Bidenomics 101: the American dream of owning a home has become the American nightmare for almost half the US population.

As housing specialist Redfin reports, rising home prices and mortgage rates "are making it harder to believe in the American dream of homeownership. Lack of affordability is the most commonly cited reason renters don’t believe they’ll ever own a home."

The details are dire: Nearly two in five (38%) U.S. renters don’t believe they’ll ever own a home, up from roughly one-quarter (27%) less than a year ago.

This is according to a Redfin-commissioned survey of roughly 3,000 U.S. residents conducted by Qualtrics in February 2024. This report focuses on the 1,000 respondents who indicated they are renters. The relevant questions were: “Do you believe that you will ever own your own home in the future?” and “Which of the following are reasons you aren’t likely to purchase a home in the near future?” The 27% comparison is from a Redfin survey conducted in May and June 2023.

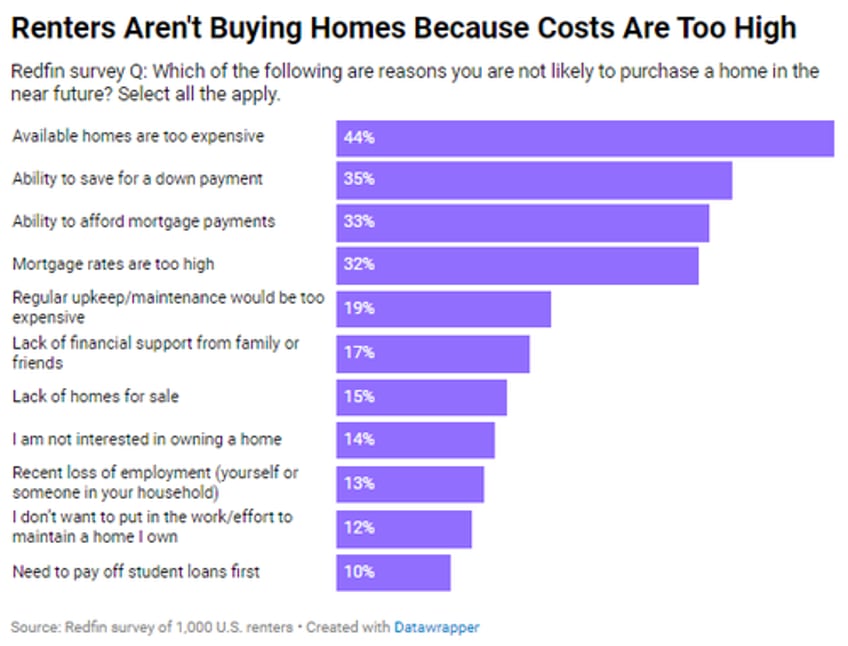

Lack of affordability is the prevailing reason renters believe they’re unlikely to become homeowners. Nearly half (44%) of renters who don’t believe they’ll buy a home in the near future said it’s because available homes are too expensive. The next most common obstacles: Ability to save for a down payment (35%), ability to afford mortgage payments (33%) and high mortgage rates (32%). Roughly one in eight (14%) simply aren’t interested in owning a home.

Buying a home has become increasingly out of reach for many Americans due to the one-two punch of high home prices and high mortgage rates. First-time homebuyers must earn roughly $76,000 to afford the typical U.S. starter home, up 8% from a year ago and up nearly 100% from before the pandemic, according to a recent Redfin analysis. Home prices have skyrocketed more than 40% since 2019, due to the pandemic homebuying frenzy and a shortage of homes for sale. And the current average 30-year fixed mortgage rate is 6.82%. While that’s below the 23-year-high of nearly 8% hit in October, it’s still more than double the record low rates dropped to in 2020.

Home prices have risen 7% in the last year alone, and monthly mortgage payments have risen more than 10%, which helps explain why renters today are more likely than they were last year to say they don’t see themselves owning a home anytime soon.

Many renters can’t fathom homeownership because they’re already struggling to afford their monthly housing costs. Nearly one-quarter (24%) of renters say they regularly struggle to afford their housing payments, and an additional 45% say they sometimes struggle to do so.

Rents have soared over the last few years because so many people moved during the pandemic, upping demand for rentals. The median U.S. asking rent is roughly $2,000, near the record high hit in 2022–but the good news for renters is that prices aren’t growing nearly as fast as they were during the pandemic, partly because an influx of apartment supply is taking some of the heat off prices.

“Housing costs are high across the board, but renting is a more affordable and realistic option for many Americans right now–especially those who have never owned a home and aren’t able to tap into equity from a previous sale,” said Redfin Chief Economist Daryl Fairweather. “While owning a home is usually a sound longterm investment, the barriers to entry and upfront costs of buying are higher than renting. Buying typically requires a sizable down payment and approval for a mortgage–things that are difficult for many people today, when the typical down payment is near $60,000 and mortgage payments are sky-high. The sheer expense of purchasing a home is causing the American Dream of homeownership to lose some of its shine.”

Gen Z renters are most likely to believe they’ll own a home

Broken down by generation, Gen Z renters are by far the most likely to believe they will become homeowners (maybe it's because they are also the dumbest). Just 8% of Gen Z renters believe they’ll never own a home, compared to 22% of millennials, 40% of Gen Xers and 81% of baby boomers.