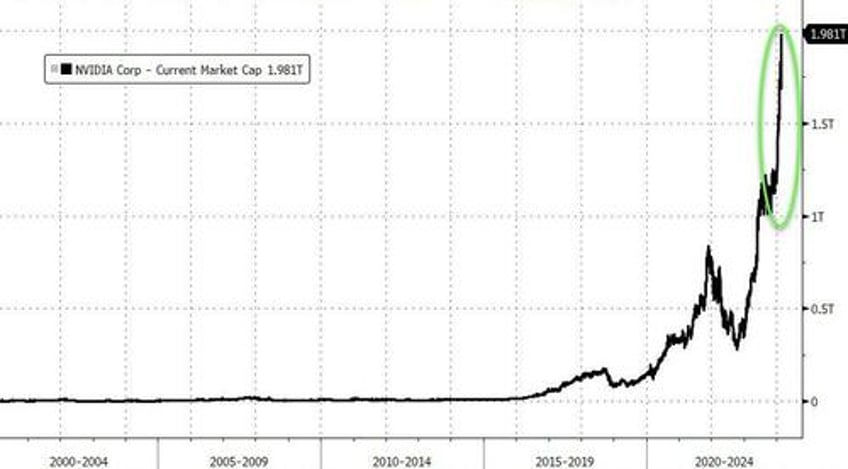

Ok, so everyone knows, NVDA is awesome, topping $2 trillion in market cap intraday this week (after a $2BN hike above consensus)...

Source: Bloomberg

...but today saw a smidge of profit-taking...

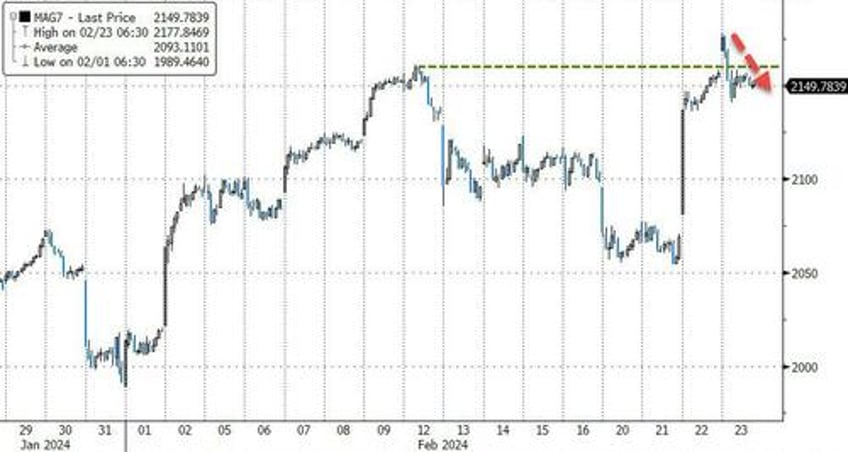

MAG7 stocks were obviously up on the week (the sixth in the last seven), but today's weakness took the basket back below its prior record high...

Source: Bloomberg

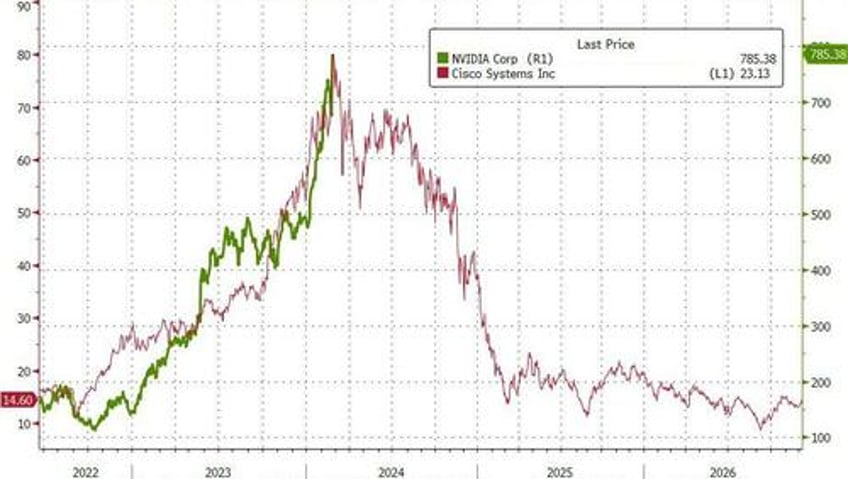

There's no way, right?

Source: Bloomberg

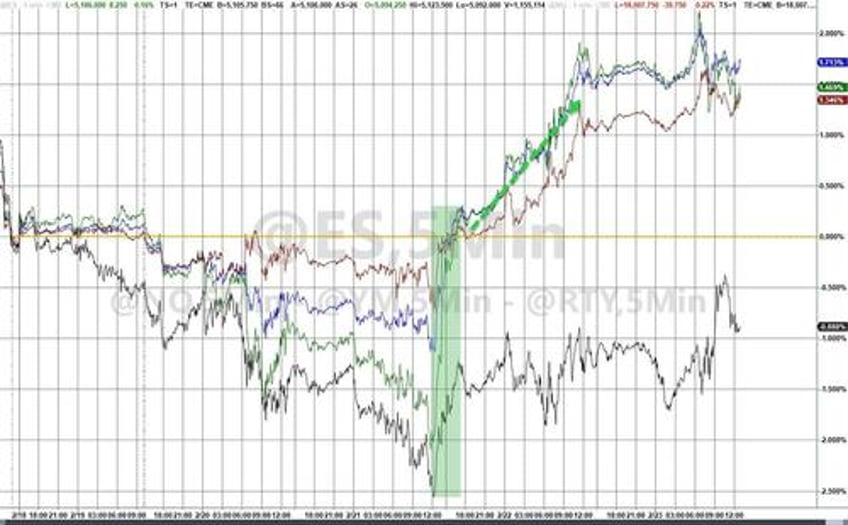

Small Caps ended the week down around 1% while the rest of the majors surged 1.5-2% on this holiday-shortened week...

And the best-performing sector of the week was... drum roll please... NOT tech. Consumer Staples were best, energy worst (but green), and Technology middle of the pack...

Source: Bloomberg

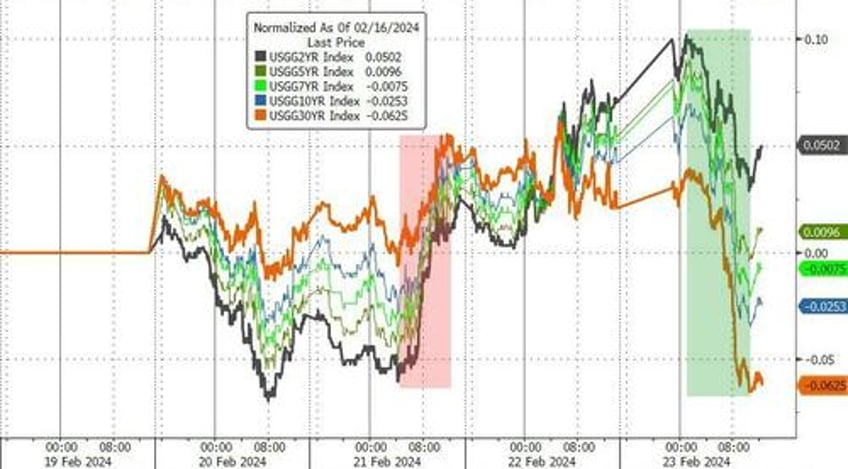

Bonds were bid to end the week with the long-end outperforming overall and the curve flattening around the 5Y...

Source: Bloomberg

The yield curve (2s30s) flattened bigly on the week to its most inverted since 2023...

Source: Bloomberg

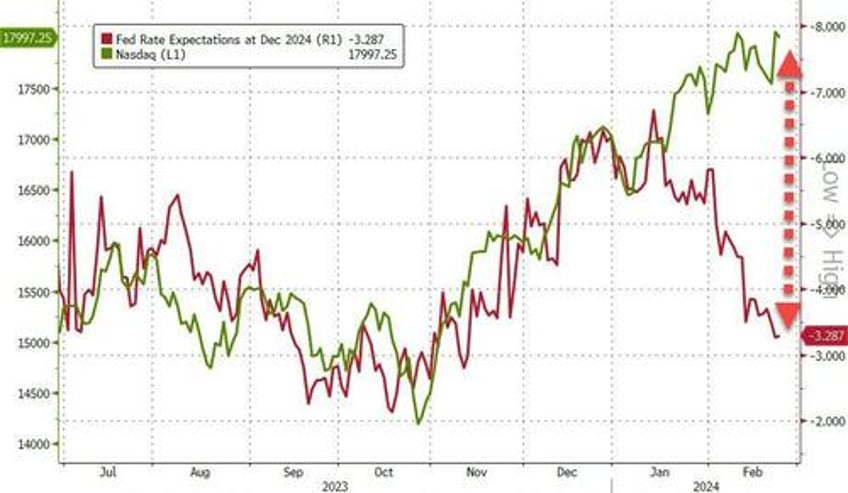

Rate-cut expectations for 2024 continued to slide, now at just a 30% chance of 4 cuts (70% of 3)...

Source: Bloomberg

...and June is now the favored month for rate-cuts to start...

Source: Bloomberg

But stocks don't care about The Fed... for now...

Source: Bloomberg

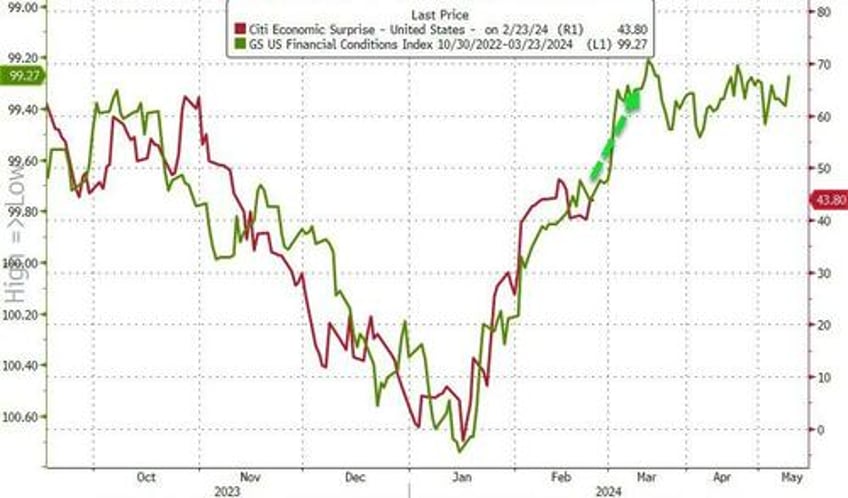

Macro data continued to strengthen - just as we said it would given the lagged impact of the massive loosening of financial conditions...

Source: Bloomberg

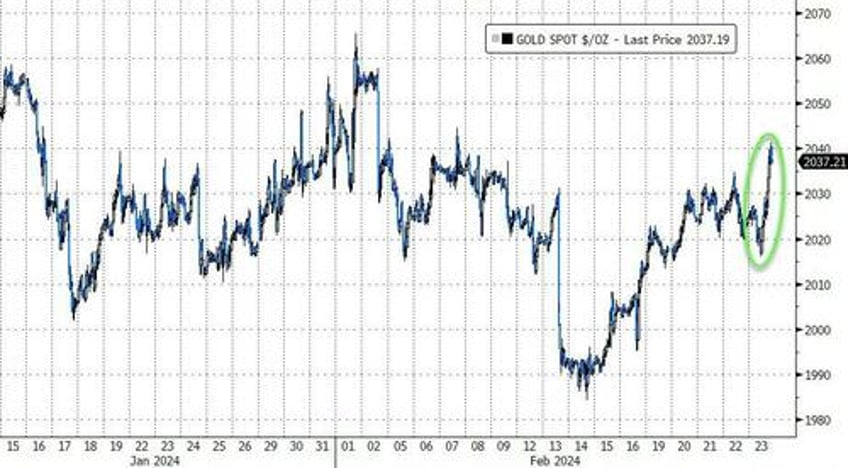

Gold ended the week with its best day in February, up 6 of the last 7 days to close at the highs sine the start of the month...

Source: Bloomberg

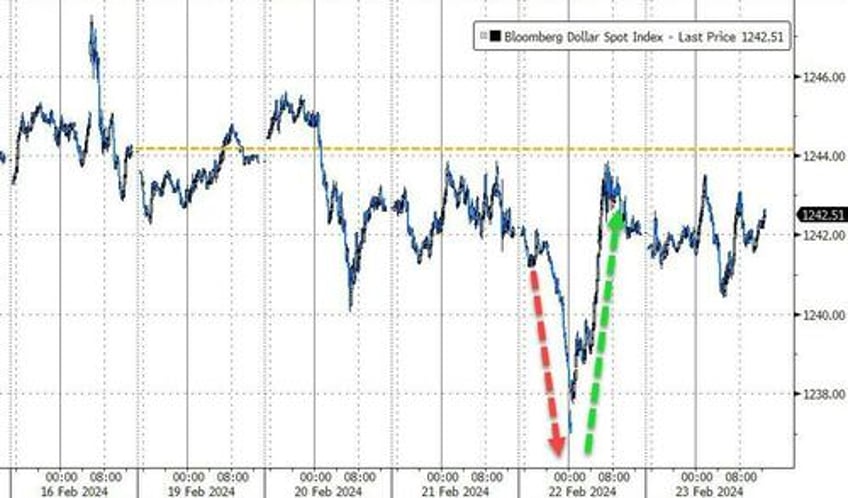

The dollar drifted lower on the week, but recovered from an ugly overnight puke on Wednesday

Source: Bloomberg

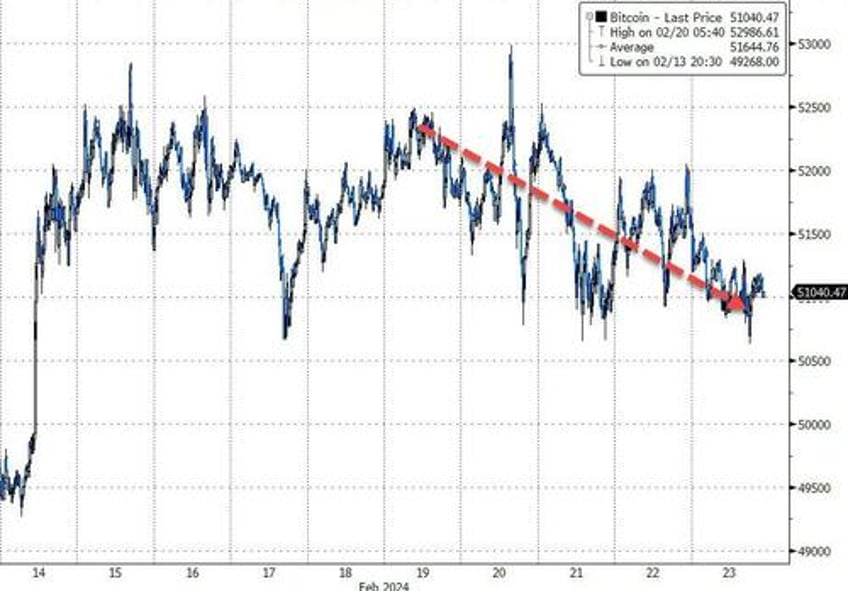

Bitcoin drifted lower this week...

Source: Bloomberg

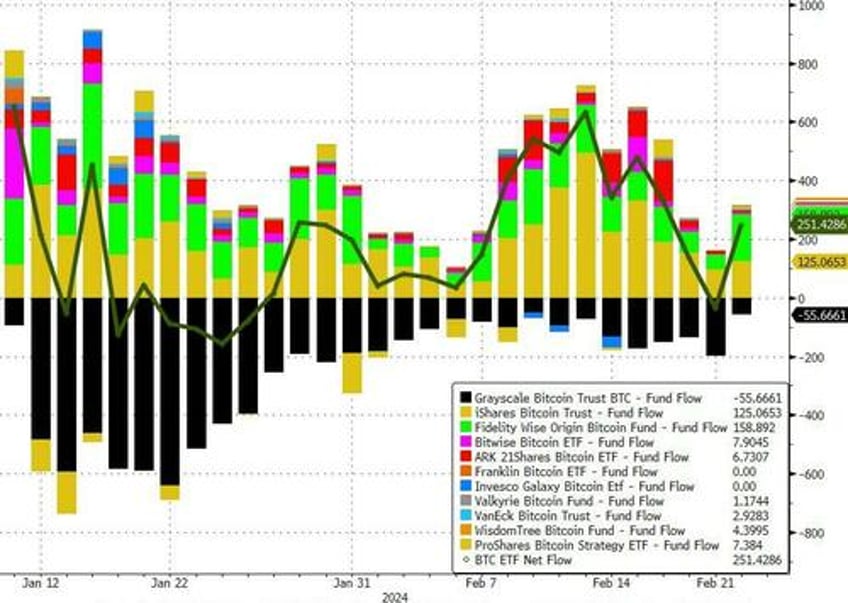

Despite solid net inflow from ETFs...

Source: Bloomberg

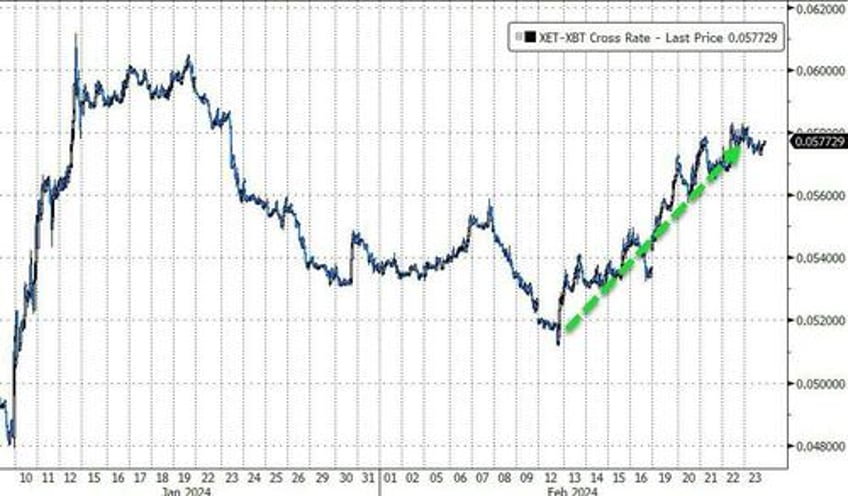

While bitcoin was down, ethereum significantly outperformed, topping $3,000 during the week. This dragged ETH up to one-month highs relative to BTC...

Source: Bloomberg

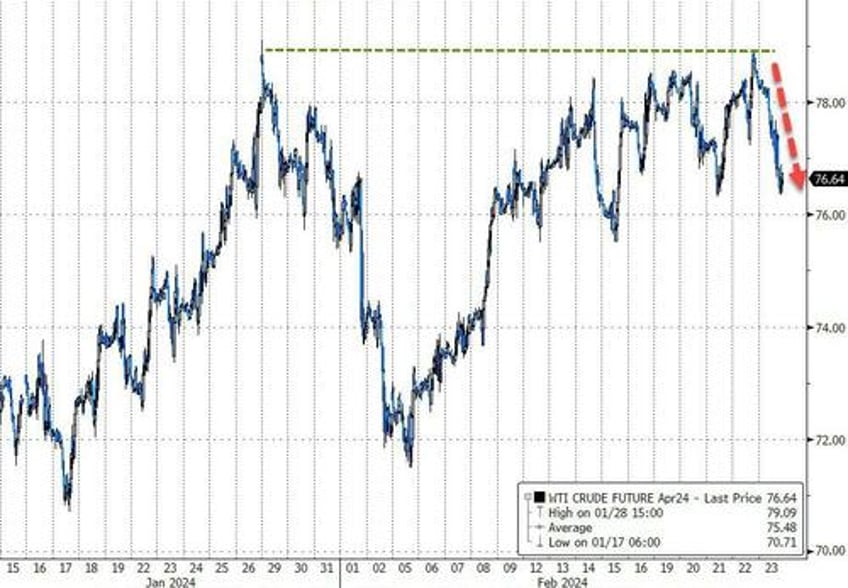

Oil prices tested up to January's highs (WTI $79) before fading back lower today and lower on the week...

Source: Bloomberg

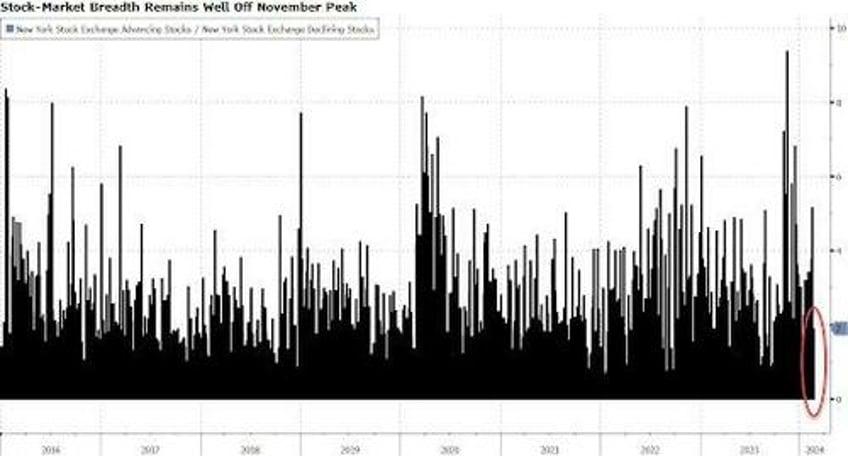

Finally, under the hood, it's kinda worrying...

the S&P jumped more than 2% on Thursday as investors cheered blowout results from Nvidia Corp., even though only 73% of its members advanced. That’s the lowest participation for an up day of this magnitude since the immediate aftermath of the 2020 election, when the S&P 500 gained 2.2% while only 47% of its members went up. Since then, 2% up days have been accompanied by an upward move in 92% of its stocks, on average, data compiled by Bloomberg show.

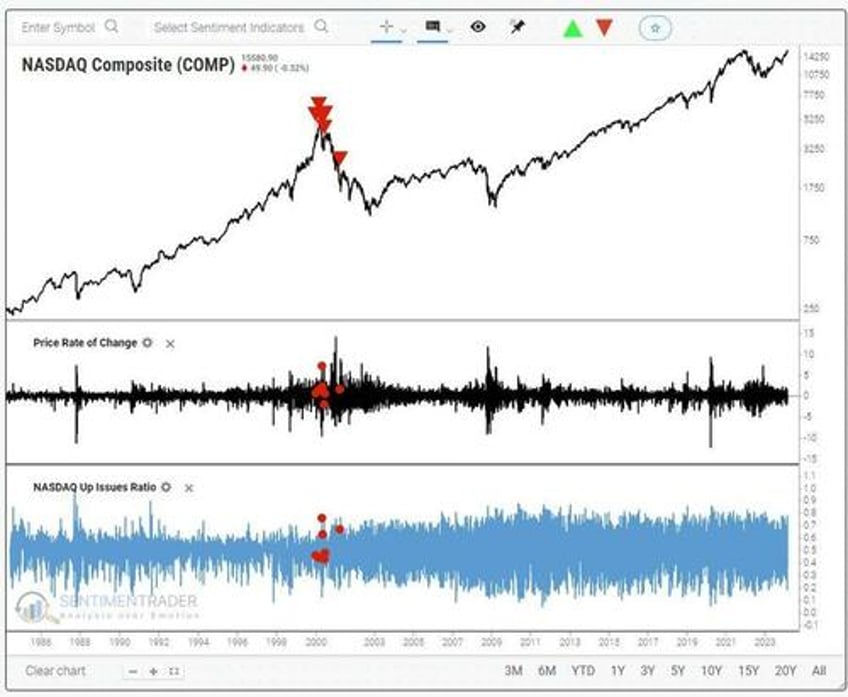

As Jason Goepfert noted on X, the performance divergence between the S&P 500 Index and individual stocks on the New York Stock Exchange was even more extreme. The index’s 2.1% rally came as less than 60% of stocks on the New York Stock Exchange advanced. The mismatch was seen just three other times in the past 60 years - 1987, 2008 and 2020, data compiled by Sentimentrader show.

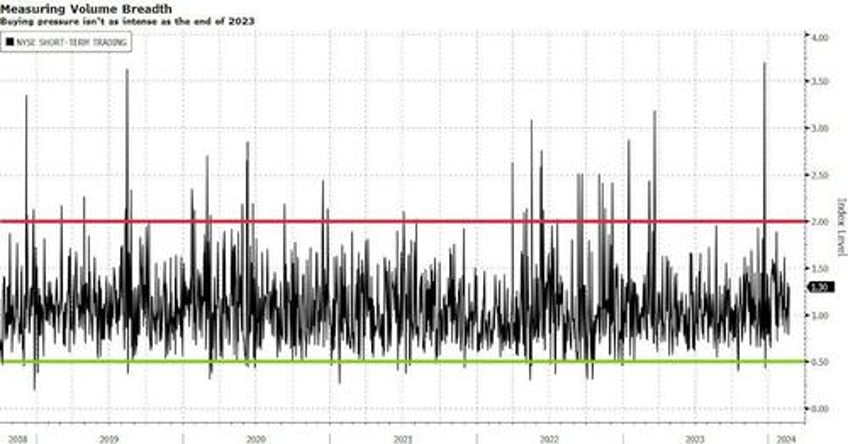

The Arms Index, also called the Short-Term Trading Index, or TRIN, compares the number of advancing and declining stocks to advancing and declining volume. Readings below 0.5 historically suggest there’s more demand for shares since that would mean volume is higher in the average up stock than down ones, while a move above 2.0 is a sign investors are dumping equities, according to market technicians. Following Thursday’s rally, it sat at a level of 1.3, meaning buying pressure was still well off its peak from late last year.

And as Nomura's Charlie McElligott noted earlier, the most analogous week to this week, just happens to be 1/7/2000 (in terms of spot, vol, and breadth moves).