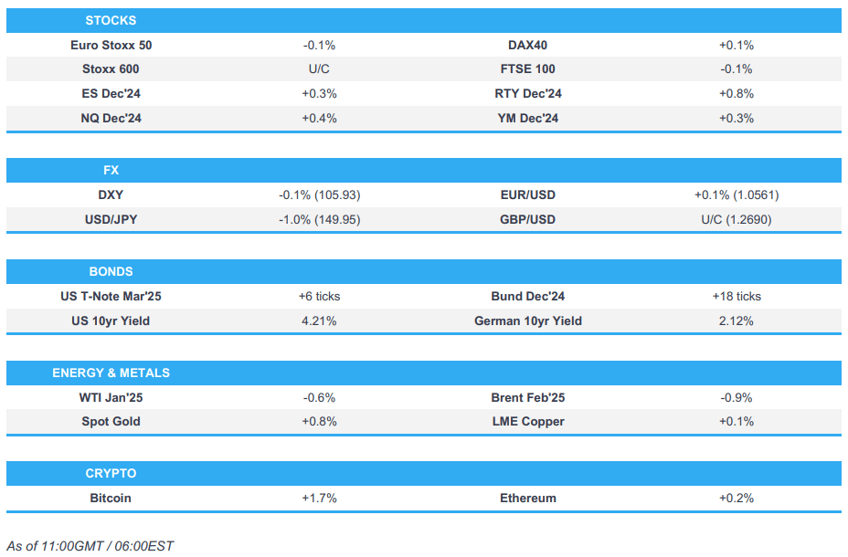

- European bourses near unchanged while US futures are modestly firmer post-Thanksgiving

- USD knocked by a stronger JPY. EUR unreactive to Flash HICP

- Fixed benchmarks in the green, OATs in focus awaiting a Le Pen decision

- Crude diverges given the lack of settlement but benchmarks are at the lower-end of c. USD 1/bbl parameters

- Metals in the green, gold gleans support from the USD and punchy language around Lebanon

- Looking ahead, highlights include Canadian GDP, S&P on France, Comments from ECB’s de Guindos

- Holiday: US post-Thanksgiving (recommended early close); normal service until 18:15GMT/13:15EST, upon which the desk will close.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

THANKSGIVING NEWS RECAP

- OPEC+ reportedly discussing delaying oil output hike for Q1 2025, is to hold further talks on policy in coming days after delaying the meeting, according to Reuters citing sources. Prior to this, the meeting was delayed to the 5th from the 1st of December.

- RBA Governor Bullock says policy needs to remain restrictive. Expects it will take a little longer for inflation to settle at target in Australia. At present, we judge that conditions in the labour market remain tighter than what would be consistent with low and stable inflation.

- ECB's Knot says they must take a close look at supply shocks to the economy and react forcefully if there is a risk of expectations de-anchoring.

- ECB's Villeroy says negative rates should remain in the ECB's toolkit. Interest rates should clearly go to the neutral rate, would not exclude going below neutral rate in the future.

- ECB's Wunsch in an interview with Nikkei says he sees the possibility of continuing to cut rates in a gradual manner; would not send good signal to accelerate pace of rate cuts.

- French Finance Minister Armand reaffirms France may make concession on electricity taxes to avoid any ensuing "storm" that could hit financial markets; says better to have a modified budget than no budget. Just prior to this remark the French 10yr yield briefly matched its Greek counterpart

EUROPEAN TRADE

EQUITIES

- European bourses trade around the unchanged mark, Stoxx 600 U/C; specifics light aside from Flash EZ HICP.

- Sectors mostly in the red with Autos & Parts lagging to end a bruising week. Basic Resources bucks the trend given metals and Anglo American (+3.4%) amid speculation in the FT that BHP could come back with a fresh bid.

- Stateside, futures firmer ES +0.3% with the RTY +0.9% outperforming. Specifics light and the docket sparse on a limited post-Thanksgiving session, as such the macro narrative may not change significantly.

- MSFT -0.5% after the FTC launched an antitrust investigation while unconfirmed reports indicate MSTR +4.5% could join the Nasdaq 100.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD was knocked lower by the stronger JPY. Today's US macro narrative is likely to remain unaltered due to the early close. DXY has been as low as 105.61 with the next potential level of support via the 12th low @ 105.48.

- EUR trivially firmer vs. the USD. Headline EZ inflation in-line, super-core a touch softer than Exp. ECB pricing was little changed; 25bps seen at 84% for Dec. EUR/USD went as high as 1.0597 in early trade before running out of steam ahead of the 1.06 mark.

- JPY leading on account of firmer Tokyo inflation metrics. BoJ Dec hike priced at 56%. USD/JPY briefly crossed below 150 for the first time since October 21st with a session low @ 149.55.

- GBP briefly made its way back onto a 1.27 handle vs. the USD; UK macro drivers light. Cable has been as high as 1.2749 with the next upside target coming via the 13th November peak @ 1.2769.

- NZD outpacing its antipodean peer; has been gaining since RBNZ on Wednesday. NZD/USD has moved back onto a 0.59 handle and above its 21DMA @ 0.5909. AUD/USD is holding above the 0.65 mark.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Benchmarks generally firmer with specifics outside the EZ light and expected to be limited ahead given the partial post-Thanksgiving closures. Stateside, cash trade has resumed but, unsurprisingly, is limited with yields softer across the curve and a modest flattening bias in play.

- Bunds firmer by around 15 ticks, unreactive to Flash EZ HICP which printed broadly as expected while the super core and services Y/Y came in slightly cooler; pricing points to an 85% chance of a 25bps Dec. cut.

- OATs in focus, though the OAT-Bund yield spread remains shy of the 90bps multi-year peak from earlier in the week. As it stands, we are largely waiting for a decision from Le Pen on French budget as a whole.

- A morning of gains for Gilts which opened in the green and extended to a 96.10 peak shortly after with specifics light and fundamentals behind the move limited. Thereafter, Gilts settled slightly but have since surpassed the above peak by six ticks.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are diverging, on account of the lack of settlement due to Thanksgiving. Specifics today have been somewhat light in European hours, with the docket ahead also limited.

- For the most part, we are awaiting updates on OPEC+ and the Lebanon ceasefire. Benchmarks towards the lower-end of c. USD 1/bbl parameters but, as has been the case throughout all of the week, remain in proximity to familiar ranges.

- Spot gold is in the green, benefitted this morning on overnight punchy geopolitical rhetoric around the ceasefire and as the USD was under pressure.

- Base metals firmer but with action modest, as has been the case for much of the week. Chinese PMIs on the weekend the next major catalyst.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HICP Flash YY (Nov) 2.3% vs. Exp. 2.3% (Prev. 2.0%); Core 2.8% vs. Exp. 2.8% (Prev. 2.7%); Services CPI 3.9% vs. Prev. 4.0%

- EZ Super-core HICP Flash YY (Nov) 2.7% vs. Exp. 2.8% (Prev. 2.7%)

- French CPI (EU Norm) Prelim YY (Nov) 1.7% vs. Exp. 1.7% (Prev. 1.6%); MM -0.1% vs. Exp. 0.0% (Prev. 0.3%)

- French CPI Prelim. (Nov): Y/Y 1.3% vs Exp. 1.5% (prev. 1.2%); M/M -0.1% vs Exp. 0.1% (prev. 0.2%)

- German Unemployment Chg SA (Nov) 7.0k vs. Exp. 20.0k (Prev. 27.0k); Rate SA (Nov) 6.1% vs. Exp. 6.1% (Prev. 6.1%)

- ECB Consumer Expectations Survey (Oct): See inflation in next 12 months at 2.5% (prev. 2.4%); 3y ahead sees 2.1% (prev. 2.1%)

- UK Mortgage Approvals (Oct) 68.303k vs. Exp. 64.5k (Prev. 65.647k, Rev. 66.115k); Lending 3.435B GB vs. Exp. 2.85B GB (Prev. 2.541B GB, Rev. 2.573B GB)

NOTABLE EUROPEAN HEADLINES

- German government plans about EUR 2bln in new chip subsidies, according to Bloomberg.

- ECB announces changes to the Eurosystem collateral framework to foster greater harmonization.

- BoE says the CCyB is held at 2%.

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said he asked the army to prepare for a strong war in Lebanon if it violates the agreement, according to Al Arabiya. It was also reported that Israel’s Chief of Staff said they must implement the agreement strongly so that residents of the north can return to their homes, while IDF said they detected suspicious operations that posed a threat to Israel on the part of Hezbollah in what is considered a violation of the ceasefire.

- Israeli military said Lebanese residents are forbidden to move south to a line of several southern villages, according to Reuters.

- Iran informed the IAEA it intends to feed uranium feedstock into the eight IR-6 centrifuge cascades recently installed at Fordow to enrich to up to 5% purity, while the agency shared with Iran the changes required to the intensity of inspection activities following the commission of those cascades. Furthermore, IAEA verified that Iran had completed the installation of the last two IR-2M centrifuge cascades in a batch of 18 at its underground Natanz plant and intends to install one cascade of up to 1,152 IR-6 centrifuges at Natanz PFEP to enrich up to 5% purity, according to the IAEA report seen by Reuters.

- Senior Iranian official says Tehran expects "tough and serious" talks with E3 in Geneva.

RUSSIA-UKRAINE

- Russian air defences downed 30 Ukrainian drones in the southern Rostov region with some damage on the ground reported, according to the regional Governor.

- Ukrainian President Zelensky said Russian President Putin’s promotion of the Oreshnik missile shows he does not want to end the war or allow others to try, while he added that Putin's actions are intended to boost tension and disrupt moves by Trump on the war after his inauguration.

- US President Biden said on Thursday that Russia's overnight aerial attack against Ukraine was outrageous and that Russian attacks serve as a reminder of the urgency and importance of supporting Ukrainian people in their defence, according to Reuters.

- Russian Defence Ministry said Defence Minister Belousov is visiting North Korea, according to agencies cited by Reuters.

OTHER

- Chinese and Russian militaries conducted a ninth joint strategic air patrol in relevant airspace over the Sea of Japan on Friday, according to Chinese state media.

- Eleven Chinese and Russian military aircraft intruded South Korea's air defence zone and South Korea launched air force jets in a tactical manoeuvre against the intrusion, according to Yonhap.

CRYPTO

- Bitcoin is firmer and comfortably above the USD 95k mark but yet to attempt a move towards the USD 100k figure. High for the session thus far at USD 96.9k.

APAC TRADE

- APAC stocks traded mixed albeit with a slightly positive bias in the absence of a lead from Wall Street owing to the Thanksgiving Day holiday and as participants digested a slew of data releases into month-end.

- ASX 200 was lacklustre amid weakness in defensives, finance and tech with the latter not helped after the Australian Senate passed the social media ban for under-16s, while ANZ Bank also pushed back its forecast for the first RBA rate cut to May next year from February and only sees two 25bp cuts vs a prior view of three cuts.

- Nikkei 225 mildly declined with headwinds from recent currency strength after firmer-than-expected Tokyo inflation, while participants also digested the latest Industrial Production and Retail Sales figures which both fell short of estimates.

- Hang Seng and Shanghai Comp were underpinned despite the lack of obvious catalysts and shrugged off the PBoC's net daily liquidity drain, while participants await tomorrow's official PMI data in which the headline Manufacturing PMI is expected to show a further improvement.

NOTABLE ASIA-PAC HEADLINES

- China's Finance Ministry said tariffs imposed by China on some US goods will continue to be exempted until 28th February 2025.

- Australian Treasurer Chalmers said RBA reforms are expected to apply after the February meeting.

- RBNZ Deputy Governor Hawkesby said they clearly signalled another 50bps cut in February and the New Zealand economy is turning a corner.

- Japan FX intervention amounted to 0 from Oct 30 - Nov 27.

- German Foreign Minister will visit China from Dec 2-3rd, according to China's Foreign Ministry.

DATA RECAP

- Tokyo CPI YY (Nov) 2.6% vs. Exp. 2.2% (Prev. 1.8%)

- Tokyo CPI Ex. Fresh Food YY (Nov) 2.2% vs. Exp. 2.1% (Prev. 1.8%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Nov) 1.9% vs. Exp. 1.9% (Prev. 1.8%)

- Japanese Unemployment Rate (Oct) 2.5% vs. Exp. 2.5% (Prev. 2.4%)

- Japanese Industrial Production MM (Oct P) 3.0% vs. Exp. 3.9% (Prev. 1.6%)

- Japanese Retail Sales YY (Oct) 1.6% vs. Exp. 2.2% (Prev. 0.5%, Rev. 0.7%)