By John Kingston of FreightWaves

With the closure of the Port of Baltimore for the foreseeable future, the question of which truck drivers are most affected inevitably focuses first on drayage.

But Baltimore is not a major intermodal port, with estimates that its share of U.S. intermodal traffic is in the low single digits.

What the Port of Baltimore is, however, is a huge gateway for automobile imports and, to a lesser extent, car exports. And that fact is likely to shake up the niche truck segment of auto haulers.

Guy Young is the general manager of the Auto Haulers Association of America. Reached by phone Monday, the day of the Francis Scott Key Bridge collapse, he assessed his members’ industry as it suddenly deals with the loss of its biggest import point.

“What car haulers need that not necessarily any of the other types of container shippers need are places to store the cars until the auto haul trucks come in and pick them up,” Young said.

That means parking lots — big ones — and not every port has them. And if they do, there is not necessarily spare capacity beyond what they are utilizing now.

“Containers require a space to put them, too, but you can stack them,” Young said. That obviously isn’t possible with cars.

He noted that the East Coast also has a significant auto import site at the Port of Brunswick, Georgia, not far from Savannah.

In an article published in Forbes, Ken Roberts, who analyzes trade data, said he believed that the Georgia port would be the best location to take in auto carriers diverted from Baltimore. In the article, Roberts said the leading import partners at Brunswick “align most closely with those of the Port of Baltimore.”

Movin’ out?

But that raises a question. Drivers of auto haulers who are located in the Baltimore region to service that port would need to move their base of operations at least temporarily to Brunswick or other ports — Roberts and Young both mentioned Newark, New Jersey, and Jacksonville, Florida, as leading car import sites — to make the increased operations there work. Will they make that move?

Most auto haulers are home at night, Young said. Companies that specialize in auto hauling “probably have drivers that are based in Baltimore or live close by. You can’t necessarily just send them out anywhere because they don’t have a home to get back to.”

Auto hauling is “not really like over-the-road driving,” Young said. “It’s more regional.”

If the drivers who move autos out of Baltimore to the mid-Atlantic or Northeast are doing so in a day’s time, and now will have to tack on additional over-the-road hours to get cars out of a port like Brunswick, “that’s going to affect hours of service,” Young said.

Possible HOS waiver looms

And online chatter Monday was focusing on the possibility of a more generalized HOS waiver from the Federal Motor Carrier Safety Administration.

Governors have the power to declare states of emergency that include state waivers of HOS for a certain period of time, but ultimately, a federal waiver is needed. Maryland Gov. Wes Moore did declare a general state of emergency, but the wording has no specific reference to hours of service.

Auto import data for Baltimore is described in terms of tonnage. In January, according to Maryland data, auto imports were 56,332 tons. The monthly average for 2023 was 68,871 tons. A year earlier it was 71,332 tons. And in 2013, it was 91,191 tons. Specific port by port data was not immediately available, but Baltimore has been described as the largest auto port by several sources.

Auto exports were 5,064 tons in January, averaged 8,883 tons per month in 2023 and averaged 19,783 tons in 2013.

The impact on the number of drayage carriers now staring into a demand for their services is impossible to quantify precisely but is undoubtedly huge.

But Louis Campion, the president and CEO of the Maryland Motor Truck Association, told FreightWaves in an email that his organization has about 75 companies that provide intermodal services to Baltimore’s port.

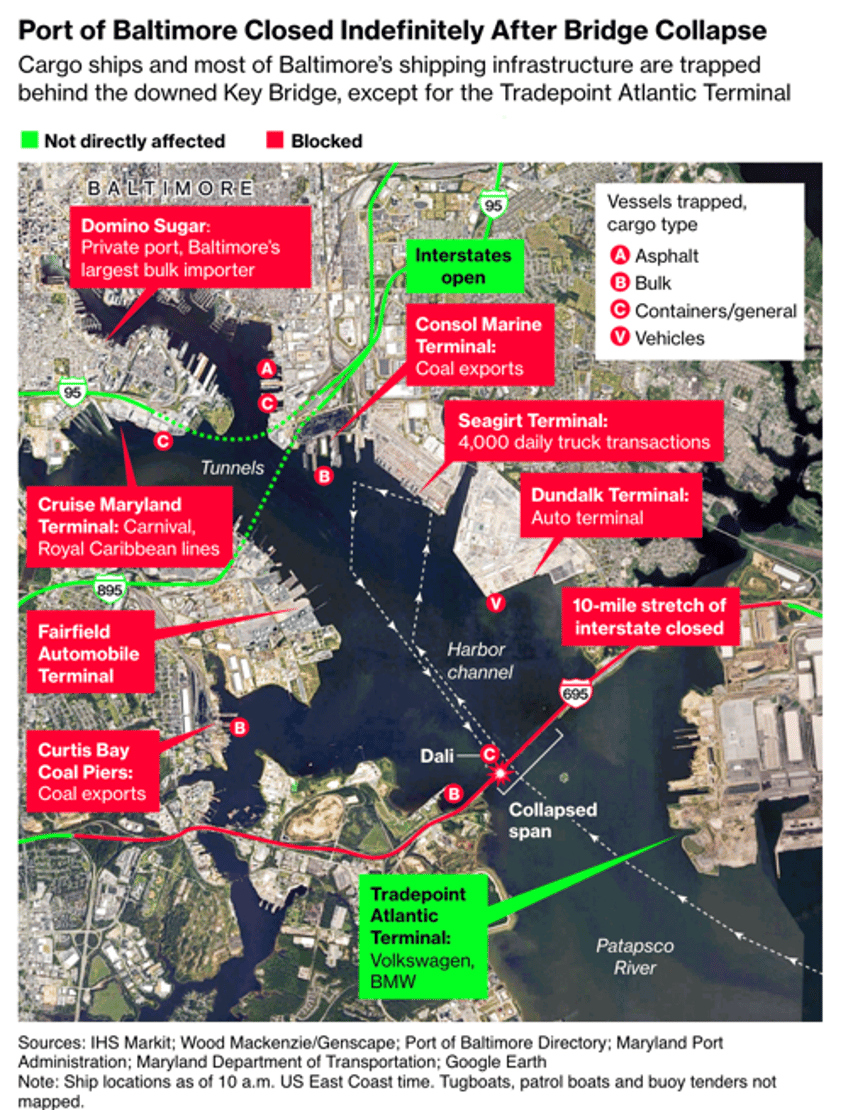

Although the port is technically open to service freight on the docks and in the terminals, the collapsed bridge serves as a barrier for entry and exit from those facilities, which are all inside the site of the catastrophe.

Campion noted that activity can continue at terminals. “However, unless the waterways are reopened, it will serve as a blockade to the Port and effectively choke off economic activity,” he said. “If the waterways are not cleared so that ships can continue to access the Port, we would see the impact in literally a few days. It may already be difficult as some shippers will most certainly start to re-route to other ports.”

News reports have noted shipping officials who are already rerouting freight.

Drayage drivers would face the same dilemma as the auto haulers Young discussed: They can possibly move their trucks to other ports to service diverted freight, but what becomes their home base?

Campion’s group issued a statement on the bridge collapse that discussed some of the numbers affected by its fallout.

“We know that the Port itself is responsible for 20,000 direct jobs, and thousands of other indirect jobs it creates in industries like trucking,” the statement said. “The Key Bridge is a critical route for trucking into and out of the Port of Baltimore. In 2022 the Bridge carried over 4,800 trucks per day.”

Traffic that had crossed the bridge has three alternative routes. Two are through tunnels that cross under the Port of Baltimore, one on Interstate 95 and the other on Interstate 895, but hazardous materials cannot travel through either tunnel.

The second is the western side of the 695 loop around Baltimore. The eastern side of 695 includes the Key Bridge.

Limited intermodal impact

An irony in the bridge collapse is that it was caused by a container ship, though Baltimore is not a significant intermodal port.

In a commentary about the impact of the bridge collapse on East Coast railroad CSX, the transportation team at Deutsche Bank led by Amit Mehrotra said Baltimore last year handled about 300,000 inbound twenty-foot equivalent units, far fewer than New York/New Jersey (2.4 million) and more than 900,000 in Norfolk, Virginia. However, it was more than the 240,000 units handled in Philadelphia, which has been spoken of as a possible alternate destination for cargo routed away from Baltimore.

That small amount of intermodal service is one reason why the Key Bridge collapse is not viewed as a significant incident for the rail intermodal industry, though it could have more impact on coal traffic. Baltimore is a key export site for coal.

“The temporarily displaced imports should be able to easily reroute to nearby ports of entry,” Deutsche Bank wrote. “There is also plenty of available outbound capacity to divert the 200k+ loaded exports that leave Baltimore each year.”

The bank added that the coal slowdown could impact CSX. The Curtis Bay Coal Piers has export capacity of 14 million tons of coal. “At full capacity this would account for about one third of CSX’s annual export (metallurgical) coal volume (40 million tons), though we estimate the actual volume is much less than this,” Deutsche Bank wrote. “The bottom line is CSX’s weekly coal volumes are likely to be down a lot in the coming weeks; if we assume an impact for 2 months, we see max potential for about 30k lower coal carloads.”

On the energy front, recent records show Baltimore importing minor amounts of petroleum. In December, it was one shipment of asphalt and one shipment of biomass-based diesel, which could be either renewable diesel or biodiesel.

The liquefied natural gas export port at Cove Point, Maryland, is outside the port and is not affected by the collapse, according to a spokesman for the facility.