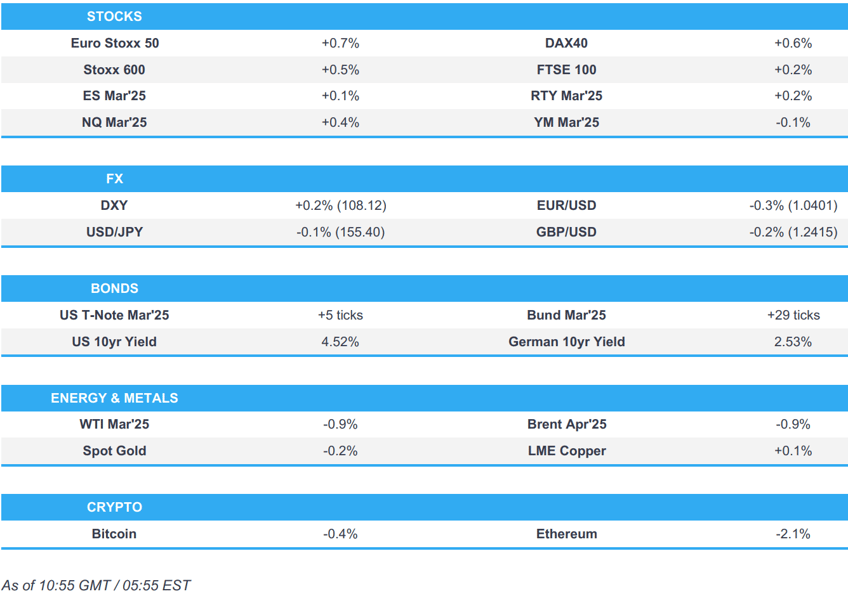

- European bourses mostly firmer, with Tech surging after blockbuster ASML bookings; NQ slightly outperforms.

- USD is a little firmer ahead of the FOMC, CAD awaits BoC, AUD softer post-CPI.

- Bonds are bid into the FOMC. BTPs & OATs attentive to domestic matters.

- Crude slides and metals trade mixed ahead of FOMC.

- Looking ahead, US Advance Goods Trade Balance, NZ Trade Balance, Fed, BoC, & BCB Policy Announcements Speakers including Fed Chair Powell, BoC’s Macklem & Rogers, BoE Governor Bailey, Earnings from Tesla, Meta, Microsoft, IBM, ServiceNow, T-Mobile, Danaher, General Dynamics & VF Corp.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 +0.5%) began the European session mostly firmer and traded rangebound, at elevated levels throughout the morning. The CAC 40 -0.1% is the clear underperformer in Europe today, with the index weighed on by post-earning losses in LVMH (-5%); the AEX is the day’s outperformer, with sentiment in the Tech sector lifted following blockbuster results in ASML (+8.7%).

- European sectors hold a slight positive bias. Tech is by far and away the clear outperformer in today’s session, lifted by post-earning strength in ASML (+11%). The Co. reported strong rev. for Q4, and its Bookings were exceptionally strong; it came in well above expectations at EUR 7.09bln (exp. 3.53bln). It also raised its Q1 net sales guidance above consensus. Consumer Products is underperforming today, weighed on by losses in LVMH (-6%). The Co. beat on its FY Revenue figure, though its Net Profit fell short of expectations. The Q4 figures were a little more positive, which generally topped expectations.

- US equity futures are modestly firmer, but with slight outperformance in the tech-heavy NQ +0.4%, which is taking impetus from the significant strength in the European tech sector, following strong results from ASML.

- Norwegian Sovereign Wealth fund CEO says "the good returns may not continue". Not made any major changed after Monday's tech fall, have a small underweight in tech stocks. Do not have a strong view on share price of NVIDIA. Have no plans to pull out of Tesla (TSLA)

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

EARNINGS SUMMARY

- ASML (ASML NA) +8.7%, Earnings Call at 14:00GMT/09:00EST: Q4 metrics beat, Bookings stood out at EUR 7.09bln (exp. 3.53bln). Q1 Guidance: Net Sales between 7.5-8.0bln (exp. 7.25bln), Gross Margin between 52-53% (exp. 51.2%). CEO: Revenue "was primarily driven by additional upgrades. We also recognized revenue on two High NA EUV systems." & "Consistent with our view from the last quarter, the growth in artificial intelligence is the key driver for growth in our industry". CEO/CFO: still very bullish; seeing increased demand for advanced technology in logic and DRAM markets, continues to invest in advanced EUV and mainstream DUV technologies. Click for more commentary.. ASML (ASML NA) on DeepSeek, says anything that drives cost down is good news for ASML; AI cost reduction will lead to increased use and higher volumes

- Akzo Nobel (AKZA NA) -4.9%: Q4 metrics mixed, FY24 slight beat. FY25 guidance slightly short. Co. does not expect a significant market rebound in 2025.

- Remy Cointreau (RCO FP) -5.8%: Q3 & 9-month sales beat. FY guidance confirmed at lower-end of range.

- Logitech (LOGN SW) +6.2%: Q3 metrics beat. FY25 guidance lifted. Gaming sales near COVID peaks. Notable progress in China.

- Volvo (VOLVB SS) +6.9%: Q4 mixed. Cuts China truck market outlook, but notes that North America is gradually improving.

- Fresnillo (FRES LN) Production Report, Q4: Another solid year of production, with gold production ahead of guidance, whilst "Lead and zinc production were also up strongly over the year again".

FX

- DXY is marginally higher with the USD stronger vs. most peers (ex-JPY). Today is of course Fed day which is set to see the FOMC pause its rate cutting cycle. As it stands, markets currently price around 50bps of loosening by year-end. Elsewhere, markets remain alive to the risk of potential tariff announcements by the Trump admin. DXY is currently oscillating around the 108 mark and briefly matched the top end of Tuesday's 107.68-108.05 range.

- EUR is now softer vs. the USD after a bout of selling pressure early doors alongside a disappointing outturn for German GfK Consumer Sentiment. Greater focus lies on tomorrow's ECB policy announcement and the looming threat of tariffs from the Trump administration. As it stands, the odds of a 25bps cut in March are at around 80% with a total of 90bps of loosening seen by year-end. EUR/USD briefly slipped below Tuesday's and the 24th Jan lows at 1.0414.

- JPY is slightly firmer vs. the USD. BoJ Minutes from the December meeting did little to shift the dial given that there was a more recent meeting last week where the central bank delivered a widely expected 25bps rate hike. Furthermore, JPY was unreactive to news that Japanese Finance Minister Kato held a videoconference with new US Treasury Secretary Bessent in which they confirmed close cooperation on FX. USD/JPY is currently within Tuesday's 154.45-155.97 range and holding above its 50DMA at 154.86.

- GBP is a touch softer vs. the USD but mildly firmer vs. the EUR with fresh macro drivers for the UK on the light side. On today's docket, BoE Governor Bailey is to attend the TSC hearing on the November Financial Stability Report at 14:15GMT. Cable currently sits towards the lower end of yesterday's 1.2415-98 range. Chancellor Reeves in her "Kickstart Economic Growth" press conference, said "the government has begun to turn things around". She set forth a few additional investments, but steered clear of any major announcements; as such, the Pound was little changed.

- Antipodeans are both on the backfoot vs. the USD for a third consecutive session. AUD was hampered overnight by soft Australian CPI metrics in which all figures for Q4 printed softer-than-expected and resulted in increased bets for a cut at the next RBA meeting (cut now priced at around 76% vs. 64% pre-release).

- SEK was trivially softer against the EUR post-Riksbank, where a 25bps cut was delivered as expected. The accompanying statement noted that "the forecast for the policy rate made in December essentially holds, but the Executive Board is prepared to act if the outlook for inflation and economic activity changes". Since, the Governor has said it looks like they are at the bottom in rates but the outlook is uncertain, a remark which has lifted the SEK.

- CAD marginally softer vs. the USD in the run up to today's BoC rate decision which is set to see policymakers pull the trigger on another 25bps rate reduction, bringing the total quantum of cuts to 200bps for the current cycle.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are firmer into the FOMC. Derived support from a strong 7yr Note auction on Tuesday, an outing which followed mixed results across Monday’s lines. As it stands, USTs are at a 109-09 peak which is just below Monday’s 109-12 best. If the move continues then there is a bit of a gap until the 110-00 mark and then the 110-03+ peak from mid-December.

- Bunds are moving in tandem with USTs and as such find themselves at a 131.81 peak, stopping shy of the figure and then Monday’s 132.14 best. A 2035 auction garnered decent demand, which sparked some very modest upside.

- OATs are firmer, but modestly underperforming core peers. Underperformance which is on account of increasing attention on tensions between the French PM and the Socialist party. Tensions which stemmed from the PM’s remarks around immigration at the start of the week. In response, Socialist member Brun said they have suspended negotiations with the PM on the budget.

- Gilts are directionally in-fitting with the above; the Green Gilt outing was a little weaker than the prior, but b/c remained above 3x. Into the Chancellor Reeves "Kickstart Economic Growth" press conference, Gilts traded near highs at 92.47. The presser, thus far has been as expected, and as such has spurred little move in Gilts; UK paper has continued its upward bias to a current 92.54 peak.

- UK DMO announces new March 2035 Gilt syndication; transaction planned to take place in the week beginning 10th Feb, subject to demand and market condition.

- UK sells GBP 0.875% 2033 Green Gilt: b/c 3.1x (prev. 3.55x), avg. yield 4.473% (prev. 3.731%) & tail 0.7bp (prev. 0.9bp).

- Germany sells EUR 3.439bln vs exp. EUR 4.5bln 2.50% 2035 Bund: b/c 2.8x (prev. 2.12x), average yield 2.54% (prev. 2.51%) & retention 23.58% (prev. 24.4%)

- Click for a detailed summary

COMMODITIES

- Softer trade across the crude oil complex amid a firmer dollar and following a choppy session yesterday. Desks suggest the overall weakness in the oil market seen over the past few sessions likely emanate from US prepares to impose tariffs on imports from Canada, Mexico and China from Saturday, with the WTI discount to Brent also narrowing as higher tariffs could tighten US supply. Brent near the lower end of a USD 75.69-76.65/bbl parameter.

- Mixed/flat trade across precious metals in the run-up to the FOMC policy announcement and Fed Chair Powell's press conference later today. Spot gold resides in a narrow USD 2,757.46-2,766.26/oz range.

- Mixed trade across base metals with upside hampered by the firmer dollar and cautious sentiment amid Trump's ongoing tariff threats, as also cited by several desks. 3M LME copper dipped under USD 9,000/t and resides in a USD 8,961.00-9,023.23/t range at the time of writing.

- Private inventory data (bbls): Crude +2.9mln (exp. +3.2mln), Distillate -3.8mln (exp. -2.3mln), Gasoline +1.9mln (exp. +1.3mln) Cushing -0.1mln

- Peruvian Economy Minister says the country has to open more copper mines to take advantage of growth; Anglo American (AAL LN) committed to resolving water issues in northern city before moving ahead with USD 2bln copper-gold project.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Money-M3 Annual Growth (Dec) 3.5% vs. Exp. 3.8% (Prev. 3.8%); Loans to Non-Fin (Dec) 1.5% (Prev. 1.0%); Loans to Households (Dec) 1.1% (Prev. 0.9%)

- Italian Consumer Confidence (Jan) 98.2 vs. Exp. 96.0 (Prev. 96.3); Manufacturing Business Confidence (Jan) 86.8 vs. Exp. 85.5 (Prev. 85.8, Rev. 85.9)

- Swiss Investor Sentiment (Jan) 17.7 (Prev. -20.0)

NOTABLE EUROPEAN HEADLINES

- Swedish Riksbank Rate 2.25% vs. Exp. 2.25% (Prev. 2.5%); forecast for the policy rate made in December essentially holds, but the Executive Board is prepared to act if the outlook for inflation and economic activity changes. Click for details

- Riksbank Governor Thedeen says best judgement is that rates have reached the bottom, but the outlook is genuinely uncertain.

- German equipment investment seen growing 1.1% in 2025, according to annual government economic report cited by Reuters. Expects exports to decline by 0.3% in 2025. Expects imports to grow by 1.9% in 2025.

- UK Chancellor Reeves says the government has begun to turn things around. Solution is for the government to systematically remove barriers. Will work with the US to deepen the UK's economic relationship in the months and years ahead. Will prioritise proposals with the EU that are consistent with Labour's manifesto. Business and Trade minister to travel to India to resume talks on a trade deal. Click for details.

NOTABLE US HEADLINES

- US DOGE said it is saving the federal government about USD 1bln per day but added that the federal government savings needs to increase to over USD 3bln per day.

- US judge temporarily paused the Trump administration's freeze of federal loans and grants with a pause to Trump's halt on funding of open programs to last until February 3rd, while it was also reported that a state attorney general group sued the Trump administration after earlier saying it would challenge the federal funding pause.

- OpenAI said Chinese companies are 'constantly' trying to distil US AI models, while it engages in 'countermeasures' to protect its intellectual property and will work with the US government to protect US technology. It was separately reported that Microsoft (MSFT) is probing if a DeepSeek-linked group improperly obtained OpenAI data, while OpenAI said it has found evidence that Chinese artificial intelligence start-up DeepSeek used the US company’s proprietary models to train its own open-source competitor, according to FT.

GEOPOLITICS

MIDDLE EAST

- "Israeli army: monitoring a march that penetrated the airspace from Egyptian territory in an attempt to smuggle weapons", according to Sky News Arabia.

- "Iranian Foreign Minister Abbas Araqchi: We have not received any message from Trump regarding the negotiations", according to Sky News Arabia.

- US Secretary of State Rubio reiterated in a call with the Egyptian Foreign Minister the importance of close cooperation to advance post-conflict planning to ensure Hamas can never govern Gaza or threaten Israel again.

- Russia and Syria are to hold further talks on Russian military bases in Syria, while there are no changes so far to the presence of Russian military bases in Syria, according to Russia's Deputy Foreign Minister cited by TASS.

RUSSIA-UKRAINE

- Ukrainian President Zelensky commented that Ukraine needs broader guarantees and that Russian President Putin is not afraid of Europe, while he added that Ukraine cannot recognise the Russian occupation.

- Ukrainian drone attack at an industrial facility in Russia's Nizhny Novgorod region sparked a fire at an oil refinery, according to Russian Telegram news outlets.

- Russia's Smolensk regional Governor said Russian air defence systems destroyed a Ukrainian drone attempting to attack a nuclear power facility in the Smolensk region, while it was later reported that the Smolensk nuclear power plant is operating in normal mode after a drone attack on the region, according to RIA.

- EU is proposing new Russian sanctions including an aluminium ban that would phase in over one year, while it also proposes new measures against Russian banks and dark fleet tankers, according to Bloomberg.

OTHER

- North Korean leader Kim inspected a nuclear material production base and called for bolstering nuclear forces this year, as well as boosting production of weapons-grade nuclear materials, according to KCNA. It was separately reported that an NSC spokesperson said US President Trump is to pursue a complete denuclearisation of North Korea, according to Yonhap.

- Estonia's Defence Minister says Shipping firms may need to pay a fee to use Baltic Sea to cover cost of protecting undersea cables.

CRYPTO

- Bitcoin is slightly lower today, trading around USD 102.5k.

- Head of the Czech Central Bank wants it to buy billions of Euros in Bitcoin and said if approved, the Czech Central Bank could eventually hold as much as 5% of its EUR 140bln reserves in Bitcoin, according to FT.

- CNB Governor Michl on X says, an asset under consideration for reserves is Bitcoin; currently has zero correlation with Bonds and is an interesting asset for a large portfolio; Only at the stage of analysis and discussion; no decision is imminent.

APAC TRADE

- APAC stocks traded higher following the positive handover from Wall St where tech clawed back some of the DeepSeek-related losses, although the conditions were quiet in Asia amid mass closures for the Chinese New Year.

- ASX 200 was led higher by outperformance in tech and utilities, while softer-than-expected Australian CPI data for Q4 also spurred increased rate cut bets for the RBA's meeting in February (cut now priced at around 76% vs. 64% pre-release).

- Nikkei 225 took impetus from US counterparts but with gains capped amid few fresh drivers and after outdated BoJ minutes.

NOTABLE ASIA-PAC HEADLINES

- BoJ December meeting minutes stated members agreed inflation expectations are heightening moderately and agreed the BoJ should raise the interest rate if the economy and prices move in line with forecasts. Many members said the economy and prices are moving in line with forecasts and agreed the BoJ must decide the timing for raising rates by looking carefully at various data and information. Furthermore, members also agreed they wanted a bit more data on wage momentum and saw uncertainty over the next US administration's economic policies.

- US State Department spokesperson said part of Secretary of State Rubio's trip to Central America is about countering China, according to Fox Business.

DATA RECAP

- Australian CPI QQ (Q4) 0.2% vs. Exp. 0.3% (Prev. 0.2%); YY (Q4) 2.4% vs. Exp. 2.5% (Prev. 2.8%)

- Australian RBA Trimmed Mean CPI QQ (Q4) 0.5% vs. Exp. 0.6% (Prev. 0.8%)

- Australian Weighted CPI YY (Dec) 2.50% vs. Exp. 2.50% (Prev. 2.30%)