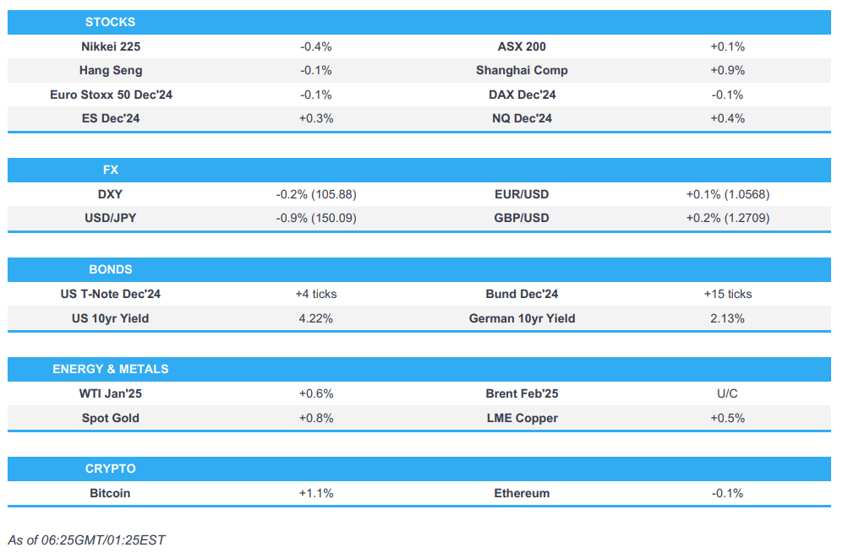

- APAC stocks traded mixed albeit with a slightly positive bias in the absence of a lead from Wall Street.

- Tokyo CPI data, seen as a leading indicator of nationwide price trends, supports the case for the BoJ to resume rate hikes next month.

- USD is softer vs. peers with JPY leading on account of Tokyo inflation data; USD/JPY briefly broke below 150.

- European equity futures are indicative of a contained cash open with the Euro Stoxx 50 future -0.1% after the cash market closed higher by 0.5% on Thursday.

- Looking ahead, highlights include German Import Prices & Retail Sales, French CPI, German Unemployment, EZ Flash HICP, Canadian GDP, ECB SCE (Oct), S&P on France, Comments from ECB’s de Guindos.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

- US markets were closed on Thursday for Thanksgiving Day.

APAC TRADE

EQUITIES

- APAC stocks traded mixed albeit with a slightly positive bias in the absence of a lead from Wall Street owing to the Thanksgiving Day holiday and as participants digested a slew of data releases into month-end.

- ASX 200 was lacklustre amid weakness in defensives, finance and tech with the latter not helped after the Australian Senate passed the social media ban for under-16s, while ANZ Bank also pushed back its forecast for the first RBA rate cut to May next year from February and only sees two 25bp cuts vs a prior view of three cuts.

- Nikkei 225 mildly declined with headwinds from recent currency strength after firmer-than-expected Tokyo inflation, while participants also digested the latest Industrial Production and Retail Sales figures which both fell short of estimates.

- Hang Seng and Shanghai Comp were underpinned despite the lack of obvious catalysts and shrugged off the PBoC's net daily liquidity drain, while participants await tomorrow's official PMI data in which the headline Manufacturing PMI is expected to show a further improvement.

- US equity futures (ES +0.3%) rebounded from early pressure to trade slightly higher heading into a shortened US trading session.

- European equity futures are indicative of a contained cash open with the Euro Stoxx 50 future -0.1% after the cash market closed higher by 0.5% on Thursday.

FX

- DXY retreated below 106.00 amid quiet conditions due to Thanksgiving and as the greenback continued to give up ground to yen strength.

- EUR/USD eked mild gains but with the upside limited and trade contained within a narrow range at the 1.0500 handle after the recent mixed data releases from the bloc and the latest ECB rhetoric including dovish remarks from Villeroy.

- GBP/USD gradually edged higher and just about reclaimed the 1.2700 status in the absence of any major UK-specific catalysts.

- USD/JPY extended on recent selling with pressure seen following mostly firmer-than-expected Tokyo CPI data which is seen as a leading indicator of nationwide price trends and supports the case for the BoJ to resume rate hikes next month.

- Antipodeans benefitted from the softer dollar, upside in commodity prices, and after the PBoC continued to strengthen the CNY fix.

FIXED INCOME

- 10yr UST futures lacked direction following the Thanksgiving Day holiday lull.

- Bund futures took a breather after steadily gaining yesterday amid a plethora of data releases and several ECB speakers.

- 10yr JGB futures were lacklustre due to the mostly hotter-than-expected Tokyo inflation data and weaker 2yr JGB auction.

COMMODITIES

- Crude futures were kept afloat following reports that OPEC+ is discussing delaying an oil output hike for Q1 2025 and is to hold further talks on policy in the coming days after pushing back its meeting to December 5th.

- Spot gold traded higher in tandem with the upside in silver prices and on the back of a softer dollar.

- Copper futures gained amid the mostly positive risk appetite overnight and notable outperformance in China.

CRYPTO

- Bitcoin notched mild gains and climbed back above the USD 96,000 level.

NOTABLE ASIA-PAC HEADLINES

- China's Finance Ministry said tariffs imposed by China on some US goods will continue to be exempted until 28th February 2025.

- Australian Treasurer Chalmers said RBA reforms are expected to apply after the February meeting.

- RBNZ Deputy Governor Hawkesby said they clearly signalled another 50bps cut in February and the New Zealand economy is turning a corner.

DATA RECAP

- Tokyo CPI YY (Nov) 2.6% vs. Exp. 2.2% (Prev. 1.8%)

- Tokyo CPI Ex. Fresh Food YY (Nov) 2.2% vs. Exp. 2.1% (Prev. 1.8%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Nov) 1.9% vs. Exp. 1.9% (Prev. 1.8%)

- Japanese Unemployment Rate (Oct) 2.5% vs. Exp. 2.5% (Prev. 2.4%)

- Japanese Industrial Production MM (Oct P) 3.0% vs. Exp. 3.9% (Prev. 1.6%)

- Japanese Retail Sales YY (Oct) 1.6% vs. Exp. 2.2% (Prev. 0.5%, Rev. 0.7%)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said he asked the army to prepare for a strong war in Lebanon if it violates the agreement, according to Al Arabiya. It was also reported that Israel’s Chief of Staff said they must implement the agreement strongly so that residents of the north can return to their homes, while IDF said they detected suspicious operations that posed a threat to Israel on the part of Hezbollah in what is considered a violation of the ceasefire.

- Israeli military said Lebanese residents are forbidden to move south to a line of several southern villages, according to Reuters.

- Iran informed the IAEA it intends to feed uranium feedstock into the eight IR-6 centrifuge cascades recently installed at Fordow to enrich to up to 5% purity, while the agency shared with Iran the changes required to the intensity of inspection activities following the commission of those cascades. Furthermore, IAEA verified that Iran had completed the installation of the last two IR-2M centrifuge cascades in a batch of 18 at its underground Natanz plant and intends to install one cascade of up to 1,152 IR-6 centrifuges at Natanz PFEP to enrich up to 5% purity, according to the IAEA report seen by Reuters.

RUSSIA-UKRAINE

- Russian air defences downed 30 Ukrainian drones in the southern Rostov region with some damage on the ground reported, according to the regional Governor.

- Ukrainian President Zelensky said Russian President Putin’s promotion of the Oreshnik missile shows he does not want to end the war or allow others to try, while he added that Putin's actions are intended to boost tension and disrupt moves by Trump on the war after his inauguration.

- US President Biden said on Thursday that Russia's overnight aerial attack against Ukraine was outrageous and that Russian attacks serve as a reminder of the urgency and importance of supporting Ukrainian people in their defence, according to Reuters.

- Russian Defence Ministry said Defence Minister Belousov is visiting North Korea, according to agencies cited by Reuters.

OTHER

- Chinese and Russian militaries conducted a ninth joint strategic air patrol in relevant airspace over the Sea of Japan on Friday, according to Chinese state media.

- Eleven Chinese and Russian military aircraft intruded South Korea's air defence zone and South Korea launched air force jets in a tactical manoeuvre against the intrusion, according to Yonhap.

EU/UK

NOTABLE HEADLINES

- German government plans about EUR 2bln in new chip subsidies, according to Bloomberg.