- APAC stocks were mostly higher following the tech strength stateside where Nvidia briefly reclaimed the largest market cap title and closed at a fresh record.

- DXY felt some slight reprieve from the prior day's selling pressure, EUR/USD held on to most of yesterday's gains, USD/JPY briefly breached the 158.00 level to the upside.

- Canada reportedly considers an early release of retaliatory tariffs against the US, according to The Globe and Mail.

- European equity futures indicate a negative cash open with Euro Stoxx 50 futures down 0.4% after the cash market closed higher by 2.4% on Monday.

- Looking ahead, highlights include Swiss CPI, ECB SCE, EZ HICP & Unemployment, US ISM Services PMI, JOLTS Job Openings, International Trade, Canadian Imports/Exports, Comments from Fed's Barkin, Supply from UK, Germany & US.

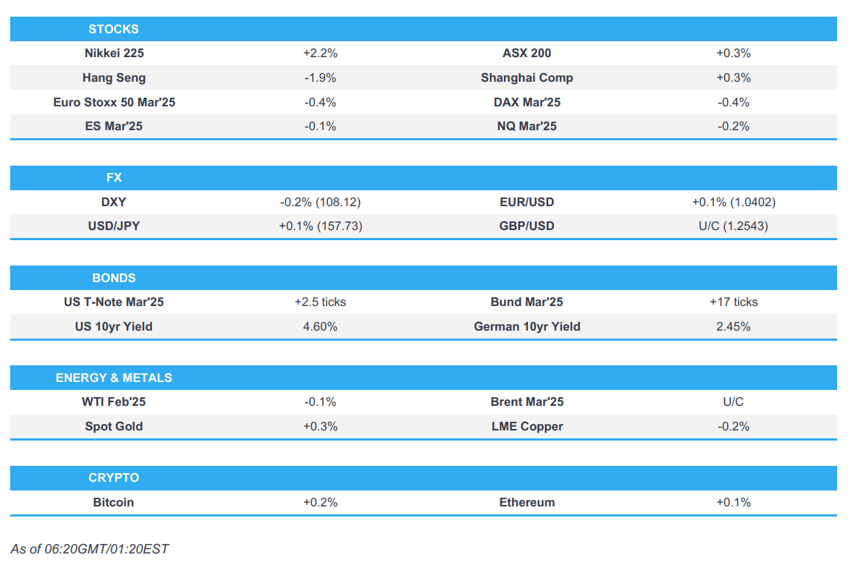

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were ultimately mixed with outperformance seen in the Nasdaq as large caps gained and semis were bid following commentary from Microsoft (MSFT) which is to spend USD 80bln on AI data centres and as attention turns to CES this week with Nvidia CEO speaking overnight.

- Equity futures were bid early on after a report in The Washington Post that Trump's trade policies are going to focus on certain sectors, essentially a watered-down tariff proposal from what Trump was gunning for during the election, although Trump later refuted the Post's claims in which he stated the story of paring back his tariff policy is wrong and fake news.

- SPX +0.55% at 5,975, NDX +1.09% at 21,559, DJIA -0.06% at 42,707, RUT -0.08% at 2,267.

- Click here for a detailed summary.

NOTABLE HEADLINES

- New York judge denied US President-elect Trump's request to delay sentencing in hush money case, according to a court ruling cited by Reuters.

- US President-elect Trump commented on Truth Social that many people in Canada love being the 51st state and the US can no longer suffer the massive trade deficits and subsidies Canada needs to stay afloat. Furthermore, he stated if Canada merged with the US, there would be no tariffs, taxes would go down, and they would be completely secure from the threat of Russian and Chinese ships constantly surrounding them.

- Canada reportedly considers an early release of retaliatory tariffs against the US, according to The Globe and Mail.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher following the tech strength stateside where Nvidia briefly reclaimed the largest market cap title and closed at a fresh record.

- ASX 200 eked mild gains as strength in tech and telecoms picked up the slack from the weakness in the utilities, miners and materials sectors, while advances were limited amid disappointing Building Approvals data which showed a wider-than-expected contraction.

- Nikkei 225 outperformed on a break above the 40,000 level with the index propelled by a weaker currency.

- Hang Seng and Shanghai Comp were pressured from early in the session with heavy losses in Hong Kong after the Pentagon added several companies including Tencent (700 HK) and CATL to the US list of firms alleged to help Beijing's military, while the downside in the mainland was gradually cushioned following the announcement that China is to hold a briefing on consumer goods trade-in program on Wednesday involving officials from the PBoC, MoF and NDRC.

- US equity futures were rangebound and struggled for direction after the prior day's mixed and choppy performance.

- European equity futures indicate a negative cash open with Euro Stoxx 50 futures down 0.4% after the cash market closed higher by 2.4% on Monday.

FX

- DXY felt some slight reprieve from the prior day's selling pressure that was exacerbated by a Washington Post report suggesting a potential moderation of Trump's aggressive tariff plans which dragged the DXY briefly beneath the 108.00 level before rebounding off intraday lows as Trump later refuted the report. Elsewhere, recent data provided little to spur a recovery as Factory Orders fell more than expected and Final S&P Global PMI data was revised downward on both the composite and services components for December.

- EUR/USD held on to most of yesterday's gains but was off highs after failing to sustain a brief reclaim of the 1.0400 handle, while attention turns to EU inflation.

- GBP/USD took a breather at the 1.2500 territory following its recent outperformance, while overnight data was encouraging as UK BRC Retail Sales returned to growth and Total Sales accelerated at the fastest pace since March last year.

- USD/JPY resumed its advances and briefly breached the 158.00 level to the upside to print its highest in around six months which prompted some jawboning from Japan's Finance Minister Kato who noted they are recently seeing one-sided, rapid moves and reiterated to take appropriate action against excessive moves.

- Antipodeans kept afloat with gains gradual after a firmer-than-expected yuan reference rate and disappointing Australian Building Approvals data.

- PBoC set USD/CNY mid-point at 7.1879 vs exp. 7.2994 (prev. 7.1876).

FIXED INCOME

- 10yr UST futures were little changed after the recent indecisive performance as Trump refuted reports that he is dialling back on his tariff policies, while prices were also not helped in the aftermath of a soft 3yr auction stateside.

- Bund futures attempted to nurse some of their recent losses but with the recovery limited by firmer-than-expected German inflation and as supply looms.

- 10yr JGB futures were constrained as yields continued to gain with the 30yr yield at its highest since 2010, although there was slight support seen after a stronger-than-previous 10yr JGB auction.

COMMODITIES

- Crude futures were subdued after the prior day's whipsawing as indecision was seen across a wide range of asset classes alongside the Trump tariff reports.

- Bloomberg OPEC Survey for December found crude output fell 120k BPD to 27.05mln BPD with output dipping as UAE improves delivery of cuts.

- Spot gold traded rangebound with only mild support seen despite the recent dollar weakness.

- Copper futures lacked conviction as sentiment in its largest purchaser China lagged behind regional peers amid trade-related frictions.

CRYPTO

- Bitcoin marginally eased back overnight following yesterday's resurgence to above the USD 102,000 level.

NOTABLE ASIA-PAC HEADLINES

- US Treasury Secretary Yellen spoke with Chinese Vice Premier He Lifeng and discussed economic developments, while she raised issues of concern including China's non-market policies and industrial overcapacity, as well as expressed serious concern about 'malicious' cyber activity by Chinese state-sponsored actors. Furthermore, she underscored 'significant consequences' facing Chinese companies for material support to Russia, according to Reuters.

- Japanese Finance Minister Kato said they are seeing one-sided and sudden FX moves. He reiterated that it is important for currencies to move in a stable manner reflecting fundamentals. Kato said he is alarmed over FX moves including those driven by speculators and will take appropriate action against excessive moves, while he also commented that they cannot rule out the chance of Japan going back to deflation.

DATA RECAP

- Australian Building Approvals (Nov) -3.6% vs. Exp. -1.0% (Prev. 4.2%, Rev. 5.2%)

GEOPOLITICS

MIDDLE EAST

- Israeli army said it bombed a cell of militants in the town of Tammun, south of Tubas, in the northern West Bank, according to Al Jazeera.

- Hamas leader said they asked for maps outlining the withdrawal process and the atmosphere pointing to an integrated deal to end the war in Gaza, according to Asharq News.

RUSSIA-UKRAINE

OTHER

- North Korea confirmed Monday's launch of a new hypersonic missile, while it was separately reported that North Korea plans to launch an ICBM before the Trump inauguration, according to Chosun Ilbo. In relevant news, South Korean acting President Choi said they are to respond sternly to North Korean provocation and that North Korea missile test poses a significant security threat.

EU/UK

NOTABLE HEADLINES

- Barclays UK December consumer spending was flat Y/Y compared to December 2023.

DATA RECAP

- UK BRC Retail Sales YY (Dec) 3.1% (Prev. -3.4%)

- UK BRC Total Sales YY (Dec) 3.2% (Prev. -3.3%)