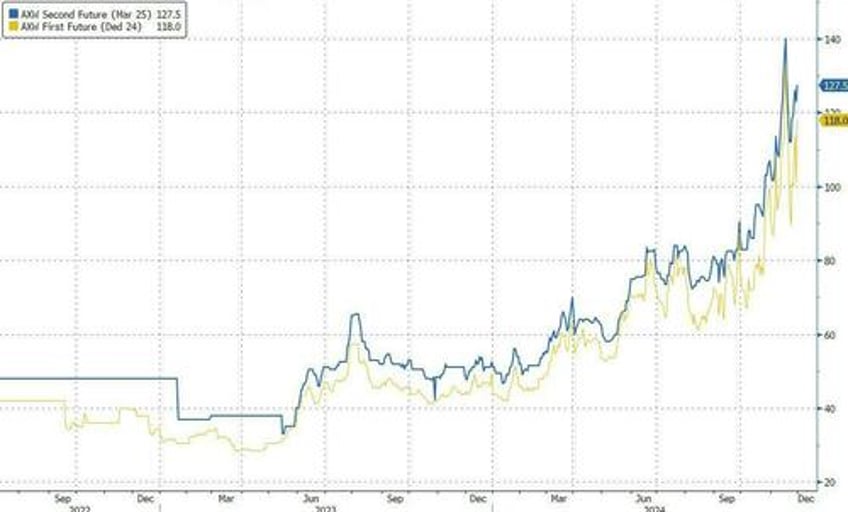

One month ago we pointed out something bizarre: at a time when the S&P was hitting record highs with every passing day on what appeared a relentless daily 0DTE bid, coupled with a surge in stock buybacks and seemingly unstoppable retail demand to chase every meltup higher, it appeared that large institutions were piling into stocks with just the same fervor as their less experienced, more naive retail peers. This was manifest through the 1st and 2nd month S&P 500 TRF BTIC, or so-called equity funding spreads; as we said in early December, "taking a closer look at equity funding pressures, we find that after hitting a decade high on Nov 15, then reversing sharply, AXW spreads have once again started rising."

In our attempt to explain this move, we quoted Goldman deriatives guru John Marshall, who noted that funding spreads are a proxy for professional investor positioning, and who wrote that "funding spreads resumed their climb over the past week following mid-November volatility. This suggests there has been no reduction in appetite for equity upside from professional investors in the futures, swaps and options markets" which "is a bullish sign for future near-term equity performance." And indeed it was as the S&P proceeded to soar every day for the next two weeks. He also noted that "the correlation of its rise with equities suggests it was driven by demand rather than another perceived supply shock" (more in the December Goldman note, available to pro subs).