- APAC stocks traded higher following the positive handover from Wall St where tech clawed back some of the DeepSeek-related losses.

- European equity futures indicate a positive open with Euro Stoxx 50 future up 0.8% after the cash market closed with gains of 0.1% on Tuesday; boosted by pre-market earnings from ASML.

- DXY is a touch lower, JPY, EUR and GBP are all marginally firmer vs. the USD, AUD lags post-CPI.

- Microsoft (MSFT) is probing if a DeepSeek-linked group improperly obtained OpenAI data, according to FT.

- Looking ahead, highlights include Spanish GDP (Q4), US Advance Goods Trade Balance, NZ Trade Balance, Fed, BoC, Riksbank & BCB Policy Announcements, Fed Chair Powell, BoC’s Macklem & Rogers, Riksbank’s Thedeen, BoE Governor Bailey, Supply from UK & Germany, Earnings from ASML, Volvo AB, Santander, Tesla, Meta, Microsoft, IBM, T-Mobile, Danaher, General Dynamics & VF Corp.

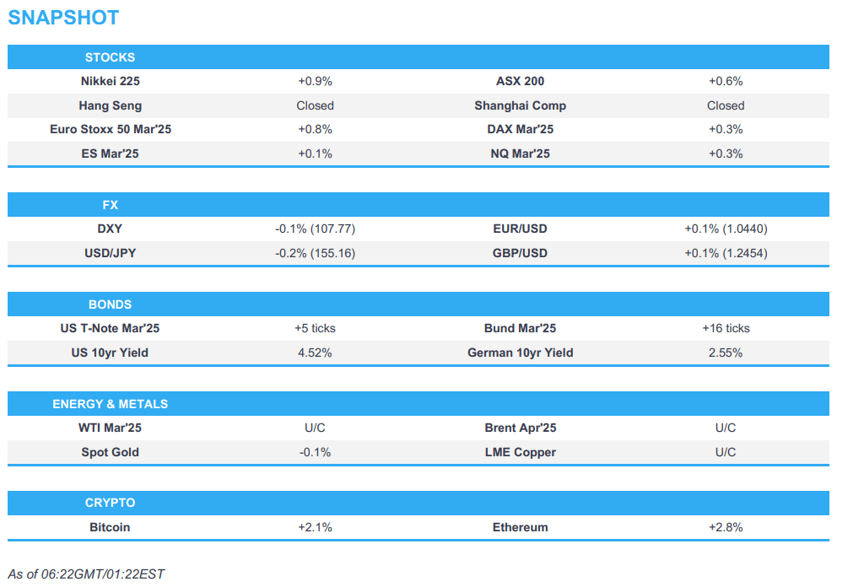

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks reversed some of the DeepSeek downside and equity futures were bid throughout the majority of the session with upside in tech as Nvidia (NVDA) regained some of Monday's historic losses although still has some ground to cover to completely retrace the move. Elsewhere, T-notes settled in red but were very choppy in response to risk sentiment, tariff commentary and auctions, while the dollar caught a bid on Trump's recent tariff remarks.

- SPX +0.92% at 6,067, NDX +1.59% at 21,463, DJIA +0.31% at 44,850, RUT +0.04% at 2,284.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US DOGE said it is saving the federal government about USD 1bln per day but added that the federal government savings needs to increase to over USD 3bln per day.

- US judge temporarily paused the Trump administration's freeze of federal loans and grants with a pause to Trump's halt on funding of open programs to last until February 3rd, while it was also reported that a state attorney general group sued the Trump administration after earlier saying it would challenge the federal funding pause.

- White House said the February 1st date for tariffs on Canada and Mexico still holds, while there is no specific date for tariffs on steel and copper.

- Mexico and Canada launched a flurry of border measures to appease US President Trump in which the tariff threat spurs Mexico to fill in the smuggling tunnel and Canada to deploy helicopters and drones, according to FT.

- White House is looking at national security implications of DeepSeek and the US Navy issued a warning to its members to avoid using DeepSeek in any capacity, due to potential security and ethical concerns, according to CNBC.

- OpenAI said Chinese companies are 'constantly' trying to distil US AI models, while it engages in 'countermeasures' to protect its intellectual property and will work with the US government to protect US technology. It was separately reported that Microsoft (MSFT) is probing if a DeepSeek-linked group improperly obtained OpenAI data, while OpenAI said it has found evidence that Chinese artificial intelligence start-up DeepSeek used the US company’s proprietary models to train its own open-source competitor, according to FT.

APAC TRADE

EQUITIES

- APAC stocks traded higher following the positive handover from Wall St where tech clawed back some of the DeepSeek-related losses, although the conditions were quiet in Asia amid mass closures for the Chinese New Year.

- ASX 200 was led higher by outperformance in tech and utilities, while softer-than-expected Australian CPI data for Q4 also spurred increased rate cut bets for the RBA's meeting in February (cut now priced at around 76% vs. 64% pre-release).

- Nikkei 225 took impetus from US counterparts but with gains capped amid few fresh drivers and after outdated BoJ minutes.

- US equity futures (ES +0.1%, NQ +0.3%) took a breather following yesterday's tech-led recovery and with participants lacking conviction ahead of the FOMC and upcoming big tech earnings releases.

- European equity futures indicate a positive open with Euro Stoxx 50 future up 0.8% after the cash market closed with gains of 0.1% on Tuesday; boosted by pre-market earnings from ASML.

FX

- DXY is marginally softer after gaining yesterday on recent tariff rhetoric, while the latest data releases were mixed and garnered little reaction with participants now looking ahead to the FOMC.

- EUR/USD traded sideways at the weaker half of the 1.0400 handle with very few catalysts to spur the single currency.

- GBP/USD lacked direction amid a fairly sparse data calendar for the UK this week although BoE's Bailey is to speak later.

- USD/JPY was indecisive as the BoJ Minutes from the December meeting did little to shift the dial given that there was a more recent meeting last week where the central bank delivered a widely expected 25bps rate hike.

- Antipodeans were briefly pressured after Australian CPI data in which all figures for Q4 printed softer-than-expected and resulted in increased bets for a cut at the next RBA meeting, while Westpac also brought forward its RBA rate cut call to February from May.

FIXED INCOME

- 10yr UST futures edged higher in the aftermath of a well-received 7yr auction but with gains capped as the FOMC looms.

- Bund futures rebounded from this week's trough although remains below the 132.00 level with Bund supply scheduled later.

- 10yr JGB futures traded indecisively amid a lack of catalysts and with little reaction seen from the outdated BoJ minutes from the December meeting and Japan's 5yr climate bond auction.

COMMODITIES

- Crude futures remained indecisive following the recent choppy performance and mixed private sector inventory data.

- Private inventory data expectations (bbls): Crude +2.9mln (exp. +3.2mln), Distillate -3.8mln (exp. -2.3mln), Gasoline +1.9mln (exp. +1.3mln) Cushing -0.1mln.

- Spot gold loitered around yesterday's peak but with further upside capped as participants await the FOMC.

- Copper futures were mildly pressured with demand subdued amid the mass holiday closures for the Chinese New Year.

CRYPTO

- Bitcoin gradually gained overnight with prices back above the USD 102k level.

- Head of the Czech Central Bank wants it to buy billions of Euros in Bitcoin and said if approved, the Czech Central Bank could eventually hold as much as 5% of its EUR 140bln reserves in Bitcoin, according to FT.

NOTABLE ASIA-PAC HEADLINES

- BoJ December meeting minutes stated members agreed inflation expectations are heightening moderately and agreed the BoJ should raise the interest rate if the economy and prices move in line with forecasts. Many members said the economy and prices are moving in line with forecasts and agreed the BoJ must decide the timing for raising rates by looking carefully at various data and information. Furthermore, members also agreed they wanted a bit more data on wage momentum and saw uncertainty over the next US administration's economic policies.

- US State Department spokesperson said part of Secretary of State Rubio's trip to Central America is about countering China, according to Fox Business.

DATA RECAP

- Australian CPI QQ (Q4) 0.2% vs. Exp. 0.3% (Prev. 0.2%)

- Australian CPI YY (Q4) 2.4% vs. Exp. 2.5% (Prev. 2.8%)

- Australian Weighted CPI YY (Dec) 2.50% vs. Exp. 2.50% (Prev. 2.30%)

- Australian RBA Trimmed Mean CPI QQ (Q4) 0.5% vs. Exp. 0.6% (Prev. 0.8%)

GEOPOLITICS

MIDDLE EAST

- US Secretary of State Rubio reiterated in a call with the Egyptian Foreign Minister the importance of close cooperation to advance post-conflict planning to ensure Hamas can never govern Gaza or threaten Israel again.

- US President Trump's Middle East envoy Steve Witkoff met with a senior adviser to Palestinian president Mahmoud Abbas in Riyadh, according to Axios.

- Russia and Syria are to hold further talks on Russian military bases in Syria, while there are no changes so far to the presence of Russian military bases in Syria, according to Russia's Deputy Foreign Minister cited by TASS.

RUSSIA-UKRAINE

- Russian President Putin said they will allocate appropriate people if Ukraine wants to negotiate with Russia and there is a legal way to do it if Ukraine wants to negotiate, but he does not see any desire to negotiate.

- Ukrainian President Zelensky said Russian President Putin shows he is afraid of negotiations and strong leaders, and his actions are aimed at making the war endless. Zelensky also commented that Ukraine needs broader guarantees and that Russian President Putin is not afraid of Europe, while he added that Ukraine cannot recognise the Russian occupation.

- Ukrainian drone attack at an industrial facility in Russia's Nizhny Novgorod region sparked a fire at an oil refinery, according to Russian Telegram news outlets.

- Russia's Smolensk regional Governor said Russian air defence systems destroyed a Ukrainian drone attempting to attack a nuclear power facility in the Smolensk region, while it was later reported that the Smolensk nuclear power plant is operating in normal mode after a drone attack on the region, according to RIA.

- EU's Kallas spoke with US Secretary of State Rubio to discuss shared foreign policy priorities and they agreed on the necessity of maintaining maximum pressure on Moscow to move towards a just and sustainable peace in Ukraine. Kallas also emphasised Europe's increasing investment in defence and readiness to take on greater responsibility, alongside the importance of diversifying energy supplies.

- EU is proposing new Russian sanctions including an aluminium ban that would phase in over one year, while it also proposes new measures against Russian banks and dark fleet tankers, according to Bloomberg.

- US is reportedly sending dozens of patriot missiles from Israel to Ukraine, according to Axios.

OTHER

- North Korean leader Kim inspected a nuclear material production base and called for bolstering nuclear forces this year, as well as boosting production of weapons-grade nuclear materials, according to KCNA. It was separately reported that an NSC spokesperson said US President Trump is to pursue a complete denuclearisation of North Korea, according to Yonhap.