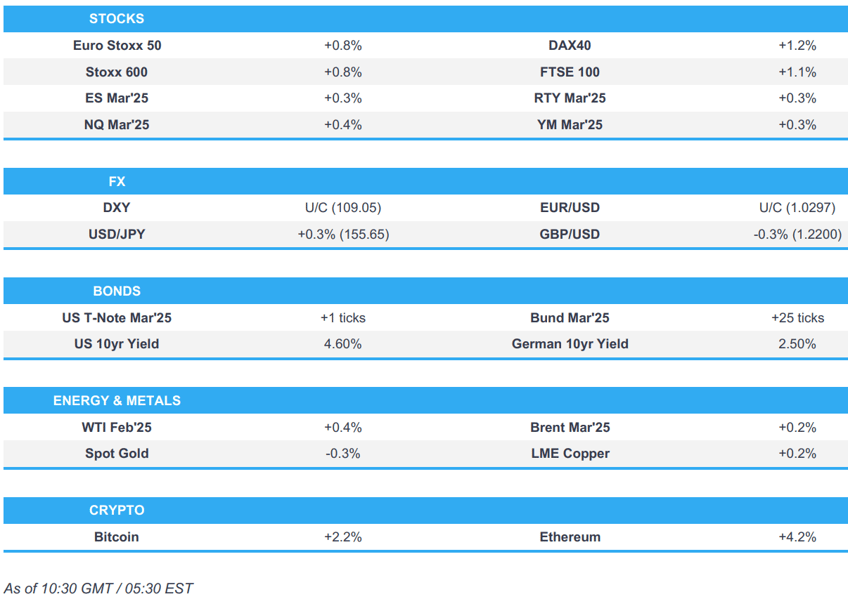

- European bourses grind higher, US futures modestly in the green.

- USD marginally firmer, JPY softer and GBP knocked lower by disappointing retail sales.

- JGBs lag slightly on further BoJ reports, Gilts gapped higher on Retail Sales.

- Mixed trade in the base metal complex but crude stays firm.

- Looking ahead, US Industrial Production, CBO Budget and Economic Outlook, Comments from ECB’s Cipollone, Earnings from SLB, Fastenal, Truist, State Street & Citizens.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 +0.7%) opened modestly firmer across the board and have continued to climb since the cash open; as it stands, indices reside near best levels.

- European sectors hold a strong positive bias, with Autos & Parts leading the gains whilst Tech is the marginal laggard, as it trades on either side of the unchanged mark, paring the TSMC-induced upside seen in the prior day.

- US equity futures are modestly in positive territory, attempting to make up for the lacklustre performance in the prior session and garnering optimism via a strong European session thus far.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is marginally higher with the dollar gaining some strength at the hands of a softer GBP and JPY. DXY remains within yesterday's 108.82-109.38 trading band. Docket ahead is light.

- EUR is flat vs. the USD in quiet EZ-specific newsflow other than comments from dovish GC member Stournaras noting that easing should continue with a series of cuts and news that French PM Bayrou survived a no-confidence motion against the government. EUR/USD is currently contained within yesterday's 1.0259-1.0314. EZ HICP Finals saw modest downward revisions to some components, but had little impact on price action.

- JPY is softer vs. the USD after two hefty sessions of gains. Source reporting surrounding the BoJ continues to indicate that a 25bps hike is likely on the horizon. The Nikkei reports that a majority of BoJ board members are poised to approve a rate hike next week with the final decision set to come after Trump's inauguration. USD/JPY just about briefly dipped below 155 with a 154.99 low.

- GBP is on the backfoot in what has been an indecisive week for Cable with the pair broadly pivoting around the 1.22 mark. Today's selling pressure has been triggered by a soft outturn for UK retail sales which unexpectedly contracted on a M/M basis. Cable briefly broke below yesterday's low at 1.2174 before trimming downside.

- Antipodeans are both slightly softer vs. the USD and unable to benefit from a better-than-expected outturn for Chinese GDP, retail sales and industrial production.

- PBoC set USD/CNY mid-point at 7.1889 vs exp. 7.3275 (prev. 7.1881).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are modestly firmer, but yet to deviate significantly from the unchanged mark. Derived a modest bid from action across the pond as Gilts lifted on the back of soft Retail Sales metrics for December. At a 108-22+ peak but with ranges narrow and the low at just 108-16+.

- JGBs are once again the modest underperformer on the account of more sources pointing to a BoJ hike in January.

- Bunds lifted off their 131.50 base (following UK Retail Sales) to a 131.88 session high over the course of the morning. EZ HICP (Finals) saw modest downward revisions; ahead, a few ECB speakers are due.

- Gilts gapped higher at the open by 27 ticks and then extended further to a 91.89 peak. A move which was driven by soft Retail Sales for December, metrics which complete the week’s set of dovish UK data and cement the view that February is a live meeting with a strengthening market bias towards a cut occurring. The 91.89 peak marks a WTD high and has Gilts on track to close the week out with gains of c. 250 ticks from the 89.00 open and 88.96 WTD low just below that.

- Click for a detailed summary

COMMODITIES

- A firm Friday session in the crude complex as risk appetite grinds higher in early European hours, with the crude benchmarks also supported by constructive Chinese GDP and activity data. WTI Feb resides in a current 78.65-79.44/bbl range and Brent Mar trades within 81.37-81.93/bbl.

- Subdued price action in the metal complex as the Dollar continues to grind higher, and with the Middle Eastern geopolitical landscape more constructive after yesterday's blip surrounding last-minute tweaks to the Israel-Hamas deal. Spot gold resides in a USD 2,705.81-2,717.43/oz range.

- Mixed trade in the base metal complex despite the constructive Chinese data overnight and the risk appetite in the European morning. 3M LME copper ekes mild gains and resides in a current narrow USD 9,239.00-9,295.50.t range.

- Colonial Pipeline now estimates an earlier-than-expected restart of Line 1 on Friday after it made progress with on-site work to identify the source of a leak on Line 1 and began repairs.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Retail Sales MM (Dec) -0.3% vs. Exp. 0.4% (Prev. 0.2%, Rev. 0.1%); Ex-Fuel -0.6% vs. Exp. 0.1% (Prev. 0.3%, Rev. 0.1%)

- UK Retail Sales YY (Dec) 3.6% vs. Exp. 4.2% (Prev. 0.5%, Rev. 0.0%); Ex-Fuel YY 2.9% vs. Exp. 3.6% (Prev. 0.1%, Rev. -0.5%)

- EU HICP-X F&E MM (Dec) 0.3% vs. Exp. 0.4% (Prev. -0.4%); HICP Final MM (Dec) 0.4% vs. Exp. 0.4% (Prev. -0.3%); HICP-X F&E Final YY (Dec) 2.7% vs. Exp. 2.8% (Prev. 2.8%); HICP Final YY (Dec) 2.4% vs. Exp. 2.4% (Prev. 2.4%); HICP-X F,E,A&T Final YY (Dec) 2.7% vs. Exp. 2.7% (Prev. 2.7%)

- EU Current Account NSA,EUR (Nov) 34.62B (Prev. 32.0B) Current Account SA, EUR (Nov) 26.98B (Prev. 25.8B)

NOTABLE EUROPEAN HEADLINES

- ECB's Stournaras says easing should continue with a series of cuts, via Bloomberg.

- ECB's Nagel says there is no doubt that the German economy is experiencing a pronounced growth weakness

NOTABLE US HEADLINES

- Fed's Hammack (2026 voter; dissenter) says Fed can be patient on rate cuts; inflation remains an issue; adds that monpol is only moderately restrictive, WSJ reports.

- BofA weekly total card spending: -0.8% Y/Y, "LA wildfire impact seems to be more localised since total card spending in California has only slowed modestly so far".

- US President Trump reportedly planning an aggressive immigration in the first hours of his administration, via CNN citing sources. Article writes "The package of actions amounts to a dramatic shift in immigration policy that will affect immigrants already residing in the United States and migrants seeking asylum at the US-Mexico border."

GEOPOLITICS

MIDDLE EAST

- Hamas says issues regarding ceasefire deal resolved on Friday, according to a statement.

- "Israel's security cabinet ratifies Gaza agreement", according to Al Jazeera.

- Israel security cabinet begins meeting to vote on Gaza ceasefire, hostage release deal, according AFP.

- Israel agreed to the Gaza hostage deal and the cabinet is to meet on Friday, according to Israeli media.

- Reports suggest that the demand by Israel's Finance Minister Smotrich were met, following him stating to PM Netanyahu that he would resign if not.

OTHER

- French Defence Minister says French maritime patrol aircraft was the target of Russian intimidation measured in Baltics; France calls the measures unacceptable.

- Chinese hackers reportedly accessed Treasury Secretary Yellen's computer in the US Treasury breach, according to Bloomberg.

- North Korean Foreign Ministry said it will exercise its thorough right to self-defence, according to KCNA.

CRYPTO

- Bitcoin is on a firmer footing and holds just shy of USD 102k; Ethereum tops USD 2.4k.

APAC TRADE

- APAC stocks were mixed in mostly rangebound trade after the uninspiring handover from Wall St and despite encouraging Chinese GDP and activity data.

- ASX 200 traded indecisively as weakness in the top-weighted financials sector and telecoms clouded over the marginal gains in most sectors, while the index also failed to benefit from the mostly better-than-expected data in Australia's largest trading partner.

- Nikkei 225 continued to underperform amid recent currency strength and the potential for a BoJ rate hike next week.

- Hang Seng and Shanghai Comp were choppy with only mild support seen after GDP, Industrial Production & Retail Sales beat expectations with China's economy growing 5.4% Y/Y (exp. 5.0%) in Q4 and by 5.0% (exp. 4.9%) for 2024. Nonetheless, the data only briefly supported Chinese stocks which were ultimately rangebound after the mixed commentary from the stats bureau which noted the impact of external environment changes is deepening, domestic demand is not sufficient, and economic operations still face many difficulties and challenges but also stated that positive factors will outweigh negative factors for China's economy in 2025. In addition, US-China trade frictions continued to linger after the USTR found China shipbuilding to be actionable under Section 301.

NOTABLE ASIA-PAC HEADLINES

- Majority of BoJ board members poised to approve a rate hike next week, according to Nikkei sources; some of the board hold cautious view; the final decision will come after Trump's inauguration.

- China's stats bureau said China's economic operations were generally steady in 2024, but the impact from external environment changes is deepening and domestic demand is not sufficient, while it added that economic operations still face many difficulties and challenges. China stats bureau head said China's economic achievements in 2024 were hard won but China policy stimulus was timely and boosted confidence and growth, as well as noted they will continue to promote economic recovery and implement more pro-active economic policies. The stats bureau head said positive factors will outweigh negative factors for China's economy in 2025 and he is fully confident about China's economic development in 2025, while he added that facing external changes, China will prioritise boosting domestic demand especially consumption.

- US Trade Representative said China's dominance of maritime, logistics and shipbuilding sectors is actionable under Section 301 statute but did not make specific recommendations. USTR said China's targeting of maritime sectors is enabled by forced labour, lack of labour rights, and excess capacity in steel and other areas, while it displaces foreign firms, lessens competition and creates dependence on China.

- China's Commerce Ministry said China is strongly dissatisfied and firmly opposed to the US report about China's shipbuilding and logistics sectors, while it will closely monitor US actions and take necessary measures to safeguard its legitimate rights and interests. MOFCOM also said the relevant investigation is marked by 'unilateralism and protectionism', while it added the 'decline' of the US shipbuilding industry has nothing to do with China and it urged the US to stop shifting problems in its domestic industrial development onto China.

- China's Commerce Ministry requested the WTO to set up an expert group on Turkey's restrictions on electric vehicles imported from China and said the next step will be to start a litigation process in accordance with WTO rules.

- BoJ is reportedly likely to hike in January barring any major Trump-driven market shocks, via Reuters citing sources; will make no major change to guidance that they will keep increasing rates. BoJ is unlikely to offer explicit guidance on the pace of future tightening or how far rates could eventually go, while source added "the market seems to have gotten the BoJ's message".

DATA RECAP

- Chinese GDP QQ SA (Q4) 1.6% vs. Exp. 1.6% (Prev. 0.9%, Rev. 1.3%)

- Chinese GDP YY (Q4) 5.4% vs. Exp. 5.0% (Prev. 4.6%)

- Chinese GDP YTD YY (Q4) 5.0% vs. Exp. 4.9% (Prev. 4.8%)

- Chinese Industrial Output YY (Dec) 6.2% vs. Exp. 5.4% (Prev. 5.4%)

- Chinese Retail Sales YY (Dec) 3.7% vs. Exp. 3.5% (Prev. 3.0%)

- Chinese Unemployment Rate Urban Area (Dec) 5.1% (Prev. 5.0%)

- Chinese China House Prices MM (Dec) 0.0% (Prev. -0.1%); YY -5.3% (Prev. -5.7%)