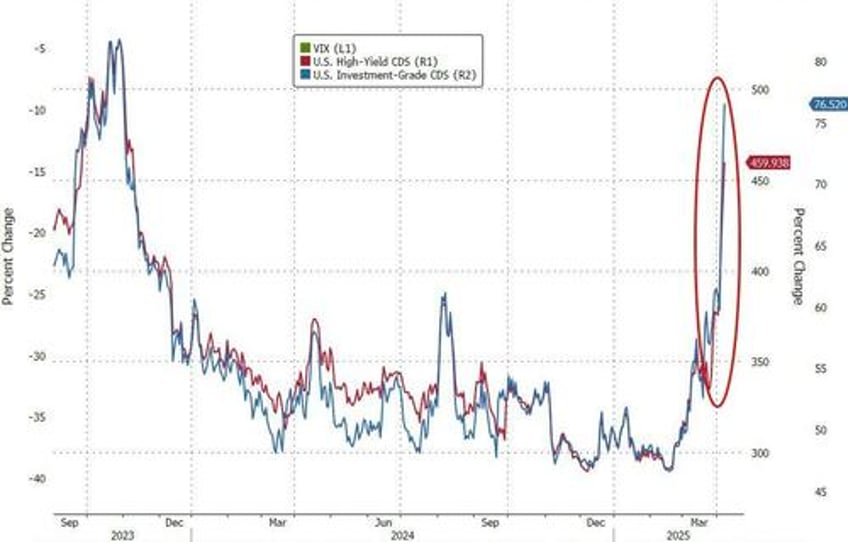

Just over a week ago, before the proverbial tariff fecal matter struck the rotating market object, we warned that cracks were starting to appear in the credit market...

Credit starting to crack.

— zerohedge (@zerohedge) March 31, 2025

Finally the Fed is about to wake up pic.twitter.com/1azfoGABPH

...a week later, things started to 'escalate quickly'...

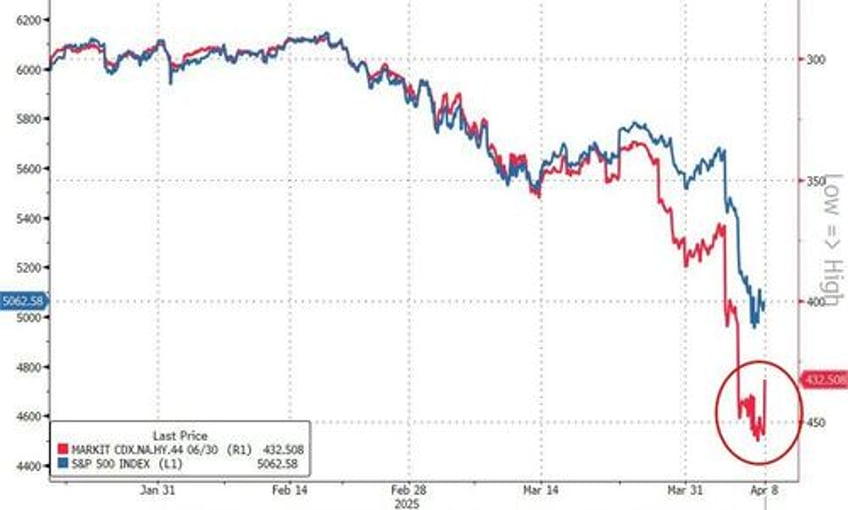

And while stocks have rebounded (amid utter chaos and headline roulette), credit market remain stressed and Saba Capital Management founder Boaz Weinstein warned Bloomberg that the selloff in corporate bonds accelerate by tariffs tensions could spur a wave of bankruptcies that may ramp up faster than in previous market crises... and The Fed is hamstrung from taking action (cutting rates to save the world) because of inflation fears.

“The avalanche has really just started,” Weinstein said on Friday during an interview for an upcoming Bloomberg Originals series, Bullish.

“The hit could be faster and the bankruptcy rate could spike much faster than other crises.”

Investors shouldn’t rule out the possibility of a severe recession, he added. (Click on image for link to full conversation - no embeddable link provided)

Weinstein, whose hedge fund firm is known for navigating volatile markets, added that he expected the credit selloff “to accelerate.”

“There might be something in between that stops the boulder, but I’m very concerned about a crash,” he said.

As Bloomberg reports, Weinstein joins a chorus of investors and strategists who have swiftly started revising down their economic forecasts. A JPMorgan Chase & Co. team led by Bruce Kasman hiked the odds of a global recession to 60% on Thursday.

Weinstein's warning is that "you cannot out this genie back in the bottle":

“Maybe it’s not a buy the dip,” Weinstein said.

“Maybe it’s a phrase no one ever used before, a sell the dip because this is not going to get fixed tomorrow.”

Weinstein, the former co-head of credit at Deutsche Bank AG, made a now famous trade back in 2012, when he rode a bet on a bank rushing to offload risk, taking the other side of outsize wagers made by JPMorgan’s so-called London Whale.

“This is really, really major,” he said.

“The range of outcomes is so wide here, and markets started quite expensive, credit especially, so I think we could go a lot lower.”

Returning back to where we started, if the credit markets do crack (more), then The Fed will be increasingly forced to address the uncomfortable need to cut rates in a stagflationary environment (as Trump has demanded) as Powell's "pause" gets put on hold until markets stabilize.