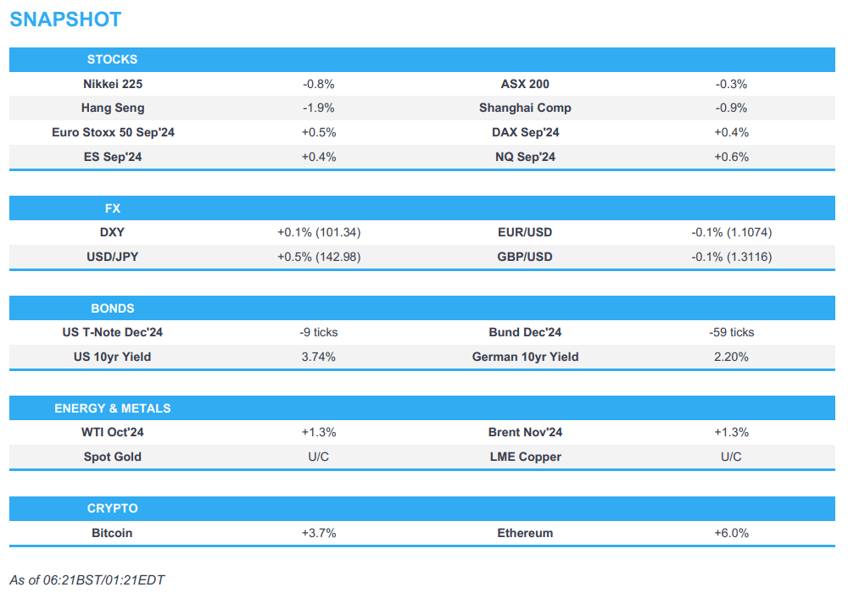

- APAC stocks suffered firm losses as the region took its opportunity to react to last Friday's disappointing US jobs data.

- Chinese data saw softer-than-expected CPI metrics and sharper PPI deflation.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.4% after the cash market closed lower by 1.6% on Friday.

- DXY is in positive territory with USD strongest vs. JPY and CHF across the majors, EUR/USD languishes beneath 1.11.

- Looking ahead, highlights include US Employment Trends, Wholesale Sales, NY Fed SCE, Apple iPhone Event.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks weakened on Friday and extended on last week's declines for the worst weekly performance in the S&P 500 and Nasdaq since 2023 and 2022, respectively, with the major indices weighed on by the souring of risk sentiment despite initial gains following the US jobs report which missed forecasts but ultimately failed to decisively guide towards a greater magnitude of the September FOMC rate cut.

- SPX -1.7% at 5,408, NDX -2.7% at 18,421, DJIA -1.0% at 40,345, RUT -1.9% at 2,091.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Goolsbee (2025 Voter) said on Friday that the employment data is a continuation of what they've been seeing and the jobs market is slowing down. Goolsbee also noted that it raises some serious questions about this meeting and the next several months, while he suggested they have to make sure not to make the labour market turn into something worse and he is concerned odds of a recession might be rising if they maintain this level of restrictiveness.

- A New York Times survey showed former President Trump ahead of VP Harris at 48% vs 47% among likely voters nationally which was the first major poll to show a drop in the support for Harris, while it lowered Harris’s lead in the overall average of polls to 2.5% and just 0.3% in the key swing state of Pennsylvania, according to the Telegraph.

- Former US President Trump threatened a 100% tariff for countries that turn away from the dollar, according to Bloomberg.

- US is to propose bank capital rule revisions as soon as this month, according to Bloomberg.

NOTABLE US EQUITY UPDATES

- Apple’s (AAPL) new iPhone will use Arm’s (ARM) next-gen chip technology for AI, according to FT.

- Boeing (BA) said it reached a tentative agreement with the International Association of Machinists and Aerospace Workers and district lodges for a 25% wage hike, according to Reuters.

APAC TRADE

EQUITIES

- APAC stocks suffered firm losses as the region took its opportunity to react to last Friday's disappointing US jobs data, while participants also braced for this week's key events including the latest US CPI report.

- ASX 200 declined with the index pressured by underperformance in gold stocks and the top-weighted financials sector.

- Nikkei 225 gapped beneath the 36,000 level with sentiment not helped by disappointing Japanese Q2 GDP revisions.

- Hang Seng and Shanghai Comp conformed to the negative mood with the former dragged lower by notable weakness seen in the energy-related stocks after recent oil price pressures, while the mainland also reflected on softer-than-expected CPI data and sharper PPI deflation.

- US equity futures (ES +0.4%) partially nursed recent losses but with price action contained ahead of this week's key events.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.4% after the cash market closed lower by 1.6% on Friday.

FX

- DXY was little changed after Friday's data-induced fluctuations with price action calm to start the week amid the Fed blackout period and with markets awaiting US CPI data scheduled for Wednesday.

- EUR/USD lacked direction and languished beneath the 1.1100 handle as participants also looked ahead to an expected ECB rate cut.

- GBP/USD traded rangebound after failing to sustain a brief incursion above 1.3200 late last week, while a monthly REC/KPMG report showed the UK labour market cooled noticeably in August as job placements declined sharply and pay growth slowed.

- USD/JPY rebounded from support around the 142.00 level following the downward revisions to Japanese Q2 GDP.

- Antipodeans attempted to nurse some of their recent losses but with the recovery limited after softer-than-expected Chinese CPI data and deeper deflation in Chinese factory gate prices.

FIXED INCOME

- 10yr UST futures traded subdued after the post-NFP price swings as the combination of a disappointing headline reading, a fall in the Unemployment Rate and firmer Average Earnings ultimately did little to boost the prospects of a greater cut for next week's FOMC meeting.

- Bund futures continued to pull back from last week's peak with little pertinent catalysts to start the week.

- 10yr JGB futures followed suit to the recent retreat in global peers in the absence of BoJ purchases and despite downward Q2 GDP revisions.

COMMODITIES

- Crude futures found some mild reprieve following the prior week's losses but with the rebound limited amid ongoing economic concerns.

- Iraq set October Basrah medium crude OSP to Asia at a discount of USD 0.50/bbl vs Oman/Dubai average, according to SOMO.

- Kuwait’s Emir accepted the resignation of Deputy PM and Oil Minister Al-Atiqi, while Kuwait’s Minister of Finance Al-Fassam was appointed as the acting Minister of Oil, according to Reuters.

- NHC said a system in the Gulf of Mexico is likely to strengthen from Tuesday, increasing the risk of a life-threatening storm surge and damaging winds along the upper Texas and Louisiana coasts by mid-week, according to Reuters.

- Goldman Sachs still expects three months of OPEC+ production increases but pushed out the start date to December from October, while it maintained its USD 70-85/bbl Brent forecast range and December forecast of USD 74/bbl. Furthermore, it still sees risk to its forecast range skewed to the downside given high spare capacity, risks to demand from weakness in China and potential trade tensions.

- Trafigura executive said in APPEC that soft China demand is worrying markets and OPEC is sending confused messages to the market, while the executive added that oil market sentiment is soft at the moment.

- Russian Energy Minister said Russian coal exports to China decreased by 8% Y/Y 45mln tons in the first half of 2024 and no sharp growth is expected although coal exports to China are expected to increase to at least 100mln tons starting in 2025, according to TASS.

- Spot gold lacked direction and lingered just beneath the USD 2,500/oz level for most of the session ahead of US CPI data mid-week.

- Copper futures were rangebound following last week's fluctuations and after disappointing US jobs data stoked concerns that the Fed may be behind the curve in lowering rates.

CRYPTO

- Bitcoin was choppy and eked mild gains after oscillating around through the USD 55,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC may have sold long-dated bonds and bought short-dated ones last week, signalling a warning that authorities aim to maintain a tight grip on the market, according to Shanghai Securities News.

- US Treasury Secretary Yellen said she would welcome a visit to the US by her Chinese counterpart and that she may return to China, while she added the US relationship with China needs to be prioritised and nurtured.

- Typhoon Yagi killed 21 people and wreaked havoc on infrastructure and factories in Vietnam.

DATA RECAP

- Chinese CPI YY (Aug) 0.6% vs. Exp. 0.7% (Prev. 0.5%)

- Chinese PPI YY (Aug) -1.8% vs. Exp. -1.4% (Prev. -0.8%)

- Chinese FX Reserves (USD)(Aug) 3.288T (Prev. 3.256T)

- Chinese Gold Reserves (Aug) 72.8mln ounces (Prev. 72.8mln ounces)

- Japanese GDP Revised QQ (Q2) 0.7% vs. Exp. 0.8% (Prev. 0.8%)

- Japanese GDP Revised Annualised (Q2) 2.9% vs. Exp. 3.2% (Prev. 3.1%)

GEOPOLITICS

MIDDLE EAST

- Israel conducted a strike which killed three Lebanese paramedics in the southern Lebanese town of Faroun, while Hezbollah launched a “squadron of missiles” targeting an Israeli military headquarters in response which resulted in casualties, according to Reuters.

- Lebanese media reported that the Israeli army targeted the town of Kafr Kila in southern Lebanon with surface-to-surface rockets and mortar shells, according to Sky News Arabia.

- Israeli army said three Israeli civilians were killed in a shooting attack on the Jordan border, while Israel closed its land border crossings with Jordan after the deadly attack at the Allenby Bridge crossing, according to Israel’s airport authority, according to Reuters.

- Syrian media reported explosions in the city of Tartous and that Israeli aircraft conducted shelling on the Damascus countryside.

- Yemen’s Houthis claimed they shot down a US MQ-9 drone conducting hostile acts over the Marib governorate’s airspace.

- UK MI6 spy agency head Moore said he suspects that Iran will try to get revenge for the death of Hamas leader Haniyeh, while Moore also commented that it is too early to say how long Ukraine can hang on in Kursk.

OTHER

- Iran officially denied reports that it supplied Russia with ballistic missiles to aid its war in Ukraine, although an Iranian MP admitted to a deal of sending ballistic missiles to Russian forces fighting in Ukraine in exchange for soybeans and wheat, according to The Telegraph. Furthermore, Ukraine expressed concern over reports of a possible Iranian missile transfer to Russia and called on the international community to increase pressure on Tehran and Moscow, according to Reuters.

- Russian forces took control of Novohrodivka in eastern Ukraine, according to RIA.

- Italian PM Meloni said what must not happen is to think that the Ukrainian conflict can be resolved by abandoning Ukraine to its fate and that the decision to support Ukraine is aligned with Italy’s national interest which will never change. Meloni added that the Western World’s decision to support Ukraine after Russia’s invasion led to the current stalemate which is the pre-condition for peace talks.

- CIA Director Burns said there was a genuine risk of the potential use of tactical nuclear weapons in the fall of 2022, while Burns added that he doesn’t see any evidence today that Russian President Putin’s grip on power is weakening, according to Reuters.

- North Korean Leader Kim Jong Un emphasised the importance of strengthening naval power, according to KCNA. Furthermore, North Korean media also reported that Chinese President Xi called for deeper strategic communication and cooperation with North Korea, while Russian President Putin said a comprehensive partnership between Russia and North Korea will be strengthened in a planned way.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer defended the decision to scrap winter fuel payments for 10mln pensioners to shore up public finances and said his government must be prepared to be unpopular, according to FT.

- UK labour market cooled noticeably in August as job placements declined sharply and pay growth slowed, according to a monthly survey by the Recruitment and Employment Confederation and KPMG cited by Reuters.

- Italy expects 2025 GDP growth of at least 1.2%, according to a Treasury junior minister cited by Reuters.

- European banks are on course for zero growth in mortgage lending for the first time in a decade this year due to high interest rates but a recovery is expected from next year, according to FT.