- US President Trump is said to be pushing senior advisers to go bigger on tariff policy as they prepare for ‘Liberation Day’ on April 2nd; reportedly revived the idea of a flat universal tariff single rate on most imports.

- APAC stocks were pressured heading into month- and quarter-end amid tariff concerns as Trump's April 2nd Liberation Day drew closer.

- US President Trump threatened to bomb Iran if a nuclear deal can't be reached, while he also warned of secondary tariffs on Russian oil.

- European equity futures indicate a lower cash market open with EuroStoxx 50 futures down 0.8% after the cash market closed with losses of 0.9% on Friday.

- DXY is a touch softer, JPY outperforms on a safe-haven bid, EUR/USD sits on a 1.08 handle and antipodeans marginally lag.

- Looking ahead, highlights include German Retail Sales, Italian CPI (prelim.), German CPI (prelim.), US Chicago PMI.

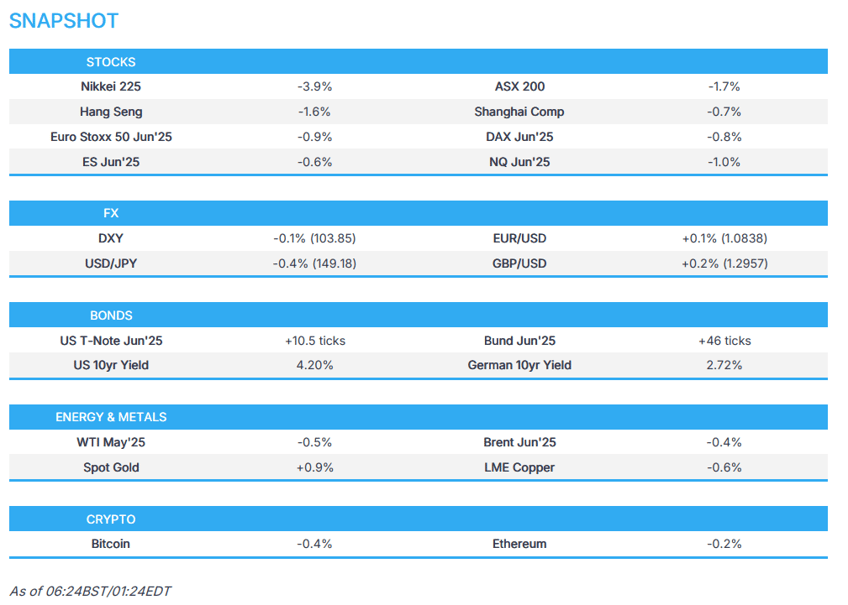

SNAPSHOT

Newsquawk in 3 steps:

Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks suffered amid the broad risk-off mood on Friday in which equity markets were hit across the board with underperformance in the Nasdaq and the vast majority of sectors were red as declines were led by steep losses seen in Communication, Consumer Discretionary and Technology. The selling pressure was likely influenced ahead of month and quarter-end, as well as the upcoming key risks including US President Trump's reciprocal tariffs on April 2nd "Liberation Day".

- SPX -1.96% at 5,581, NDX -2.61% at 19,281, DJI -1.69% at 41,584, RUT -2.05% at 2,024.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said he will hit essentially all countries that they're talking about with tariffs this week and commented that there will be a deal on TikTok before the deadline, according to Reuters.

- US President Trump is said to be pushing senior advisers to go bigger on tariff policy as they prepare for ‘Liberation Day’ on April 2nd and reportedly revived the idea of a flat universal tariff single rate on most imports, according to Washington Post. It was also noted that the option viewed as most likely, publicly outlined by Treasury Secretary Bessent this month, would set tariffs on products from the 15% of countries the administration deems the worst US trading partners which account for almost 90% of imports.

- US President Trump’s closest allies including Vice President Vance, Chief of Staff Wiles and cabinet officials have privately indicated they are unsure exactly what President Trump will do during the April 2nd announcement of global tariffs, according to Politico.

- US President Trump’s recent 25% auto tariff announcement made no mention of USMCA trade deal side letters shielding Canada and Mexico from potential auto tariffs which showed Canada and Mexico were each granted annual duty-free import quotas of 2.6mln cars and unlimited light trucks if Trump imposed global tariffs. Furthermore, Canada said it fully expects the US to honour the 2018 tariff pledges and it reserves the right to take retaliatory measures, while Mexico is evaluating the legal implications of the agreement on Trump’s ‘Section 232’ auto tariff probe.

- US President Trump’s Trade Adviser Navarro said auto tariffs will raise about USD 100bln and the other tariffs are to raise about USD 600bln a year, according to a Fox interview.

- UK PM Starmer spoke with US President Trump on Sunday evening in which they discussed productive negotiations between their respective teams on a UK-US economic prosperity deal and agreed that these will continue at pace this week. It was also reported that UK Home Secretary Cooper refused to rule out retaliating to US tariffs on cars and steel, according to Bloomberg.

- French Ministry of Foreign Trade said France and Europe will defend their businesses, consumers and values, while it added that US interference in the inclusion policies of French companies is unacceptable.

- German Chancellor Scholz said they stand by Canada’s side and that Canada is not a state that belongs to anyone else, while he added that Europe’s goal is cooperation but the EU will respond as one if the US leaves them with no choice such as with tariffs on steel and aluminium.

- Brazil’s President Lula said he will negotiate on tariffs before retaliating, according to Bloomberg. It was also reported that Brazil’s Finance Minister Haddad said the country is in a privileged position to withstand the trade war with the commodity exporter’s links to China, the US and the EU to shield it from protectionism, according to FT.

NOTABLE HEADLINES

- Fed's Daly (2027 voter) said on Friday that she is 100% focused on inflation and that progress has been flat, while she added that March PCE confirmed her own decreased confidence in her modal outlook.

- US President Trump is scheduled to sign executive orders at 13:00EDT/18:00BST and at 17:30EDT/22:30BST on Monday.

- US President Trump wouldn’t rule out seeking a third term and said there are ways to do it, according to NBC. However, it was later reported that President Trump commented that he does not want to talk about a third term now.

- White House reportedly plans to kill the funding in a new budget for a Boeing (BA)-built rocket designed for NASA to take astronauts to the moon and beyond, while terminating Boeing’s Space Launch System could reportedly free up billions of dollars which SpaceX officials said could be reallocated for NASA’s Mars efforts, according to WSJ.

- Some large cloud customers are reportedly slowing down their spending on AI services through cloud providers such as Microsoft (MSFT), Google (GOOG) and Amazon (AMZN) as prices of AI drop, according to The Information.

APAC TRADE

EQUITIES

- APAC stocks were pressured heading into month- and quarter-end amid tariff concerns as Trump's April 2nd Liberation Day drew closer, while geopolitical risks lingered after US President Trump voiced anger towards Russian President Putin for comments about Ukrainian President Zelensky and Trump also threatened to bomb Iran if a nuclear deal can't be reached.

- ASX 200 declined with all sectors in the red and underperformance in the mining, resources and materials sectors, while participants also await tomorrow's RBA rate decision where the central bank is widely expected to remain on hold and with the focus to turn to if there is any change to the cautious message regarding future rate cuts.

- Nikkei 225 suffered heavy losses and slipped beneath the 36,000 level amid the tariff concerns and with notable weakness seen in tech stocks, while the selling is also exacerbated heading into fiscal year-end and amid yen strength.

- Hang Seng and Shanghai Comp conformed to the downbeat risk tone after failing to sustain the early resilience seen in the mainland following encouraging Chinese PMI data and reports that China's Finance Ministry is to inject USD 69bln into four large Chinese banks, while there was also a slew of earnings releases including from most of the big 4 banks.

- US equity futures (ES -0.6%, NQ -1.1%) extended on Friday's declines amid trade war concerns and ahead of a risk-packed week.

- European equity futures indicate a lower cash market open with EuroStoxx 50 future down 0.8% after the cash market closed with losses of 0.9% on Friday.

FX

- DXY marginally softened with participants second-guessing what the April 2nd 'Liberation Day' tariffs will consist of as a recent report suggested that Trump is said to be pushing senior advisers to go bigger on tariff policy although it was also reported that Trump’s closest allies privately indicated they were unsure exactly what President Trump will do during April 2nd announcement. Furthermore, participants will get to digest a slew of data releases this week culminating with the latest Non-Farm Payrolls report on Friday.

- EUR/USD eked mild gains following Friday's intraday resurgence to back above the 1.0800 level but with further upside capped by the lack of bullish drivers for the single currency and with the EU bracing for Trump's reciprocal tariffs.

- GBP/USD remained afloat in relatively rangebound trade beneath the 1.3000 level with little reaction seen following UK PM Starmer's talk with US President Trump in which they discussed productive negotiations between their respective teams on a UK-US economic prosperity deal, while UK Home Secretary Cooper reportedly refused to rule out retaliating to US tariffs on cars and steel.

- USD/JPY retreated to beneath the 149.00 handle with the pair dragged lower by haven flows into the Japanese currency amid the bloodbath in Tokyo stocks.

- Antipodeans were rangebound alongside the downbeat sentiment and ahead of tomorrow's RBA announcement.

- PBoC set USD/CNY mid-point at 7.1782 vs exp. 7.2593 (Prev. 7.1752).

FIXED INCOME

- 10yr UST futures extended on Friday's advances owing to haven demand alongside the current stock market rout.

- Bund futures gapped above the 129.00 level amid the stock selling while participants now await German Retail Sales and CPI data.

- 10yr JGB futures followed suit to the advances in global counterparts amid the sell-off in Tokyo stocks and after mixed Japanese data releases, while prices also benefitted from stronger results at the latest 2-year JGB auction.

COMMODITIES

- Crude futures were lower amid the spooked sentiment across the region but with downside limited given geopolitical risks after recent reports that US President Trump threatened to bomb Iran if a nuclear deal can't be reached, while he also warned of secondary tariffs on Russian oil but later stated that he is not putting on oil sanctions right now.

- US is to revoke authorisations to foreign partners of Venezuela’s PDVSA that allowed them to export oil, according to sources cited by Reuters.

- Spot gold printed a fresh record high at the open and extended on gains to top USD 3,100/oz amid haven demand.

- Copper futures were subdued amid the risk-off tone for Asia but with the losses stemmed amid initial resilience in the red metal's largest purchaser after encouraging official Chinese PMI data.

CRYPTO

- Bitcoin retreated amid the risk-off mood and oscillated around the USD 82,000 level.

- Elon Musk commented that there are no plans for the government to use Dogecoin, according to Bloomberg.

- Japan’s Financial Services Agency plans to revise the Financial Instruments and Exchange Act to officially recognise crypto assets as financial products, according to Nikkei.

NOTABLE ASIA-PAC HEADLINES

- China’s Commerce Minister held talks on Friday with the visiting EU Trade and Economic Security Commissioner.

- China unveiled a plan to ramp up high-standard farmland development to ensure food security.

- China’s Finance Ministry will inject USD 69bln into four of the nation’s largest state banks via their share placements with the Finance Ministry to be the top investor in planned private placements by Bank of Communications, Bank of China, Postal Savings Bank of China Ltd. and China Construction Bank Corp. to raise up to a combined CNY 520bln or around USD 72bln through additional offerings of mainland-traded stocks, according to filings on Sunday. It was later reported that China will issue CNY 500bln in special treasury bonds this year to support bank capital replenishment, according to the Finance Ministry.

- PBoC said it punished two internet users who spread rate-cut rumours to gain attention and attract online followers, according to Bloomberg.

- Chinese state media said the CK Hutchison (1 HK) port deal does not conform to business logic and involves major national interests, while it added that selling the port is equal to handing a knife to the opponent and the Co. should carefully handle deals that may harm national interests.

- South Korean Finance Minister Choi said the government will submit a KRW 10tln supplementary budget to respond to wildfires and slumping growth.

- South Korean, Japanese and Chinese trade ministers agreed to strengthen cooperation on stabilising the supply chain and enhancing predictability in a trade environment, while they also agreed to closely cooperate on a trilateral free trade agreement and promote regional trade.

DATA RECAP

- Chinese NBS Manufacturing PMI (Mar) 50.5 vs. Exp. 50.5 (Prev. 50.2)

- Chinese NBS Non-Manufacturing PMI (Mar) 50.8 vs. Exp. 50.5 (Prev. 50.4)

- Chinese Composite PMI (Mar) 51.4 (Prev. 51.1)

- Japanese Industrial Production MM (Feb P) 2.5% vs. Exp. 2.3% (Prev. -1.1%)

- Japanese Retail Sales YY (Feb) 1.4% vs. Exp. 2.0% (Prev. 3.9%, Rev. 4.4%)

GEOPOLITICS

MIDDLE EAST

- IDF began ground activity in an area inside Rafah to expand the security zone in southern Gaza, while Israel reportedly sent a counter-proposal on the Gaza deal, according to Bloomberg.

- Hamas political chief Khalil Al-Hayya said Hamas agreed to a ceasefire proposal they received two days ago, while he stated that Hamas will not disarm as long as the Israeli occupation exists.

- US President Trump said US and Iranian officials are talking, while he threatened a “bombing” and secondary tariffs on Iran if Tehran does not make a deal on a nuclear program with the US, according to an NBC interview. It was separately reported that Iran said it rejected direct US talks in a reply to Trump’s letter, while Iranian sources cited by Tehran Times stated the Iranian army has built up missile bases and prepared them for launch after recent Trump threats, according to Asharq News

RUSSIA-UKRAINE

- US President Trump said he plans to speak with Russian President Putin this week and warned he will put 25%-50% secondary tariffs on all Russian oil if they are unable to make a deal on Ukraine. Trump also said he was very angry when Putin criticised Ukrainian Zelensky’s credibility and noted that Putin’s comments on Zelensky were not going in the right direction. Furthermore, Trump separately commented that Zelensky wants to back out of the critical minerals deal.

- Ukrainian President Zelensky said it is impossible to ignore nearly daily mass Russian drone attacks and Ukraine expects a strong response to these attacks from the US, Europe and others. Zelensky added that Ukraine is maintaining active measures on the front line and inside Russia to ensure no Russian troops can enter the Sumy and Kharkiv regions.

- Ukraine was reported on Sunday morning to have destroyed 65 out of 111 drones launched by Russia.

- There are reportedly serious preparations underway for Ukrainian President Zelensky to run for the presidency a second time and he is said to have tasked his team with organising a vote after a full ceasefire, aiming for summer 2025, according to The Economist. It was separately reported that Kyiv is to seek more US investments in talks over an economic deal.

- Russian Defence Ministry said Ukraine has continued attacks against Russian energy infrastructure in violation of the limited ceasefire agreement and attacked power grids in the Belgorod region leaving 9,000 residents without power. Russia’s Defence Ministry also said it has completed the liberation of the town of Zaporizhzhia in Ukraine’s Donetsk region, while it was also reported that Russian forces took control of Veselivka in Ukraine’s Sumy region.

- Moscow and Washington started talks on rare earth metals and projects in Russia, according to RIA citing Russian Sovereign Wealth Fund chief Dmitriev.

OTHER

- US Defence Secretary Hegseth said Japan is an indispensable partner in deterring China and the US will sustain a robust presence in the Indo-Pacific, while he added the US military needs expanded access to Japan’s southwest islands and has started upgrading its military command in Japan. Furthermore, Japan’s Defence Minister said they have agreed with the US to accelerate efforts to jointly air-to-air missiles and will look at the possibility of joint production of SM6 surface-to-air missiles.

- Chinese military said it conducted a routine patrol in the South China Sea on Friday, while it added the Philippines has frequently enlisted foreign countries to organise so-called joint patrols and created destabilising factors in the South China Sea.

- Greenland’s PM said that he wants to make it clear the US won’t get control of Greenland.

EU/UK

NOTABLE HEADLINES

- Dutch pension funds are set to invest EUR 100bln into risky assets boosting Europe’s defence efforts, according to FT citing APG Asset Management’s chief executive.

- US President Trump had an informal meeting with Finland’s President Stubb and said they look forward to strengthening the partnership between the US and Finland which includes the purchase and development of a large number of badly needed icebreakers for the US.

DATA RECAP

- UK Lloyds Business Barometer (Mar) 49 (Prev. 49)