- US President Trump said he has April 2nd tariffs set. Separately, reports that copper tariffs could be implemented in weeks.

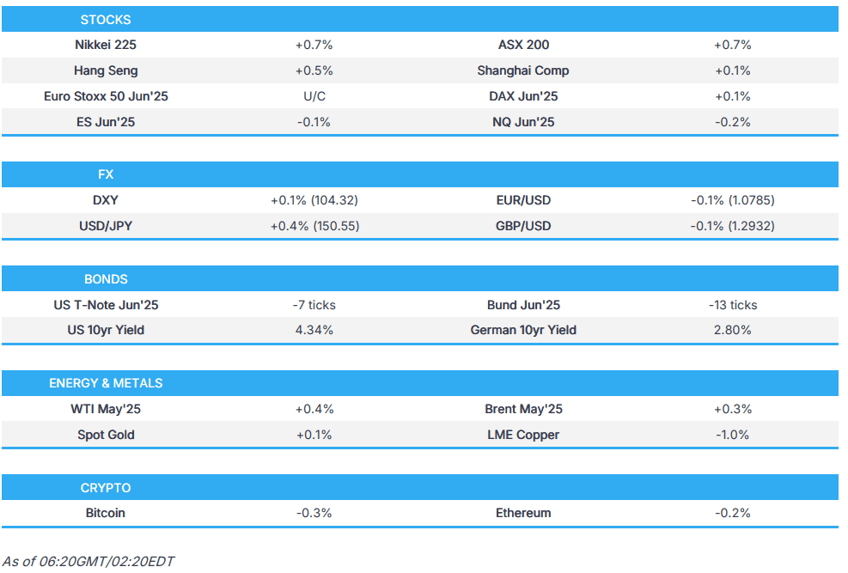

- US stocks were mixed, European futures point to a mildly positive open. APAC trade mostly firmer but capped.

- DXY posts marginal gains, EUR/USD sub-1.08, USD/JPY gradually rebounded while AUD briefly slipped on CPI.

- USTs continue to pull back from Tuesday's best, Bunds subdued but off post-Ifo lows.

- Crude mildly underpinned, copper jumped on the tariff reports but is off best, XAU range bound.

- Looking ahead, highlights include UK CPI, US Durable Goods, BoC & Riksbank Minutes, UK Spring Statement, Speakers including Fed’s Musalem, Kashkari & ECB’s Cipollone from Italy, Germany & US, Earnings from Porsche SE & Dollar Tree.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks traded mixed with outperformance in the Nasdaq 100 and the small-cap Russell 2000 was the laggard, while both SPX and DJIA were relatively flat with participants lacking firm conviction as incoming tariffs remain in the spotlight and as participants also digested several data releases including weaker-than-expected US Consumer Confidence and a disappointing Richmond Fed Index. On the geopolitical front, Russia and Ukraine have both agreed on a Black Sea ceasefire with the US and Russia to work together on measures banning strikes on energy infrastructure in Russia and Ukraine.

- SPX +0.16% at 5,777, NDX +0.53% at 20,288, DJI +0.01% at 42,588, RUT -0.66% at 2,095.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said he has April 2nd tariffs set and that he has been fair to countries that abused the US for many decades, while he added that tariffs will create more jobs. Trump also reiterated that he thinks Europeans have been freeloading and the EU has been absolutely terrible to the US on trade but noted Mexico and Canada have stepped it up a lot.

- US President Trump may implement copper tariffs within weeks, according to Bloomberg. It was separately reported that Trump may impose escalating tariff levels but Canada could be on the lower end, according to the Toronto Star citing sources.

- Mexico's Economy Minister Ebrard is to visit Washington for trade talks today.

- Chinese delegation will meet with the US Commerce Secretary and USTR on Wednesday to negotiate over tariffs, while the meeting will discuss tariffs, fentanyl and trade barriers among other issues, according to FBN's Lawrence citing a source.

NOTABLE HEADLINES

- Fed's Goolsbee (2025 voter) said it may take longer than anticipated for the next cut to come because of economic uncertainty and ‘wait and see’ is the correct approach when facing uncertainty, according to FT. Goolsbee also commented that market angst over inflation would be a red flag and believes borrowing costs will be a fair bit lower in 12–18 months, while he noted that if investor expectations begin to converge with those of American households, the Fed would need to act.

- US President Trump said another business announcement is coming on Wednesday.

- US President Trump reiterated he would like to see interest rates come down and said prices on gasoline, eggs and groceries are down, while it was separately reported that President Trump seeks a debt limit increase in the tax bill, according to Politico.

APAC TRADE

EQUITIES

- APAC stocks traded with a mostly positive bias after the somewhat mixed performance stateside where the focus centred on tariffs, data and geopolitics including reports that Ukraine and Russia agreed with the US on a maritime ceasefire.

- ASX 200 was led higher by gains in the mining, resources and financial sectors in the aftermath of the recent budget announcement, while participants also digested softer-than-expected monthly inflation from Australia.

- Nikkei 225 reclaimed the 38,000 level with upside supported by a weaker currency and after slightly softer Services PPI data.

- Hang Seng and Shanghai Comp eked slight gains but with upside capped amid ongoing tariff uncertainty with a Chinese delegation to meet with the US Commerce Secretary and the USTR today to negotiate over tariffs in which they will also discuss fentanyl and trade barriers among other issues, while a PBoC adviser warned at the Boao Forum that changes in the global environment will be challenging for China and China must boost domestic demand, especially consumption.

- US equity futures were rangebound following the prior day's mixed price action and small-cap underperformance.

- European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with gains of 1.1% on Tuesday.

FX

- DXY eked slight gains after rebounding yesterday from a brief dip beneath the 104.00 level despite weak US Consumer Confidence data, while President Trump reaffirmed he has April 2nd tariffs set and reiterated criticism against the EU regarding trade.

- EUR/USD languished beneath the 1.0800 level following recent indecision and oscillations through the aforementioned focal point in which the single currency ultimately faded an early boost from German Ifo data, while there were comments from ECB officials including Villeroy who noted there is still scope for further policy easing with the pace and extent up for debate.

- GBP/USD traded rangebound amid the quiet mood across the FX space and ahead of UK inflation and the Spring Statement.

- USD/JPY gradually rebounded from the prior day's trough and reclaimed the 150.00 handle with tailwinds amid the constructive risk tone and following the softer Services PPI data from Japan.

- Antipodeans kept afloat after recovering from an initial dip seen in reaction to the softer-than-expected Australian CPI.

- PBoC set USD/CNY mid-point at 7.1754 vs exp. 7.2559 (Prev. 7.1788).

FIXED INCOME

- 10yr UST futures continued its pullback from yesterday's peak after bull steepening on soft consumer data, while attention stateside turns to durable goods, Fed comments and looming supply.

- Bund futures lacked demand and retested the 128.00 level to the downside but were off the prior day's lows that were seen in the aftermath of the stronger-than-expected German Ifo data.

- 10yr JGB futures tracked the losses in peers and with prices also not helped by a slew of mixed comments from BoJ Governor Ueda who reiterated that the BoJ expects to keep raising interest rates if the economy and prices move in line with forecasts.

COMMODITIES

- Crude futures were mildly underpinned amid the positive risk tone and after the mostly bullish private sector inventory data which showed wider-than-expected drawdowns in headline crude and gasoline inventories.

- US Private Energy Inventories (bbls): Crude -4.6mln (exp -2.6mln), Distillate -1.3mln (exp. -2.2mln), Gasoline -3.3mln (exp. -2.2mln), Cushing -0.6mln.

- Oil loadings slow down at Venezuela's ports following US tariffs and wind down of Chevron's license, according to shipping data and a document cited by Reuters.

- Spot gold lacked direction with price action contained amid the absence of pertinent catalysts and lack of haven demand.

- Copper futures extended on yesterday's advances and briefly surged following reports that US President Trump may implement copper tariffs within weeks which saw prices rise by as much as 3% intraday before paring the majority of the gains.

CRYPTO

- Bitcoin traded indecisively and swung between gains and losses in a relatively rangebound fashion.

NOTABLE ASIA-PAC HEADLINES

- PBoC adviser said at the Boao Forum that changes in the global environment will be challenging for China and China must boost domestic demand, especially consumption, while it added that there is still very big macro policy space for supporting China's economy and reform measures alongside recent policy steps are needed to support consumption.

- BoJ Governor Ueda said cost-push factors are likely to gradually dissipate but also noted that underlying inflation is likely to gradually converge towards the 2% target even when the temporary boost from food inflation disappears. Ueda said the BoJ will make a judgment call by looking at various indicators to determine whether underlying inflation has hit the target and underlying inflation is close to but has yet to move into the narrow band defined as sufficient achievement of the 2% price target. Furthermore, Ueda said the BoJ remains vigilant to the possibility that underlying inflation may accelerate faster than projected and expects to keep raising interest rates if the economy and prices move in line with forecasts in the quarterly outlook report but later commented that if price risks overshoot expectations, they will take stronger steps to adjust the degree of monetary support.

DATA RECAP

- Japanese Services PPI (Feb) 3.00% (Prev. 3.10%)

- Australian Weighted CPI YY (Feb) 2.4% vs. Exp. 2.5% (Prev. 2.5%)

- Australian CPI Annual Trimmed Mean YY (Feb) 2.70% (Prev. 2.80%)

GEOPOLITICS

MIDDLE EAST

- Two Israeli raids were reported on the northeastern areas of Gaza City, according to Al Jazeera.

- Houthi military spokesman said they targeted Israeli military sites in the Jaffa area with a number of drones and targeted US aircraft carrier Harry Truman.

RUSSIA-UKRAINE

- US President Trump said they've made a lot of progress on Ukraine and are in deep discussions with Russia/Ukraine, while he added it is going well and that Russia and Ukraine will get together on a maritime ceasefire. Trump also said that other countries are involved in the process of monitoring the ceasefire and he will look into Russian requests for sanctions relief. Trump separately commented that he thinks Russia wants to see an end to the war but could be dragging its feet.

- Ukrainian President Zelensky said Russia has already started to engage in manipulation, even today, and the Kremlin is lying when it said the Black Sea ceasefire depends on sanctions. Zelensky added Ukraine will do everything to make agreements work and Russians must understand that if they launch strikes, there will be a strong response.

- Ukraine's Defence Minister Umerov said Ukraine and US talks in Riyadh were successful and that Ukraine is ready for a new meeting to work out truce details.

- Russia’s Kremlin published a list of Russian and Ukrainian facilities subject to a temporary moratorium on strikes on energy systems, while the list includes oil refineries, oil and gas pipelines, and nuclear plants. Kremlin stated the temporary moratorium is valid for 30 days beginning March 18th which may be extended by mutual agreement and in the event of breach by one party, the other party may consider itself free from obligation to comply with it.

- Russia's Foreign Minister Lavrov said the Black Sea deal is aimed at Russia making legitimate profit in fair competition and ensuring food safety in Africa and elsewhere. Lavrov also commented that Russia and the US are discussing other things than Ukraine in their talks, according to TASS.

- Russia said the Zaporizhzhia nuclear plant is a Russian nuclear facility and that transferring control over it to Ukraine or any other country is impossible, according to TASS citing the Foreign Minister.

- Russian drone attacks caused major destruction in the central Ukrainian city of Kryvyi Rih, according to the local military administration. It was also reported that emergency power cuts were implemented in Ukraine's Mykolaiv port following reported drone attacks, according to the mayor.

OTHER

- US Secretary of Defense Hegseth said they will work with allies to deter Communist China in the Indo-Pacific region, while he added they are rebuilding armed forces by developing the military manufacturing sector and will enhance the capabilities of allies as well. Hegseth also stated their mission is to stop wars, but if they occur, they will work to destroy their enemies, according to Al Jazeera

- US Secretary of State Rubio will meet with heads of state from Barbados, Trinidad and Tobago, and Haiti during his visit to Jamaica, while it was stated that shipping lanes through Jamaica are key to security and the US wants to ensure Guyana has the necessary security amid its territorial dispute with Venezuela. Furthermore, it was stated that Guyana and Suriname surpassing Venezuela’s oil production is seen as a huge opportunity and a top priority, while Guyana oil developments will be a major topic of discussion.

EU/UK

NOTABLE HEADLINES

- ECB's Villeroy said there is still scope for further policy easing with the pace and extent up for debate and market bets on a 2% deposit rate by the end of summer is a possible scenario. Villeroy added that fresh budget spending on defence and infrastructure are not necessarily inflationary and the disinflation trend in Europe is solid.