After a mixed bag from preliminary April European PMIs (Services strong-er, Manufacturing weaker-er, surging prices)...

“Accelerated increases in input costs, likely driven not only by higher oil prices but also, more concerningly, by higher wages, are a cause for scrutiny Concurrently service-sector companies have raised their prices at a faster rate than in March, fueling expectations that services inflation will persist. ”

and after March US PMIs exposed the end of the disinflation narrative...

"Most notable was an especially steep rise in prices charged for consumer goods, which rose at a pace not seen for 16 months, underscoring the likely bumpy path in bringing inflation down to the Fed's 2% target. ”

...S&P Global's preliminary US f°r April just dropped and they were ugly with both Manufacturing and Services disappointingly dropping further as the former dropped back into contraction:

• Flash US Services Business Activity Index at 50.9 (Exp: 52.0; March: 51.7) - 5-month low.

• Flash US Manufacturing PMI at 49.9 (Exp 52.0; March: 51.9) - 4-month low.

Source: Bloomberg

Commenting on the data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

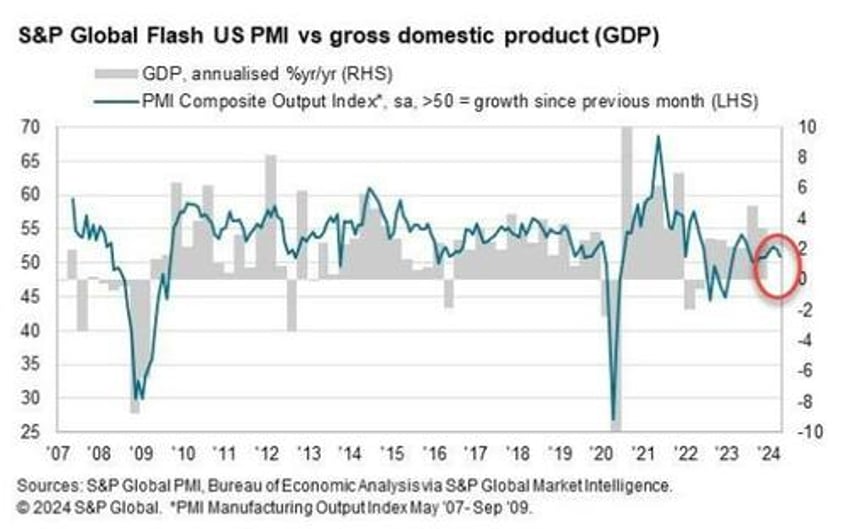

“The US economic upturn lost momentum at the start of the second quarter, with the flash PMI survey respondents reporting below-trend business activity growth in April. Further pace may be lost in the coming months, as April saw inflows of new business fall for the first time in six months and firms’ future output expectations slipped to a five-month low amid heightened concern about the outlook.

“The more challenging business environment prompted companies to cut payroll numbers at a rate not seen since the global financial crisis if the early pandemic lockdown months are excluded.

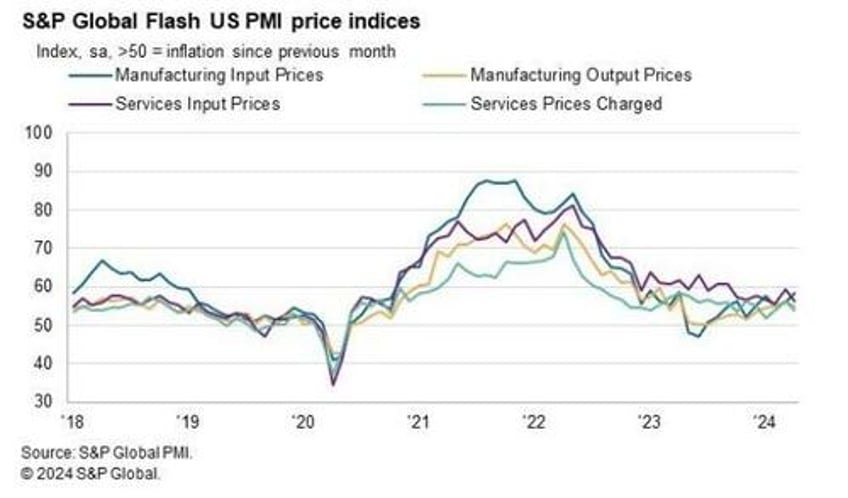

After March showed accelerating prices, flash April data confirmed the trend

“Notably, the drivers of inflation have changed.

"Manufacturing has now registered the steeper rate of price increases in three of the past four months, with factory cost pressures intensifying in April amid higher raw material and fuel prices, contrasting with the wagerelated services-led price pressures seen throughout much of 2023.”

So slower growth and much faster inflation - that does not sound like a recipe for rate-cuts... in fact quite the opposite.