Selloffs in Treasuries are compounded by the real loss in the purchasing power of the dollars they are denominated in.

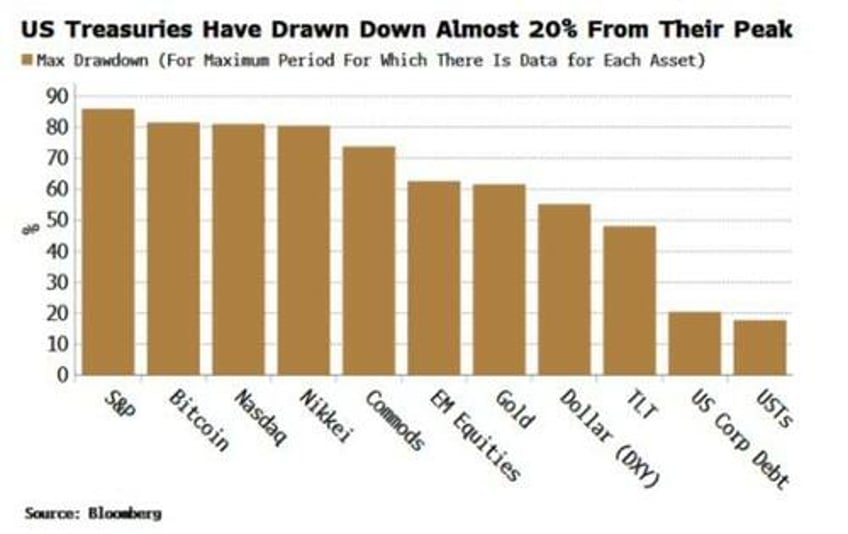

US Treasuries are in the midst of their worst drawdown, or peak-to-trough decline, for at least half a decade, with the Bloomberg Treasury Index down over 17% from its peak.

At first look, the slide appears small, compared to the other major assets. However, for longer-duration Treasury debt, using the iShares 20+ Year Treasury Bond ETF with ticker TLT as a proxy, the maximum drawdown is approaching 50%. That’s still smaller than gold, the Nikkei, Bitcoin, the S&P 500, but huge for an asset that is supposed to be “risk free”.

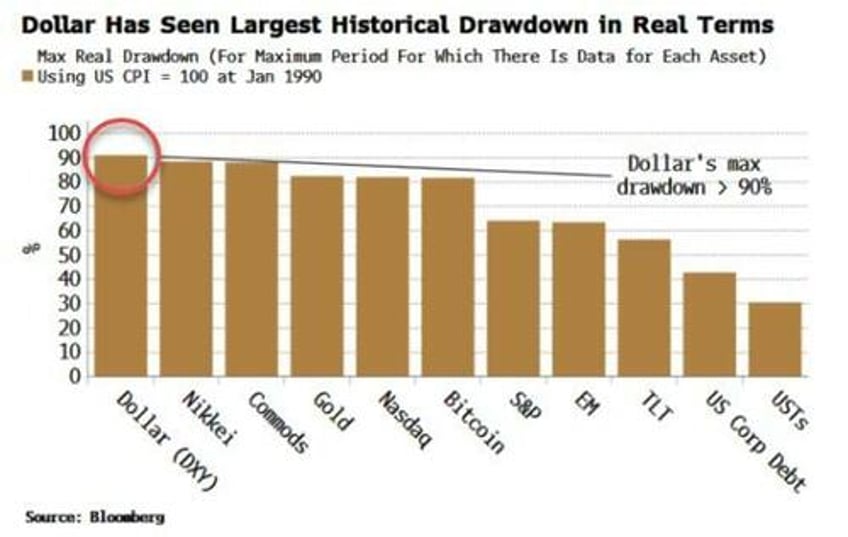

But we are in an inflationary world again, so it is real values that matter most. Using US headline CPI indexed to 100 in 1990, we can build real indices for each asset. Applying US CPI for all of them means we can compare like for like. Now, when we look at maximum drawdowns, we get a different picture. It is no longer the S&P 500 with the largest one (in the Great Depression), but the dollar.

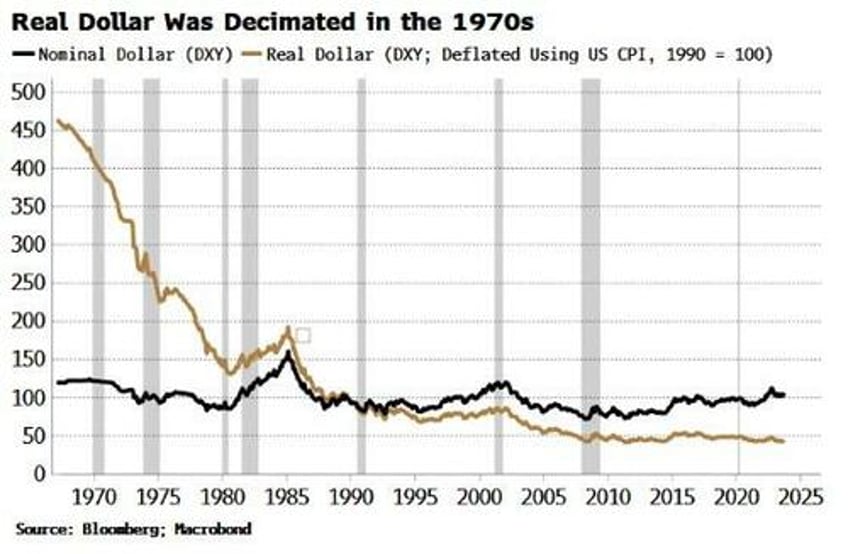

The dollar has seen a maximum peak-to-trough fall of 91%, which occurred in the 1970s. The dollar declined in nominal terms, but inflation rose sharply through the decade, meaning the dollar’s real value was eviscerated, being worth only a tenth of its purchasing power at the end of the 70s versus what it was at the beginning. The closing of the gold window in 1971, the Arab oil embargo in 1973 and the Iranian revolution in 1979 all contributed to its decline.

The decline of the real dollar’s value when inflation is elevated is an additional kick in the shins to those holding Treasuries: what you’re paid back in is losing value in real terms too. Since the end of 2019, the dollar is down ~9% in real terms, compounding the 11% total loss in Treasuries over the same period.

As the 1970s showed, the dollar’s real value is acutely exposed to elevated inflation, adding a sting in the tail for those already nursing losses in their Treasury positions.